“From July 1, 2015 to September 19, 2019 Shopify stock returned roughly 857% versus the S&P 500 return of roughly 45%.

If you aggregated all Shopify’s U.S. stores (customers’ sales volume), SHOP would be the third-largest online retailer in the U.S. Just think about that for a minute.”

COMPANY PROFILE

Shopify is the leading multi-channel commerce platform. Merchants use Shopify to design, set up, and manage their stores across multiple sales channels, including mobile, web, social media, marketplaces, brick-and-mortar locations, and pop-up shops. The platform also provides merchants with a powerful back-office and a single view of their business, from payments to shipping. The Shopify platform was engineered for reliability and scale, making enterprise-level technology available to businesses of all sizes. Headquartered in Ottawa, Canada, Shopify currently powers over 800,000 businesses in approximately 175 countries and is trusted by brands such as Unilever, Kylie Cosmetics, Allbirds, MVMT, and many more.

Shopify is an e-commerce company and platform for online stores. Shopify was founded in 2004 by Tobias Lütke, Daniel Weinand, and Scott Lake in response to their dissatisfaction with the existing e-commerce options online that were complicated and expensive. Shopify makes it easy for anyone to create their own shop by handling everything from marketing and payments to checkout and shipping. In 2018, Shopify released a range of new tools to allow small and medium-size businesses to better compete with the e-commerce giants. It launched Shopify Ping, which allows merchants to chat with customers over Facebook Messenger, to provide customer support, market products, and also provide information about inventory and shipping. It also launched Dynamic Checkout, which seeks to eliminate many of the roadblocks that lead customers to abandon their carts. Using a one-step process, shoppers can check out from all brands that use the Shopify platform.

“We’re building a retail operating system,” says COO Harley Finkelstein. Shopify enabled $41 billion in sales in 2018, a 59% year-over-year increase, and its annual revenue topped $1.07 billion.

Recent Earnings

Third-Quarter Financial Highlights

RAISED AGAIN - Revenues for the full year in the range of $1.545 billion to $1.555 billion versus last quarters guidance of $1.51 billion to $1.53 billion.

One-time tax provision of $48.3 million, would have swung adjusted net loss to a positive $14.7 million, well ahead of the $5.8 million expected.

Remember: Current online sales is still roughly 10% of total retail sales ($5.5 trillion/year) so THE company most tied to e-comm growth is SHOP because they serve so many merchants here and abroad.

Shopify expects fulfillment will allow merchants to deliver to 99% of the continental USA within two days or less,” Goldman Sachs analyst reports. So the 3rd largest online retailer in the U.S. as an aggregator is offering shipping and fulfillment services? That’s a powerful moat that few others can share. Remember, it’s the cost of fulfillment (packaging, shipping, returns, package tracking, warehousing) that keeps some smaller to medium businesses from reaching their growth goals. SHOP now offers a solution which will keep merchants loyal as a St. Bernard.

Shopify Now Powers Over One Million Merchants Worldwide - they grow WITH merchants, that’s what Amazon is really bad at.

International merchant additions accounted for the bulk of increases.

Big brands are moving aggressively into a relationship with Shopify Plus - This is the ENORMOUS opportunity for SHOP.

23,000 partners have referred a merchant to SHOP in the last 12 months. WOW

The flywheel continues to build: Shopify payments, fraud protect, Multi-currency solutions, Shopify Shipping & Fulfillment & Shopify Capital, Shopify Chat, Shopify Plus (high volume merchants, aka big brands), Native video and 3D modeling features is early in the roll-out for AR shopping experiences (hint, they are helping a merchant enhance the shopping experience, a very important theme for shoppers everywhere).

Shopify payments allows merchants to set-up payment functions without them having to work with other third-party payment providers aka making it easier to begin taking new business.

Total revenue in the third quarter was $390.6 million, a 45% increase from the comparable quarter in 2018-FYI - $362.0 million, last quarter or 7.9% higher.

Subscription Solutions revenue grew 37% to $165.6 million - They were $153.0 million last quarter. This increase was driven primarily by growth in Monthly Recurring Revenue1 ("MRR"), largely due to an increase in the number of merchants joining the Shopify platform.

Merchant Solutions revenue grew 50%, to $225.0 million - They were $208.9 million last quarter, driven primarily by the growth of Gross Merchandise Volume2 ("GMV").

Monthly Recurring Revenue as of September 30, 2019 was $50.7 million, up 34%

GMV for the third quarter was $14.8 billion, an increase of $4.8 billion YOY - It was $13.8 billion last quarter.

Gross Payments Volume3 ("GPV") grew to $6.2 billion, it was $5.8 billion last quarter. This accounted for 42% of GMV processed in the quarter, versus $4.1 billion, or 41%, for the third quarter of 2018.

Gross profit dollars were $216.7 million versus $204.8 million last quarter and compared with $149.7 million recorded for the third quarter of 2018.

Operating loss for the third quarter of 2019 was $35.7 million, or 9% of revenue versus $39.6 million last quarter - Hint - this is what Amazon did in the early days.

Net loss for the third quarter of 2019 was $72.8 million, or $0.64 per share

At September 30, 2019 SHOP had $2.67 billion in cash, cash equivalents and marketable securities versus $2.01 billion in cash last quarter end, compared with $1.97 billion on December 31, 2018. The increase reflects $688.0 million of net proceeds from Shopify’s offering of Class A subordinate voting shares in the third quarter of 2019.

Shopify launched native language capabilities in eleven more languages (Traditional Chinese, Simplified Chinese, Danish, Dutch, Finnish, Hindi, Malay, Norwegian, Swedish, Korean and Thai, Turkish), bringing the total number of languages in which the Shopify Admin is available to 19.

Shopify Fulfillment Network continued to lay the foundation for timely and affordable direct-to-consumer fulfillment for merchants that value their brands and customer experience.

Shopify announced availability for merchants in most U.S. states to start selling hemp or hemp-derived cannabidiol (CBD) products on our platform, both online or in brick-and-mortar retail locations. So SHOP becomes the consumer gateway for recreational Marijuana? Brilliant.

Shopify launched Shopify Chat, our first native chat function that allows merchants to have real-time conversations with customers visiting their stores and provide a better shopping experience. They are the most impressive customer-first organization, beating Amazon by a country mile.

Shopify Shipping adoption continued to expand, with approximately 44% of eligible merchants in the United States and Canada using Shopify Shipping in the quarter.

Purchases from merchants’ stores coming from mobile devices versus desktop continued to climb in the quarter, accounting for nearly 81% of traffic

Shopify Capital issued $141.0 million in merchant cash advances and loans in the third quarter of 2019, increase of 85% YOY. $768.9 million in cumulative cash advanced since its launch in April 2016

For the full year 2019, Shopify currently expects:

RAISED AGAIN - Revenues in the range of $1.545 billion to $1.555 billion versus last quarters guidance of $1.51 billion to $1.53 billion.

GAAP operating loss widens a bit from last quarters guide to the range of $158 million to $168 million given the increase in revenue guidance etc.

For the fourth quarter guidance:

Revenues in the range of $472 million to $482 million

GAAP operating loss in the range of $47 million to $57 million

Adjusted operating income4 in the range of $10 million to $20 million, which excludes stock-based compensation expenses and related payroll taxes of $57 million, and amortization of acquired intangibles of $10 million

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Shopify scores well as of 9/17/19:

99% high 3YR sales growth

84% in total price momentum

99% in low debt to enterprise value - a quality measure

99% in high 1 YR sales growth

88% in high sales surprise last quarter

10/29/19 Comment:

SHOP is to E-Commerce what Windows is to computing in my opinion. These guys just keep growing, adding more services and products for customers to grow and service clients better and that provides a very important moat around the business. As Amazon continues to compete with their clients, Shopify will keep winning over merchants here and abroad. The platform is too good and the agnostic perspective is part of the intangible that has real value. I’ll keep reiterating, the stock is super expensive and does discount some of the future growth but as long as they keep opening new market and revenue opportunities and keep building solid loyalty with merchants, Amazon should be nervous. I don’t believe Microsoft will make a dent in their business, this is too specialized and SHOP’s flywheel is too complex for MSFT or Google to add anything meaningful to a merchant. The logistics acquisition with 6River just makes it more difficult to compete with the full solution SHOP brings. This stock is a buy on every market dip, it’s a small position currently given how expensive it is but I would like to keep adding to the position on ST market dislocations because this will be the company that gives Amazon indigestion in the e-commerce arena.

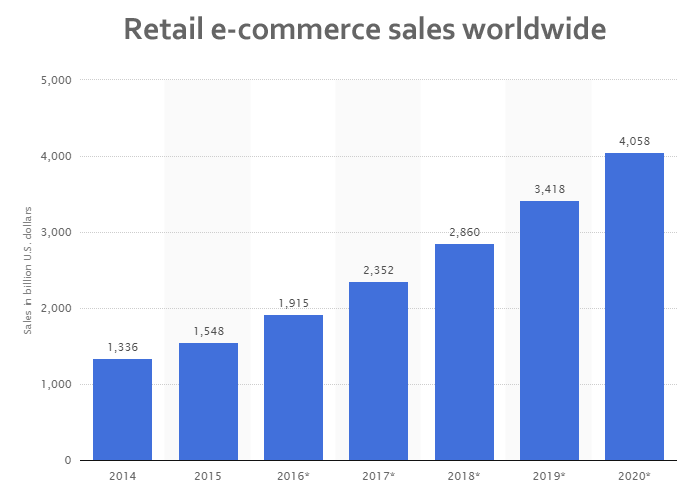

SHOP has around $1.5B in annual revenues and serves a $4+ trillion total addressable market. There’s plenty of room for multiple providers but SHOP has the agnostic solution that is supremely focused on the merchant and constantly offering them more ways to succeed. Chart source: Statista.

Older comments:

It’s hard to talk about Shopify without talking about Amazon but there’s one important difference that’s very important:

Amazon owns the customer in their network which is closed. That’s great for them but not great for the brands selling on Amazon. Shopify is a better partner to brands and businesses these days and that will continue to be important for Shopify’s business and stock. Shopify enables businesses to sell more products and provides them with all the services they need to be successful. Brands want to own the client and that’s why SHOP is intriguing to me. Amazon these days seems to be pissing more business owners off and that’s a dangerous game to play.

I’ll be clear, SHOP is one of my favorite growth stocks from a total addressable market opportunity perspective. The global scope is absolutely enormous and they have shown their willingness to continue to add new services for their merchant clients. Management truly has their customers at the center of everything they create. This client-first mentality makes switching costs high and revenues sticky. Great things happen when you remove the friction from someone starting a business, creating an online presence, and offering the tools necessary to run it, market it, and to compete with companies 10x the size. The business is capital light and with operating margins so low to foster growth, they have plenty of room to slowly turn the pricing power dial once they reach a suitable level of scale. Amazon has proven they can turn on the profitability engine when they want to and SHOP’s addressable market opportunity might even be larger than Amazon’s. SHOP makes a small percentage of everything each of their merchants sell and all they have to do is keep innovating and creating more products and services that help merchants have more sales transactions. Shopify Payments & the Merchant Solutions businesses are booming. SHOP started in English speaking nations and is now taking the service to non-english speaking countries with huge success. That’s where the real opportunity lives. Of the roughly 40+ million small businesses globally, SHOP has about 800,000 clients. That’s less than 2% of the total market. SHOP would make a wonderful acquisition as well. Yes, the big risk is a recession where consumer spending slows which makes their recurring revenue slow. The second risk is the current valuation, this year alone the stock is up over 100% so it’s likely ahead of itself right now at 27x revenue. Yes, that’s very expensive and with expectations so high, any short-term hiccup in sales growth could take the stock down hard but I’d be building a much bigger position in the company if that happened. High growth stocks always trade at high valuations, that’s the nature of the beast but I have confidence SHOP will grow into the current valuation over time and the stock will add significant value to a portfolio. This is not a 1-2 quarter story, they are competing head to head with Amazon and winning and with more scrutiny on the FANG stocks from D.C., names like Shopify could get a lift from any regulation that comes of out Washington. For me, the stock is a buy on dips when they come.