“From January 3, 1994 to 11/5/2019 or just over 25 years, Activision stock returns roughly 5,454% versus the S&P 500 return of roughly 559%. I would say video gaming is not a fad!”

COMPANY PROFILE

For more than 30 years, Activision has been changing the way people play. In the process, we have built one of the largest portfolios of recognized brands and today we are one of the most valuable interactive entertainment companies in the world.

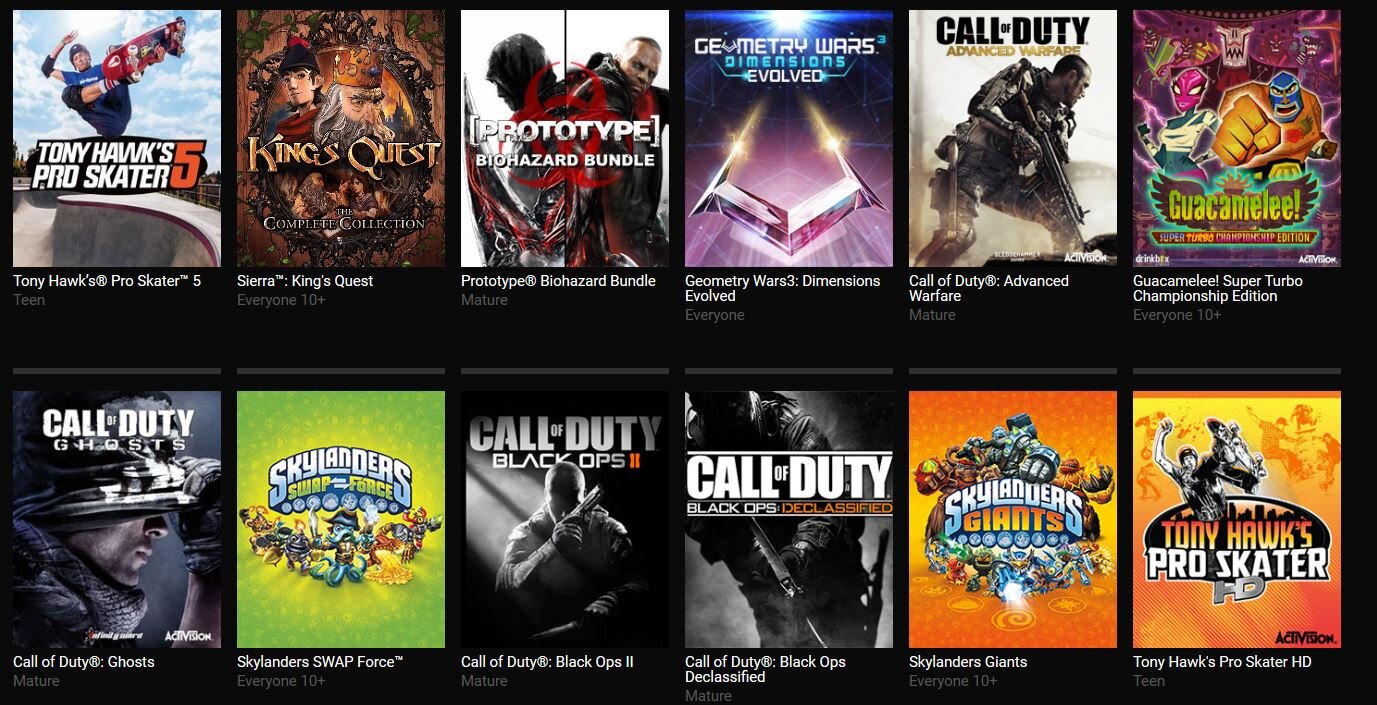

Founded in 1979 as the first independent video game software developer and distributor, the company launched a series of multi-million unit selling titles in the early 1980s for the Atari 2600 including Pitfall, Kaboom! and River Raid. And since then, Activision has created some of the most iconic and memorable game experiences of all time. The most popular games being: Call of Duty, Crash Bandicoot, Sekiro, Spyro, and Skylanders.

Best known for blockbuster hits including World of Warcraft, Hearthstone, Overwatch, the Warcraft, StarCraft, and Diablo franchises, and the multi-franchise Heroes of the Storm, Blizzard Entertainment, Inc. (www.blizzard.com), a division of Activision Blizzard (NASDAQ: ATVI), is a premier developer and publisher of entertainment software renowned for creating some of the industry’s most critically acclaimed games. Blizzard Entertainment’s track record includes twenty-two #1 games* and multiple Game of the Year awards. The company’s online-gaming service, Blizzard Battle.net®, is one of the largest in the world, with millions of active players.

We operate in more than 15 countries including in the U.S., Canada, Brazil, Mexico, the United Kingdom, France, Germany, Ireland, Italy, Sweden, Spain, Denmark, the Netherlands, Australia, Singapore, mainland China, Hong Kong and the region of Taiwan.

Recent Earnings

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Activision scores well as of 11/1/19:

97% high 1YR EPS growth

82% high 3YR sales growth

88% high margins versus the industry

83% strong price momentum

84% low debt to enterprise value

83% % change in positive estimate revisions last 4 weeks

86% high cash balance as percent of total market cap

Esports is where it’s at going forward in my opinion. Here’s ATVI’s COO last quarter: We saw significant engagement in particular around esports with interest in the playoffs and championships for the Overwatch League running above even our own high expectations. In the Call of Duty world, they continued to enjoy momentum with minutes watched up 50% year over year and now heads into its own championships later this month in Columbus, Ohio. More recently in November 2019: 40,000 attendees from 59 countries gathered at the Anaheim Convention Center to meet their fellow players, watch esports tournaments unfold live, and learn about upcoming games and updates for Blizzard’s franchises.

If you think video gaming and eSports is a fad I’ll ask you to think again. Universities are now giving scholorships to gamers and entire curriculums are being created. Arena’s are being built, new teams created and huge pools of capital are being deployed in this space. Imo it’s still too early to see who the real beneficiaries will be but ATVI is at the center of this theme. The video gamers have been superior performers for many years but got way ahead of their fundamentals and thus have been taken to the woodshed the last year offering a much more attractive entry point. I envision adding more exposure to this category on dips but we dipped our toe in the water with ATVI and will build a bigger position over time.

I’ll have more to say on the earnings report in a few days.