“From July 1, 2010 to December 28, 2021, Tesla stock returned roughly 24,680% versus the S&P 500 return of roughly 480%. That’s what happens with you catch an industry asleep at the wheel for a decade and blaze a new trail that everyone eventually needs to clone.”

COMPANY PROFILE

Tesla, Inc. designs, develops, manufactures, and sells electric vehicles, and energy generation and storage systems in the United States, China, Netherlands, Norway, and internationally. The company operates in two segments, Automotive, and Energy Generation and Storage. The Automotive segment offers sedans and sport utility vehicles. It also provides electric vehicle powertrain components and systems to other manufacturers; and services for electric vehicles through its company-owned service centers, Service Plus locations, and Tesla mobile technicians. This segment sells its products through a network of company-owned stores and galleries. The Energy Generation and Storage segment offers energy storage products, such as rechargeable lithium-ion battery systems for use in homes, commercial facilities, and utility grids; designs, manufactures, installs, maintains, leases, and sells solar energy systems to residential and commercial customers; and sell renewable energy to residential and commercial customers. The company was formerly known as Tesla Motors, Inc. and changed its name to Tesla, Inc. in February 2017. Tesla, Inc. was founded in 2003 and is headquartered in Palo Alto, California.

Amazing drone view going through the Berlin gigafactory highlighting what happens in the production process. Truly amazing.

Style Factor Benefits

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Tesla scores well as of 12/28/21:

97% price momentum leader

92% low debt/EV

88% top 3 year CAGR sales growth

88% high free cash flow growth

83% strong margin expansion

80% high change in EPS estimates last 4 weeks

81% high change in sales estimates last 4 weeks

77% high total 1 years sales

77% top operating king via a proprietary superior business screen

71% high total FCF

4/20/22 Update

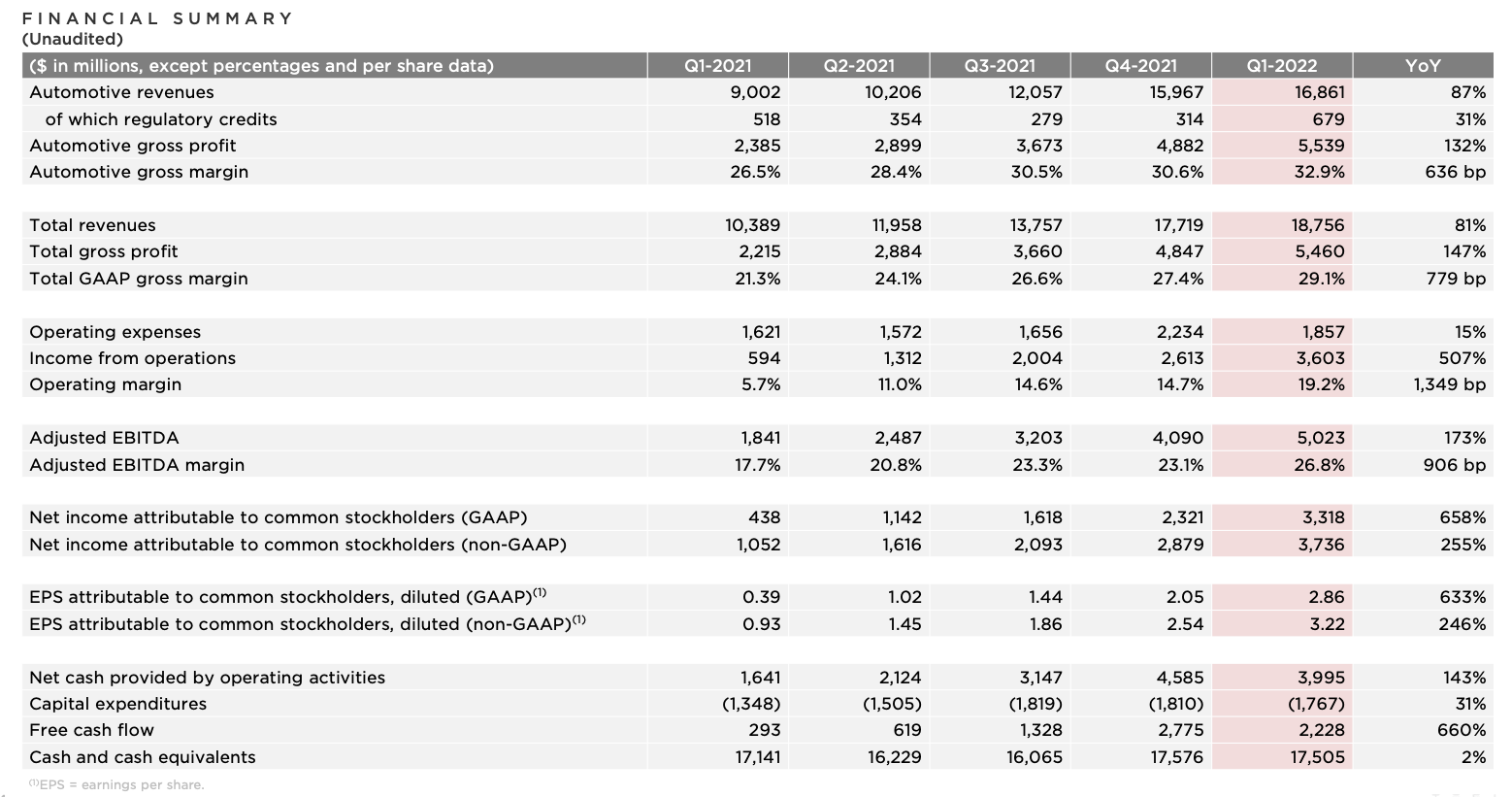

Tesla reported earnings after the close today. Very strong quarter even with all the supply chain and resource issues. China on lockdown will subtract unit sales in next quarter’s report but the overall thesis continues to be: EV adoption globally is in its inflict, Tesla is the massive winner with mind and supply-share and they have a significant lead on peers. Overall demand will be high and each brand will get their fair share but with energy prices out of control, more and more consumers will finally pivot towards EV autos. For now, Tesla has strong mind share and loyalty and the supplies and logistics to scale, over time others will ramp up and take some share but who knows how profitable Tesla will be by then. It’s their game to lose for sure. The stock is not cheap but with 50%+ unit volume growth in 2022 and likely for the next few years, very little debt and strong FCF, this brand is a very timely stock for investors. There will be a time when their growth simply slows on a forever basis and that will be a raging sell signal, but I don’t see any signs of that just yet. Love me some Tesla.

1/30/22 Update:

Earnings: Tesla continues to impress the world by showing what scale looks like once the mass production process has begin. The stock is expensive, get over it. The haters have been saying that for a decade now and largely they have missed the incredible run in Tesla shares. The stock is now over $1 trillion market cap, most still do not think it should have ever gotten to this epic milestone. The trail-blazers in a global and important spending category do all the heavy lifting but they get paid the most if they succeed. Thats why TSLA is >$1 trillion market cap. All the other car/truck brands are now playing massive catch-up, they let Tesla do the heavy lifting, cut their teethe on all the unforeseen production issues and costs and create a proven market that they could eventually compete it. Well, EV is not a fad, and now everyone is rapidly building the capabilities for scaled production. To be sure, the competitors won’t have it as tough, because they are using what Tesla has learned to their advantage but make no mistake, producing EV vehicles at scale, having a vital charging network in place for consumers and building cars that people and businesses love is not an easy task. For many years to come, the legacy gas-powered businesses will fund the EV evolution but the brand power of Tesla makes the ultimate scale no easy task. When you are THE go-to brand in a category, that intangible offers a very strong moat for Tesla. Tesla can sell as many cars as they can build and I see no end in that concept for at least a few years. They are making far more EV vehicles than any other competitor and they have about a decade lead on the software update process. EV adoption has just begun, there will be many winners but I expect Tesla to begin to show massive profitability just in time to become a more stable blue chip growth stock. And so many people and institutions still do not own the stock in any meaningful way. They missed it the whole way up. I’m certainly never going back to a gas powered vehicle.

12/31/21 Update:

Despite massive selling by Elon Musk in Q4 of this year, Tesla had another good return for 2021 at +54% as of 12/28/21. That’s pretty impressive when you consider Tesla stock was up 740% in 2020. Just let that sink in for a moment. When I hear people bash Elon for selling some stock I always ask “if I were Elon could I have not sold any stock for the 10 years prior after such huge gains? The answer is no, it’s incredibly impressive for a guy to sit on such paper wealth year over year and hold out for the real big payoff. Elon is now one of the richest people in the world and he deserves it, he built a company that took the entire industry behind the wood-shed and flogged it while they built a new business that will transform the auto industry. Yes, competition is coming aggressively but given the projected global demand for EV products over the next decade, Tesla will get its fair share and they are in many cases, light-years ahead of peers. They have been the guinea pig for this trailblazing business which could make it easier for their peers to ramp quicker. Tesla is now a smaller position now that the stock is over $1 trillion in market cap. In fact, it’s the only >$1T business who does not currently have the scale of revenues and FCF versus the others in the $1T club. I believe they will reach this milestone over time but at the current valuation and with competitors coming fast, a smaller overall weight seems more prudent. I love my ModelY and I’ll likely never NOT own an EV vehicle but I cant definitively say I will always be a Tesla owner. It’s been a great ride and I will continue to trade around my core position when it gets clocked.