Market Musings & Trading Ideas

11/7/24

Trump Wins the Election, the Popular Vote, and the Electoral College.

Massive hedging began about a week before the election. There was a pretty steep implied volatility premium that would need to unwind once the results were announced. It always amazes me how much very short-term positioning changes occur, is anyone a long-term investor anymore? What does an investor do when the market they are involved in becomes a raging casino driven by alo’s and 1-month momentum signals? You actively trade around core positions and look for quality companies exhibiting a short-term pullback for “fast-twitch scalp opportunities. If your core equity basket does an average of 13-15% per year over time and you actively trade around this to generate 2-6% per month returns, the combination can generate quite attractive returns. That’s what we do in the Dynamic Brands strategy when the market gives us an opportunity. With algo’s and the popularity of 0DTE index options, there’s always some single-stock volatility to consider for a trade. I’ll list the trades we like on these pages going forward. Remember, we only invest in the 200 brands that make up our proprietary index called, the Alpha Brands Consumer Spending Index. A list of these brands can be found on the Brands tab and the sub-tab showing the Brands Index. We update that list each December to keep our universe of brands tethered to highly relevent blue chip and innovator brands.

The Election:

This is the first time a Republican won both the popular vote and the electoral vote since 2004. The DNC clearly has lost its way and has let the cruise ship sail off course in a dramatic way. Yesterday’s election results is proof. If you want to know what the market thinks of the Trump opportunities, take a quick read of my summary note yesterday where I tell the story using cartoons I created with the help of ChatGPT. That exercise was very fun.

Link: https://catalyst-insights.com/author/eclark/

The Stock Market:

Stocks had the best 1-day gain on an election I think EVER. That tells you have low exposures and positioning was plus it tells you how many hedges needed to come off all at once. There will absolutely be winners and losers over the next 4 years from Trumps policies but for now any real decisions are based on pure speculation. It’s a different world today than it was in 2017. We have massive government debt, much higher inflation, higher rates, and the Fed has just stopped being restrictive on rates. Any aggressive economic activity stimulus will likely drive up inflation and rates which could cause stocks and bonds to get heartburn. Trumps gang has a fine line to walk.

The Consumer:

Household consumption drives every major economy so it’s very important to stay in touch with the data here. We can do that for you, keep reading these posts. We invest in the global household spending and business investment theme through the most dominant brand franchises around the globe. These are some of the most profitable, dominant companies that have ever been created and they have historically been quite good investments. We expect that to continue over time. Leaders that stay relevant and keep innovating generally widen their lead over peers. These are the companies we like to invest in.

MELI Trading Opportunity - 11/7/24

Here’s the notes from last nights earnings report. The stock missed on a few key areas but for good reasons: they were spending to grow further. The market like linear quarterly growth, that is not how the real world works, sometimes a 90 day earnings period gives off signals that mean nothing to the long-term trajectory of the business. When the market over-reacts, growth and momentum investors tend to be the worst offenders of the “sell now, read the print later” approach. MELI stock fell 16.21% on the day with full capitulation-type volume of 10x normal daily volume, they all left at once and they weren’t shy about the sell orders. I took the selloff as an opportunity to trade around the core position by adding more shares. I think I can get 5-10% on the trade by Thanksgiving at the latest. Just how I’m playing it. Here’s the notes from last night:

Mercado Libre Earnings - Miss

We have a playbook to follow where MELI and its growth drivers and demands are concerned, Amazon. MELI is the Amazon and Paypal of Latin America and its the #1 market share e-commerce brand across Latam and growing fast. When you grow fast in a capital intensive business, you have lumpy quarters on occasion, largely due to the cap-ex needs of logistics and fulfillment centers that drive higher volumes and consumer frequency. Tonights quarter showed what happens to some important operating metrics when infrastructure growth is accelerating. I'll cut to the chase, while I never love metrics that re-set lower and the stock drawdowns associated with them, in Meli's case, as far as I can see, this is the normal "spend to build so you can grow further" problem and with some patience, these usually turn into new growth opportunities so I'll likely be patient on this name given its moat is widening and it plays in a part of the world we have little other opportunities to get exposure to. Heres the details:

Missed estimates, gross margins contracting, operating margins cut in half. Solid balance sheet $2.4B in cash. FCF grew much faster than net income, this is a positive. Revenue +35% but cost of revenue +50%. Gross profit grew 16% and operating expenses +44%. Theres your spend to earn later component. They are building more distribution centers in Brazil and Mexico. The moat expands when you build these centers though so metrics will drop initially then vault back later. Then we had the Mercado Pago finance and payments segment show some noise. Ramping up this credit card biz also costs first and drops margins then they get to monetize. Generally, if you trust management to spend to grow, you add more shares in the spend phase when the stock is low. Lending money and making money is the key here. On the surface, it appears they are making bad loans but when you look further, they are seeing much higher transaction volume at the same time. This metric is called NIMAL. Its ok if it contracts but when you see transaction volume rising, this means they are accounting for the new loans up front and will get paid on them down the line.

Trade Buy Price: $1768

Sell Price in Focus: $1850-1900

2022 and Earlier Posts Below

Here’s how your “SAFE” money has been performing. And they wonder why our top two holdings are the kings of the Alts mega trend: Blackstone and KKR

Quick update on sentiment - consumer & institutional - hint - it’s still at extremes. Just remember, theres some great gains when things go from absolutely horrendous and expected to stay that way to just slightly less bad!

And they wonder why Sentiment is bad!

If there was a single indicator to watch for the credit markets, Ill take the 5 year investment grade CDS chart, its elevated but rangebound for now

August 24 interesting charts & news

A few years ago I noted the seemingly idiotic strategy of drill drill drill which just flooded the markets with oil and nat gas keeping prices down and risks to balance sheets high, energy companies have finally decided to keep supply rangebound which has turned these companies into free cash flow machines. Thanks ESG, you pushed investment dollars away and now we have higher energy prices for longer. I don’t love investing in oil and gas stocks but as consumer spending goes more to our energy needs, these stocks, their free cash flow, strong dividends and stable predictable growth offer a real inflation benefit. The chart below shows the FCF generation of the E&P sector. Wow, why would companies drill too much when they have become cash cows?

I guess the Covid “pull-forward” of e-commerce was not as sustainable as people thought? Looks like we are mean reverting back to old trends which are still favorable but were unsustainably high as people wanted to get back to being out and about. I look forward to getting some more e-comm exposure now that most have crashed back to reality.

With the likelihood that inflation (the kind that affects our everyday lives) stays much higher than the Fed and consumers are comfortable with for the next few years, is your portfolio allocated for the kind of market we saw in the late 1960’s to mid 1970’s? CPI averaged 6.3% and the S&P 500 was wildly volatile but largely went nowhere? Thats a potential scenario that very few are allocated for. It’s front of mind for our team and the brands portfolio. Here’s what that period looks like. Big rallies, big drawdowns, lots of VOL. Being active was a much better option than being passive like the vast majority of portfolios are today.

August 10 Notes: PEAK CPI RALLY DAY!!! The worst is in for inflation…but the high prices are NOT going away

A few months ago I talked about my gameplan for markets being a 2 stage process. Stage 1: extreme bearishness meets the inevitability of a peak inflation (CPI) reading causing positioning to get re-set and a wicked rally to begin on max oversold. Markets have rallied strongly over the last month as positioning was re-set and participants anticipated better news on inflation. Remember, the best gains often come when things go from horrendous to slightly less horrendous. Maybe today is the first datapoint to allow the late-comers to add more positioning into stocks but it feels like a dangerous game to begin adding more exposure here. 4330 is the real test and downtrend for the S&P 500. Theres a bit of room from todays 4200 to 4330 so I’ll use further strength to add more cash for optionality. Today we got that lower CPI reading (still 8.7%) but new trends start with better readings. Markets are ripping shorts to bis, that pleases me very much. Maybe we get a few more readings showing CPI easing slightly further but now it likely gets harder from here for bulls. Hence I’ve been raising cash into every big rally day. Positioning has largely been re-set to a more appropriate level and CPI is easing while still being way too high.

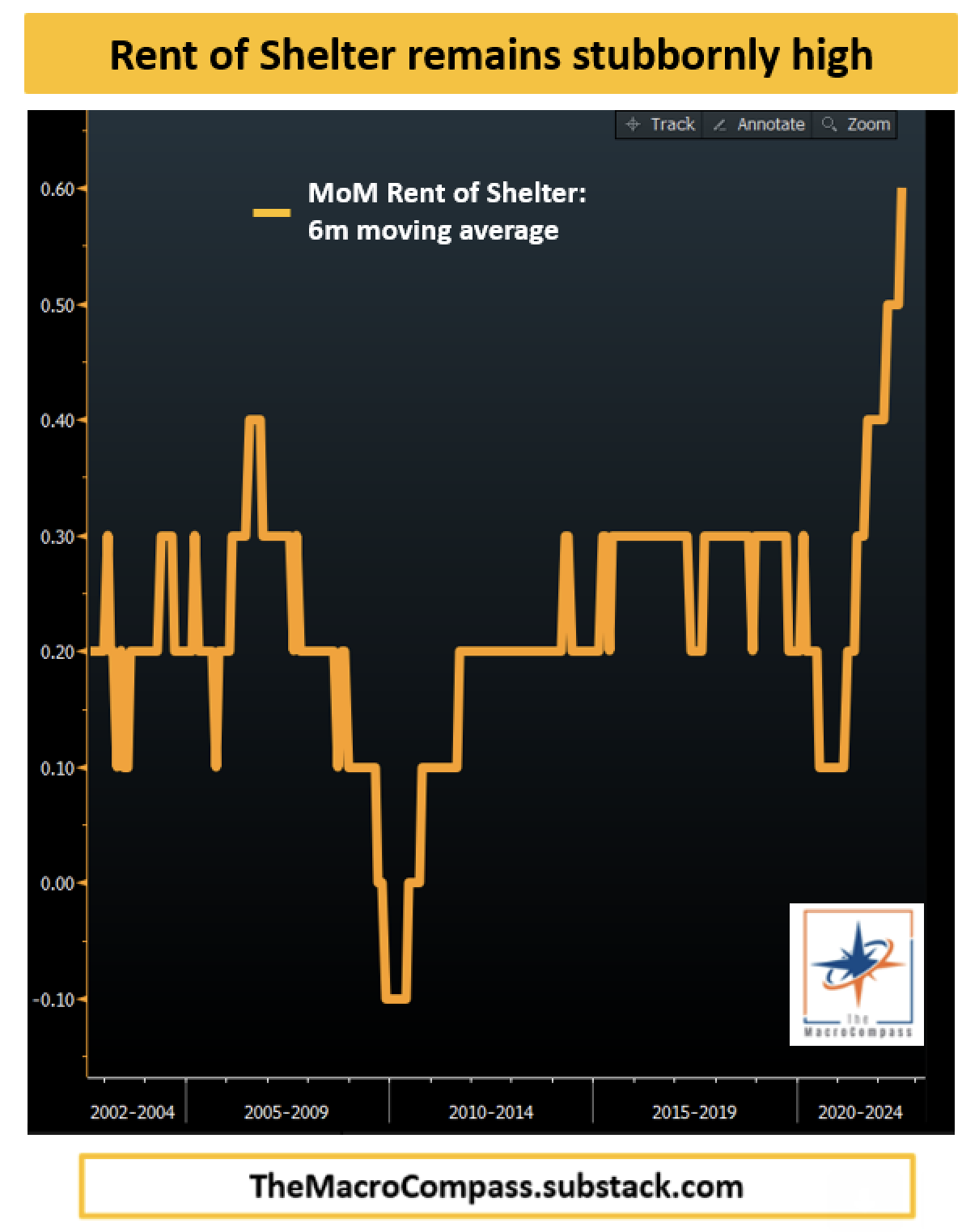

On todays CPI report: 3 of 4 of the most important datapoints that make up the inflation report were UP month over month and year over year. Housing, food and wages are sticky and not getting better. Energy prices came down a bit but gas is still too high and hurting consumers. Consumer savings rates have fallen and use of credit cards has risen, 2/3 of the population is having a tough time paying their bills. Discretionary purchases have no choice but to come down for all but the most well-off consumers. That’s why we have very little exposure to brands that serve lower income consumers for now. And don’t get me started on the “inflation fighting” legislation that will be completely benign to our actual inflation. It’s still going to be a tough slog for earnings and consumers for a while longer.

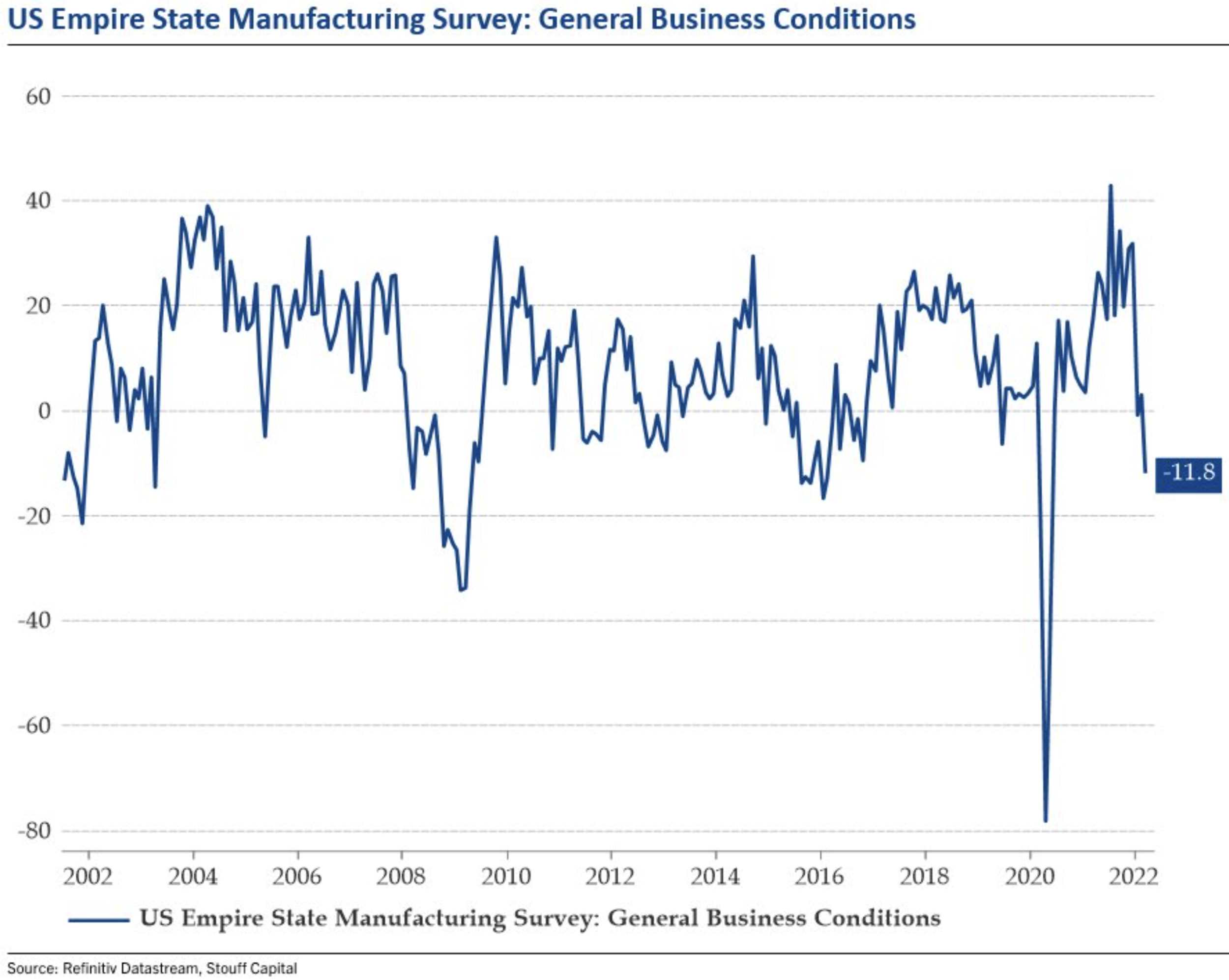

One month is not a trend but the Empire manufacturing report released Monday Aug 15 was a complete disaster. And remember folks, we haven’t even started to see the real economic slowing from all these Fed rate hikes. High earnings predictability and stability is the style factor I care about most right now.

If home affordability is bad and mortgage rates stay higher, existing home & new home inventory begins to build but it also keeps builders from releasing too much inventory into the system which keeps overall inventory tighter for longer which drives more interest in rental homes. And what firm owns more rental homes than any other in America? Blackstone BX, our top holding by weight.

Stage 2: then reality begins to set in. The reality that consumers have been stretched to the limit and need to slow down spending once summer vacations end. Its coming, I have high confidence in this call. Prices are still high and likely to stay higher than anyone wants. The next real reality has already started but will gain steam in the quarters that come. More revenue misses are on deck, margin erosion will follow for all but the best brands. Cost cutting will accelerate as companies run fast to try and keep operating metrics stable and high in the face of slowing demand for products/services. Growth is slowing but inflation is still high. Stagflation is a horrible scenario for stocks and bonds. I do not think the market is priced right for an earnings miss, margin erosion off excessively high margins relative to long term history. My base case is stocks, CPI, bonds, interest rates will stay volatile and range bound and at worst, stocks need to probe lower to get the valuations closer to the reality of slowing revenues and margins. Sometimes next year, likely before July 4 we should see the worst of the earnings slowdown and a trough in stocks but that’s a long way out and a lot of things can happen by then. The end to the bear market will be when CPI is under control and stocks reach a level that reflects a trough in earnings. I don’t think we are there yet but price is god so I will watch closely at the next resistance level.

Fun facts:

Very few investors today, including myself, have ever invested through a period where CPI was higher than normal, the Fed was tighter than normal, rates were more volatile than normal and equities were wildly volatile. The last real period was 1967-1975. Assets were volatile as hell, uncertainty was high, and asset price gains were well below long term average. I don’t think we will see this for as long as we did back then but I do believe the only way to generate an attractive return for the next 12-24 months is by being very active and using cash as your friend when markets get over their ski’s. Today, asset prices have rallied strongly from the lows a month ago, they can rally a bit more but if history is any guide, we should NOT get too complacent about a scenario called “the worst is behind us”. History suggests we all will need motion sickness pills on our desks to combat some wild swings in asset prices and from start to finish, we might NOT have much to show for this sickness from a returns perspective. IMO, the only way out is to trade the wide ranges and gyrate between fully invested and high beta and holding a lot of cash and/or being willing to be hedged at the top end of ranges.

The below chart shows how wild the 1967-1975 period was with volatile CPI. The annualized gains are included. The S&P annualized return was about 3.3% versus about 10% for the 100 year average. The CPI averaged 6.3% which is not dissimilar from what I think we will see for the next 12-24 months. I’m using 4-6% as my base case so maybe stocks average 4-5%, even 6-8% if we are lucky. BUT the real return in this past period was negative given CPI was so high so investors need to re-set their expectations for a while until we can get to a period where stocks reflect the reality or CPI crashes. If it does however, the economy will NOT be in a great place so be careful what you wish for. I’m sorry for the news but I have to report what I see. Only time will tell. The second chart below visually shows how wild and volatile that period was. To be sure, these days, markets move much quicker because of algo’s so the sea-sickness could be even worse in shorter periods of time, but it also can offer wonderful rallies like we have seen over the last month. Just don’t get too complacent because the trending markets of old are likely gone for a while longer.

How do you invest for a period like this? You get much more active than you have ever been and you stay up in quality, strong balance sheets, and strong pricing power. You have to be a superior operator in these periods and you have to sell products and services that consumers and businesses NEED or HAVE TO HAVE or ARE WILLING TO PAY UP FOR as I’ve said above. Problem: most investors, particularly advisor-driven ones are NOT active at all and they are over-diversified. In periods like this, your portfolio is destined to underwhelm unless you add some funds that get more active and are focused on the characteristics above.

Clearly theres alot of room for a major squeeze as short positions continue to build, all we need is a catalyst. It’s odd though, I also saw a chart saying this recent rally ranked very high on goldman sachs list of hedge fund covering shorts reports. How can hedge funds be covering while at the same time epic shorts being layered on?

Great summary of today’s CPI report from @callieabost

August 8 Market Notes

Interesting Monday in the summer. Pre-market NVDA pre-announced a revenue shortfall, blamed it mostly on gaming but reminded investors that are still generating string FCF and buying back stock. The stock is down about 8% but markets were firmly green for the first few hours, felt like shorts were getting squeezed and a very late sign that the rally is running on fumes. Perhaps Wednesday a CPI report that shows inflation coming down will add some fuel to the fire but I simply do NOT see much more upside near term. However, with positioning in equities still quite low and a potential for the “peak inflation and lower on ROC basis), animal spirits could get some more momentum to the upside. 4170 - 4200 is where we peaked today before rolling over as this is an area with big congestion and overhead resistance. With markets overbought after an impressive rally, I’ve been raising some cash and will continue to do so on further rallies.

Why raise some cash? 1)even if inflation slows and rolls over, it will stay elevated for much longer than people think. Companies are still implementing price increases even after their input prices have rolled over somewhat. While that offers a margin tailwind in future quarters, it also offers a potential revenue miss problem as demand cools from higher prices. I simply do not see how markets can get sustainable rallies with inflation stubbornly 2-3x where the Fed wants it to be. It won’t be long until people focus on stubbornly high inflation for longer versus the peak ROC of inflation. If inflation averages 4-6% for the next 12-24 months, estimates are likely too high and valuations are also too high for all but the most in-demand brands with the strongest of balance sheets and pricing power. The most relevant brands are very right-sized for this environment given their moats but I would say it is not the most ideal operating environment. Only when stocks really re-set for this reality will a buy and hold mentality be rewarded.

Thats why Im raising cash on every rallies. I’m about 10-11% cash now and I suspect its going higher.

Healthcare COULD be a good place to invest as profit outlooks are more stable and estimates seem more achievable. They have decent dividends too. Biotech is also quite cheap but that’s a difficult sector to analyze unless you have a ton of medical exposure.

The chart below is a bit of a north star for me. This is from Blackstone recent macro deck. It highlights what an appropriate multiple might be using certain assumptions on where interest rates and overall earnings could be. I’m struggling right now to see a world where the market should trade at 18-20x when estimates are still too high and inflation will eat into corporate profits in coming quarters.

July 15 Market Notes

Whether or not this is smart, we know with certainty the skew is “hold a lot of cash, be very defensive in your positioning, and have short hedges or outright short exposure. That short exposure is now quite extreme so wicked bear rallies can and will be expected without warning.

Great chart from Qualtrics highlighting where corporations will likely spend and cut costs. Bottom line: most who can, will invest in their growth and innovation right through a slowdown. They will cut costs by rationalizing employees and headcount, pivoting to more virtual conversations versus travel, etc. That’s why I like adding to tech, innovation and the enablers of corporate tech spend on every dang dip now that they have been significantly re-rated.

Good news, bad news: Bad news is consumer, CEO and small business optimism is in the toilet, the good news is, any data points that are LESS BAD gets these historic readings to also get less bad. This can drive a lot of good news for stocks given how extreme the bearishness is.

These are very unique times indeed. For perspective, here’s 200 years of calendar returns for markets and how frequent different return baskets tend to happen. With the worst start in 52 years and since 1970, we are in a thin air category currently.

July 1 Market Note

I think this says it all don’t you? Max bearish for the 3rd consecutive week. Well done Federal Reserve & politicians.

Worst 1H in markets since 1970 with the S&P -20%+ and the Nasdaq growth stocks faring much worse as rates rise, credit spreads widen, economic data gets softer, consumer data shows increasing stress with high food and energy costs. And the Fed keeps pushing on growth in a game called “Project Break-Shit”. I was curious to see what the next 6 months looked like after 1H 1970 and oddly back then, markets basically were at the bottom with a 27% up-move the rest of 1970. Things are obviously different now but I was pleasantly surprised. Heres what the forward 12 months looked like starting 6/30/1970. Lets hope we get some positive news to warrant something like this for the forward 12 months. God knows bearishness is extreme, positioning at hedge funds and systematic funds is extreme and traditional money managers is a bit extreme so there’s a metric ton of money that COULD come back in a very big hurry. From 6/30/1970 to 6/30/71, the S&P was higher by 37%.

Week of May 16 Market Notes

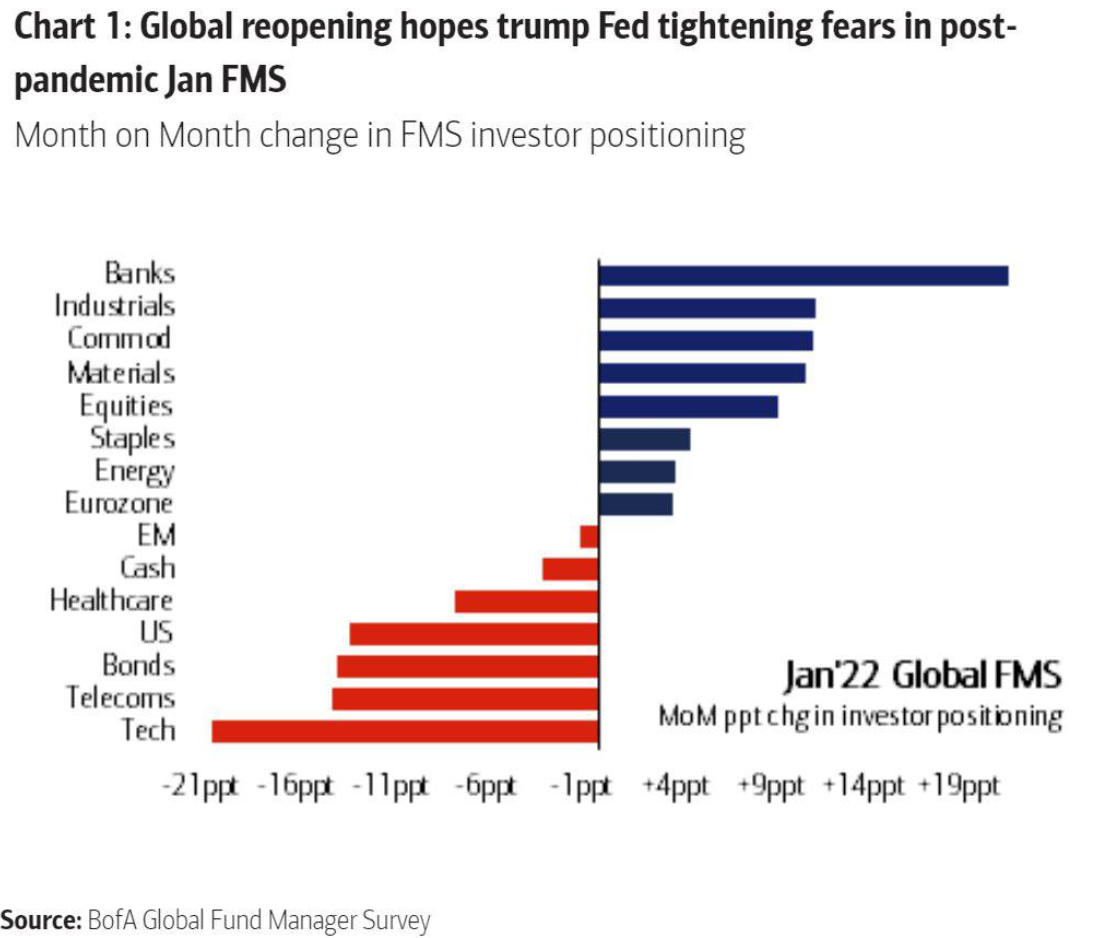

This market continues to feel on the edge of a bigger rally or a deeper pullback. Uncertainty is driving this view. There’s been massive damage to the average stock and de-risking has been deep and extreme. Exposure to cash is high among the institutional managers survey, they are now underweight tech to an extreme degree and rates seem to have stalled over the last week. The trajectory of rates is a key driver of tech sell-offs so this is a welcomed development. It’s clear the economy is down-shifting which should keep a lid on rates and keep inflation ex-energy and food from rising much further. The issue is the lingering food and energy inflation. The home improvement theme is still holding up well even though the stocks are volatile and expected to fall further as consumers further cut spending on discretionary items. I still expect the housing market will stay stronger than people think. Here’s some charts. to take notice of, some bullish, some bearish.

Bearishness got to 30 in 2018. In 2014, it went to 10 and 2015/16 it was at a low of 15. 2008/2009 financial crisis was ZERO. Today on Thursday May 19 its 19.5, not far away from the 2020 Covid bottom low.

Big bond VOL appears to be easing, a very good development.

Hedgeye Quarterly GDP and Quad framework indicates Q2 (now) but likely reported earnings in July could be the trough for the earnings slowdown. Doesn’t mean the economy will rip higher but could mean the rest of the year could get slightly better. ROC matters so getting less bad is a good thing. Then we get to see where the Fed is.

Week of May 9 Market Notes

Friday, May 13

Well, when the rubber band gets hella stretched, it can snap back viscously for a few sessions at least.

Carvana now $38.97

Peloton 15.4

Redfin 11.3

AirbnB 122

You get the picture. Its the names that got crushed the most that are largely snapping back the hardest but very few imo are well positioned for the economy we have currently. I love ABNB, just dont like the valuation but the trends of home sharing are clearly in their favor.

Tuesday May 10: the carnage in “emerging growth” is nothing short of 2000-like. Peak to today returns:

Carvana -90% 376 8/11/21 to $36.6 today

Peloton -93% to $12.1

Redfin -91% to $9.72

AirBnb -46% to 114.9

Teledoc -91% to $28.7

Wayfair -84% to $58.5

Draftkings -86% to $10.7 showing positive divergences

Fiverr -88% to $40.4 showing positive divergences

Se Limited -83% to $64.6

Roku -83% to $81.1

Zillow -83% to $35.5 showing positive divergences

Zoom -85% to $88 showing positive divergences

PYPL -75% to $77.2 showing positive divergences

Coinbase -82% to $74.9

Upstart -92% to 31.1

Shopify -81% to 326.8

Thredup -84% to 5.4

Twilio -79% to 95.4

NextDoor -82% to 3.2

Netflix -75% to 174.6

Docusign -78% to 67.6

Pinterest -78% to 19.9

Square (Block) -72% to 82

Sofi -83% to 4.87

Roblox -84% to 22.6

Lyft -73% to 18.4

Uber -64% to 22.9

Alibaba -74% to 84 showing positive divergences

Affirm -90% to 17.1

Spotify -75% to 95.5

RH Restoration Hardware -62% to 282.2

Snap -73% to 22.5

Match -63% to 68.7

Mercado Libre -61% to 781.1

Shake Shack -67% to 46.7

Etsy -73% to 83.8

Unity Software -78% to 45.6

Rivian -88% from ipo to 21.4

Trade Desk -64% to 41.2

Robinhood -89% to 8.9

There’s been a ton of carnage of -30 to -50% in mega cap, highly profitable stocks like Adobe (-45%) etc.

Well, the boat is certainly crowded with “inflation is here to stay and sell anything with growth attached to it. While individuals rarely have much commodity exposure, institutions generally do. And they are now as overweight as they have ever been. The second chart is really what intrigues me: it shows how stocks react to an initial CPI decline after having CPI exceed 8%+. Obviously, any sign that inflation is not getting worse and in fact could be easing will be greeted with a very strong upside response, at least historically. Then we have to worry if the Fed will use that data to be less aggressive. I suspect they will be stingy to make sure any easing is NOT transitory. But we are certainly oversold enough to get a fierce 1-3 day rally where sellers will be back.

Inflation expectations peaked already folks. And interest rates likely peaked as well.

Actual 1Q22 reported buybacks amount to $250 billion (for 86% of S&P having reported); already sets new 12m record of $953 billion, surpassing prior record of $882 billion, set in 4Q21 (that is without remaining unreported 14% for Q1 2022). The buyback window for buying is in full view today. It could offer a temporary respite from the buyer-strike we have now. And these are big buyers as the graph shows.

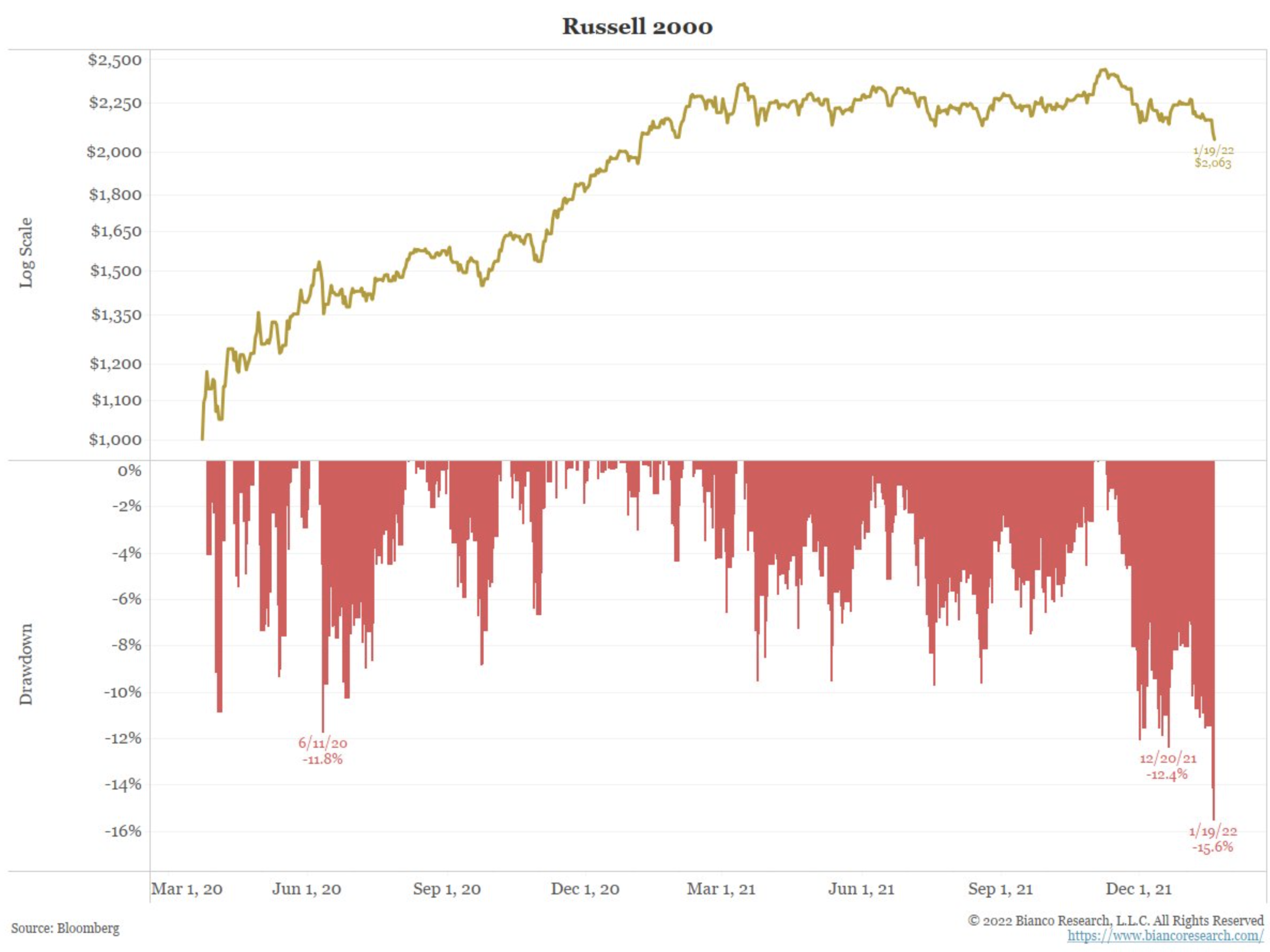

I know passive observers of markets think the market has largely gone nothing but up the last 3 years but as you can see from the below image, we have had 3 crashes in 3 years, this is NOT normal folks. We’ve also had multiple vol spasms along the way. This is NOT an easy game, the last 3 years have been a very wild ride.

Very interesting post yesterday from a man I really respect. BTW, he is rarely bullish and always cautious.

24% Bears!!

Less mortgage demand, zero refinance demand means more people stay put for longer as 8% of of mortgage owners are locked under 3.5%

It’s a good time to remind ourselves of Bob Ferrell’s 10 Rules of Investing

If we get inflation under control and stabilize the economy, theres lots of value in prices today

Week of May 2 Market Notes

2021 & 2022 Delinquincies remain low and not inflecting higher as they did in late 2006/early 2007 - below. This will be a hint about inflation creating consumer issues

Delinquencies inflected higher end of 2006, early 2007 and began to go vertical even as stock markets remained elevated. Delinquencies inflecting though, is a great leading indicator to trouble to come. For now, we have NOT seen anything of note.

For those linking today with 2000, the 65% of the stocks driving QQQ today are very different than those driving 2000, much higher quality, and a much more tech-focused economy with valuations in the quality basket much more attractive than even consumer staples. Narratives aren’t FACTS

Quick note from JP Morgan Trading desk - retail needs to stop buying the damn dips before the real bottom comes but my gosh are there some attractive prices in great brands. Maybe it gets even cheaper and better but there’s some real strong gains over the next few years being offered for those with pat

Week of April 25 Market Notes

Monday: Twitter, without other real options, accepts Musks bid to take the company private!

Week of April 18 Market Notes

Monday, April 18

From Rich Bernstein: This morning’s LEADING #Indicators declined a bit but show absolutely no sign of an imminent economic #recession.

Unless your base case is rates can only go up for the next year+ and inflation is not going down at all and will keep going higher, the growth stock complex, particularly the most profitable growth brands, are back to be highly attractive relative to the value stocks. The minute the world sniffs out a peak and/or slowing growth, growth stocks will catch a bid unlike we have seen in a very long time given how under-exposed to these names the world is now. Remember, hedge funds have rarely ever been this under-weight tech.

The big growers relative P/S are now at levels where bottoms have occurred. Again, maybe its different this time and rates and inflation will drive them to get absolutely cheap, its time to start building bigger positions in growth.

@ukarlewitz on Twitter with good post today: Conference Board Leading Economic Indicator (LEI) on the rise through March. It has historically peaked a min of 7 mo (avg of 11 mo) before the next recession

Truck tonnage in March the highest since the ATH in Aug 2019. Trucks carry 70% of US freight (from ATA)

Ed Yardeni with the Investors Intelligence Sentiment Report - timing uncertain but low readings like this arent generally bearish for forward equity performance - we just need some more clarity from Fed, Ukraine and QT

Just look at where we are via AAII Sentiment - Bull ratio very low, Bull/Bear Ratio on the floor at a rare -.3 reading. Clearly there are issues and some big ones can last but the stage is set for any positive developments to bring oodles of money back in whenever that occurs.

Not that we need a reminder that equity markets can be volatile and offer drawdowns, that’s just the nature of the beast, but here’s the reminder in a look-back.

Magazine headlines tend to mark the top or bottom in major trends. Will this age well or mark a close peak in inflationary pressures?

Week of April 11 Market Notes

Tuesday, April 12

The positioning among institutional investors remains skewed to the negative and heavily defensive. Yes, its been the right call YTD but at some point there is an unbelievable amount of money that will rotate out of the most crowded trades and back into things like highly profitable tech and high quality consumer stocks. Until then, we are in the chop-bucket.

Global growth optimism is at all-time lows folks - at levels from the GFC 2008/2009, pandemic lows. As you can see from December 2000, this pessimism doesn’t have to a contrarian buy signal, every time is different but my gosh it won’t take much positivity to drive meaningful money shifts.

A big component of CPI is auto’s and the prices are out of control but due to mean revert

Monday, April 11

Great notes from Michael Cembalast at JPM

we expect the March 15 equity market lows to hold as long as there is no US recession.

Some recession indicators are rising: first inverted 2-year to 30-year yield curve since 2007

a collapse in consumer sentiment to one of the lowest levels in 70 years

declining small business surveys

ISM business survey orders falling below inventory levels for the first time since the expansion began

China’s supply chain delays and spikes in anchored containerships due to COVID

Labor markets are very tight (there has never been a recession without a large spike in jobless claims)

household and corporate balance sheets are in very good shape

US recession risks look higher for 2023-2024

2001-2002 selloff - the median NASDAQ stock was down 75% from its peak vs the feb 28 lows 2022, median stock down 40% from peak

Another day, another sell-off in equity AND bond markets.

HY bonds now 6.5% versus the 4% at the start of the year. Yields on bonds are finally getting more interesting but my gosh with the expected VOL on rates and the bond math, the returns still don’t seem very attractive versus stocks.

The uncertainty we have now should keep markets from levitating much but by the middle of the year we should see stocks stabilize. What’s the strategy from here to then? Buy the highest quality, strong profit and cash flow businesses on the dips the markets offer. That will be a great long-term strategy even if it feels bad today. From a rates perspective, here’s the 40+ year bond bull market, yields are hitting the 40 year downtrend now. We can certainly go higher in yields but there’s a whole other group of issues that arrive if rates go much higher and with the trajectory they are doing it in.

A very clear example. ofthe concept that just a handful of stocks tend to drive the bulk of the index returns. Here’s 2017 to 2022, top 4 mega-cap growth stocks performance versus the growth indexes

For those that still can’t figure out why certain stocks are lagging for now: it’s the trajectory of rising rates that matters most.

Look at the Feds balance sheet, my lord it’s bloated. The real question: who are the early buyers of all the debt the fed wants to sell starting in May?

This is quite the software valuation re-set.

Hedge Funds have been in de-risk mode all year. Remember, these are the players that use massive leverage on occasion and get over their ski’s at the wrong time very often. Well, today they are the least exposed to Tech as they tend to get. Below is other time periods when HF were this negative on tech via low exposures. Most important, it’s only a matter of WHEN they get back into tech and now, there’s plenty of new buyers when the CPI numbers likely have peaked. I don’t know when but the crowded trades of rising rates and inflation beneficiaries will suffer rotations and tech will be the first place they rotate into.

In case you can’t see the returns, here’s the story: When HF have gotten this negative and under-exposed to Tech in the past, the forward 6 month returns have been quite positive. Max drawdowns look like ~2% and anywhere between 13% and 24% were the prize.

Great summary here from Twitter: @aboutheoptions. All people want to say is: don’t fight the fed and the fed is now NOT your friend. Until they pivot if/when CPI clearly peaks

Lots of chatter is happening comparing todays environment with 1994. There are some similarities and differences but below is what 1994 looked like and when we saw fed rate hikes and what markets did during and after those hikes. I have said for a while that 2022 is a throw away year, it will be highly volatile and largely frustrate most traders and investors and then once we get through some of the tightening and rate hikes with CPI falling back to more acceptable levels, the equity markets will take off again. In the meantime, just keep nibbling on your favorite profit compounders on the dips the market offers.

Here’s the part of inflation that will be sticky for longer: wage pressure in a tight labor market. You better have some pricing power and be able to wring out some internal costs to keep your operating metrics from collapsing.

Low wage compensation is rising faster than middle and high wage workers, thats great because the lower wage cohort is the one hurting the most and these folks have less wiggle room each month.

The following chart shows where each income cohort tends to spend their money. Services continue to be the biggest spend and durables being the lowest spend.

Week of April 4 Market Notes

Tuesday, April 5

THIS WARRANTS CAPS: YTD WHICH STYLE FACTOR CHARACTERISTICS HAVE LAGGED AND OUTPERFORMED MOST?

THE WORST PERFORMERS…WAIT FOR IT: THE HIGHEST PROFITABILITY & HIGHEST QUALITY BALANCE SHEETS.

-12% YTD for the high profitability basket

-8% for the strong balance sheet basket

+15% high dividend yield stocks, aka defensives and income for rising rates

You can chase low quality, highly levered balance sheets into a slowdown but I’ll keep adding to the highest profitability, strong FCF growers with great balance sheets, they win in the end. It’s not disputable folks.

Next point:

Key: “On average, stocks performed worse 1 year before a recession than during the recession. In the 2 years after a recession, price returns were positive 82% of the time.

Monday, April 4

There’s been a clear pivot in the growth versus value underperformance in favor of a return to growth stocks. Valuations have been broadly re-set and most growth stocks have had significant pullbacks. For many, the secular growth opportunities have not changed and are intact yet the stocks have become much more compelling. I’m not surprised to see some of the biggest laggards having strong rallies because they were so beaten down. Whether these are bear market rallies or the beginning of a lasting recovery depends on the stock but the end of growth stocks does seem greatly overblown. Many. ofthe most beaten down growth stock, lets call them the Ark stocks with no profits, cash flow or earnings, may never return to their former highs but the stable predictable growers with real profits and cash flows should return to old highs and then some. That’s certainly where I’m focused.

Here’s a great chart showing valuations across the globe for perspective. Valuations are rarely a catalyst but it’s very clear: the US is the most expensive but does have the highest quality assets and growth stocks. Japan and Europe are the cheapest regions in the world but generally I wouldn’t say thats where innovation lives.

Just another reminder that inflation is pulling consumer sentiment down to levels that are generally very bullish for future consumption growth and better stock price action.

This chart is very important and one to keep monitoring. Here’s the Federal Reserves reporting of 90+ day delinquencies across: mortgages, revolving credit lines, auto loans, credit cards and student loans. Bottom line: theres no evidence of worrisome signs that consumers are starting to be late on their payment obligations. This is one key warning sign of inflationary pressures and recessions.

Week of March 28 Market Notes

The following charts are a great look at real personal consumption expenditures and highlight how above and below trend we are from a goods versus services perspective. Lots of things have changed since the beginning of Covid, some brands and spending categories have stepped up into a new demand level and many are just beginning the mean reversion process. The market has clearly been front-running this process, most of the goods retail businesses have already corrected 30%+ and/or have returned back to the pre-pandemic price levels. There is bound to be a few quarters to even a year of re-setting long-term trends and correcting of stock prices before normalization arrives again. Services still seem to have a fair amount to go, particularly in some pent up demand areas like travel, cross-border travel , lodging, recreation, etc. Charts are from Goldman Sachs. Chart 1=we are back to the long-term PCE trend but within that trend theres a wild number of over and under-earning by company.

Inflation is the talk of the town and it’s everywhere. As a guy who studies consumer behavior, I am well aware of what drives people to change habits. As we get squeezed from every direction, we begin to mentally categorize every purchase into 3 baskets: 1)I need that item, 2) I really want that item and 3) I have to defer the purchase of that item. As an investor in consumer trends, my investment choices are tied to these consumer questions with inflation so high. To be clear, my belief is that companies that are raising prices will hold those prices until they see a shift in demand and then they will be forced to lower prices to stimulate demand again. That’s the decision MOST brands will have to make soon enough. That decision will have implications on margins and revenues and brand loyalty. At the higher end of the spectrum, those price discounts will be slower or non-existent unless the company see’s a significant set-back in demand. Pricing power with zero erosion in demand is where you want to be right now. Also, you want to be in the brands that will thrive as consumers “trade-down” to try and save money. A luxury, high pricing power with strong demand plus price discounter barbell is where we are focused today with stock selection. Here’s a great chart showing the growth of wages versus the growth of expenses in today’s high inflation. What it shows is, the lower the income cohort, the more expenses are overwhelming these consumers and forcing them to make tough choices on their spending. While I have seen some consumer sentiment data that talks about high income consumers and their interest in deferring purchases, we still haven’t seen much evidence yet. Remember, if you have the extra money, you may moan and groan more but you will likely still purchase what you want to purchase. If there’s a negative change in income though, all bets are off.

Great chart showing the semiconductor industry and players that dominate it from @investquotes on twitter. Currently, the brands portfolio owns ASML, NVDA, AMD, AAPL, TSLA

Week of March 21 Market Notes

Friday, March 25

Consumer confidence continues to fall to historic low levels due to high inflation for needs and wants. While that portends slower GDP and consumption for Q2 (market already front running that via its weakness), it also leaves massive room for improvement if/when inflation peaks and more certainty arrives in markets. To me, thats the real opportunity. Often the biggest gains come from periods of horrific to less horrific. Here’s a chart of buying conditions for homes, vehicles and bigger ticket durable items.

Perspective: Long-term markets often go from sideways, boom/bust to bull market trend. Here’s the look today. A solid case can be made for a new bull market trend that began in 2013 when markets broke out of the huge sideways range from 2000-2013. If typical bull trends last ~15 years, we have plenty of room to run. Covid and all the crazy distortions that were created out of it, have created a lot of noise but the bull trend does not appear to be completed.

Great chart from Michael Cembalast at JPM showing what the avg stock, index and median stock has done as of March 8 across all the indexes. Result - the average stock in the Russell 2000, Russell 3000, Russell 1000, Nasdaq 100, Nasdaq Index is already in a bear market. The damage has been so much more severe than the S&P 500 indicates.

This is an even better chart showing the average decline from prior peak across the indexes when compared to a recession typical decline. Bottom line: IF no recession occurs, the drawdowns we have already seen are right in-line with typical drawdowns that happen. They never feel good but they are a normal part of the long term investing landscape. Clearly, rates, inflation, fed uncertainty have created a potent cocktail of adverse risk taking but we are well within the “normal” band of corrections. The valuations and prices got very very extended from reality and we have and are wiping away those extremes now.

Heres a quick reference guide to the assets and drawdowns since the S&P 500 peaked. It’s been a crazy time folks.

With a week like last week, there’s very little that could excite me given the high bar but I think we just have lots of chop for the next few months. Earnings will start again in 3 weeks and any company with international exposure will likely add a note of caution given whats happening in Europe and what could happen in Asia. Ah, 2022 is shaping up to be a tough, volatile year.

What do we do when things are volatile? We trade more. I’m now only looking for trades that are 1-5 days, I want to see the VIX stabilize but with a strong week last week, the VIX is now back to the low end of the range at 23 so a better time to sell trades.

Barrons never fails to be a great contrarian indicator but with issues in Ukraine and Russia, things could get bad in agriculture land real quick. I sinscerely hope our politicians understand.

SAAS MULTIPLES GOT WAY OUT OF WHACK, THEY ARE MEAN REVERTING AND THERES SOME OPPORTUNITIES NOW. THE MOST EXPENSIVE GROWTH COHORT IS BACK TO “NORMAL EXPENSIVE CONDITIONS, THE MID GROWTH MEDIAN ALSO BACK TO NORMAL BUT THE LOW GROWTH COHORT IS NOW ABSOLUTE CHEAP. For me though, I’d most likely be looking for brands in the blue and red area.

Here’s the breakdown of the universe when compared to the growth expectations and the current multiple. Some observations: VEEV, MDB,NOW,ADSK,ADBE, WDAY, U, SNOW, CRW, SHOP, DOCU, are still slightly more expensive than the mean avg of the growth cohort even when taking into consideration of the growth opportunities. Then you have to do the work on which company is worth paying a premium. But the best result is, the massive overvaluation that we saw has largely been rectified and it seems very smart to start picking through the rubble.

On a more positive note, corporate America has a massive cash hoard currently, particularly a handful of the biggest companies, aka brands. Look at Google in particular, my lord. FB, Meta also has a hoard of cash but they intend to be spending a ton of cash on the next-gen Meta platform, I’m still skeptical of their ultimate ability to monetize whatever the Metaverse becomes but there’s probably not a ton of downside in the stock with the balance sheet looking this strong. 9% of Googles market cap is cash, 8% of Meta’s is cash, Apple and Microsoft at 3% and 2% of Amazons in cash.

Unless you think this period is most like 2000 and 1973, many people do, I absolutely do NOT, buying Nasdaq stocks AFTER the 20% drawdown was most often a wonderful decision assuming you have more than a nanosecond time frame. Why don’t I think this is like 2000? Make no mistake today’s period rhymes like 2000 with all the garbage SPAC’s, hundreds of IPO’s of companies that don’t seem to have any path to profitability BUT the blue chip tech brands at the top of the index are wildly more profitable, unbelievably more dominant and at the center of tech innovation that will not, can not stop unless china and Russia hold back all the minerals that go into tech. And inflation was all the rage in the early 70’s and now, inflation is all the rage. Wait, now I’m scared lol.

I believe the services sector, particularly leisure travel has a lot more room to expand. Here’s a great chart showing when the services % of PCE fell below trend, there was a wicked, multi-year period when it mean reverted and got back over trend. I’ll add more services and particularly travel on dips. The second chart shows how the inbound/outbound travel spend is still well below where it normally is.

Week of March 14 Market Notes

Friday, March 18

Well the Nasdaq was up 10% for the week and SPY +6%-ish, hows that for a bear market rally? These daily moves wreak of high uncertainty and zero confidence. This remains a problem short term but a wicked opportunity long-term, as uncertainty always reverts to more certainty and the market likes certainty.

Wednesday, March 16 - It’s FED day, isn’t it funny how they say every fed meeting is THE most important Fed meeting EVER? Well, this meeting is kinda important but I don’t think anything will change:

The fed will hike by 25bps - expected

The fed will talk tough on inflation - expected but at some point the market will realize they have ZERO aircover to hike 5-7 times

The fed will remind people again, they are data dependent and there’s alot of issues and concern out there which are already leading to economic softness. This will matter when it matters, I’m not smart enough to know when that is.

I don’t love the market ripping yesterday and today into the meeting though, raises the chances of a sell the news knee-jerk response but with so much positioning in both directions, Im confident there will be quick, sharp moves in both directions. It will take a day I suspect to see how the market really feels about the trajectory. More certainty is better than what we have now but I suspect the Fed wants to keep animal spirits at bay for now so they will be balanced in their comments.

More on the decision and comments after they occur.

Some great charts: There is a very predictable inverse correlation between consumer sentiment and rising inflation. With the price of everything going up STILL, consumers have likely already begun to make the this versus that decisions and lower income consumers are likely trying to defer where they can and cut costs where they can. We will see that in April earnings reports. The trick is how much of that eventuality is already priced into prices as they have come down an awful lot. I guess it depends on how cool or hot we go into earnings and what the world looks like in a month.

This chart highlights one of the many reasons I like Blackstone BX as a top holding: they have been invested in some of the best neighborhoods with regard to themes for many years. Rise of e-commerce via more warehouse and logistics space, life sciences growth, and housing via rental real estate. The hard asset of housing and real estate has historically been a stable inflation hedge and the rents and their ability to rise provide much better income than traditional fixed income. Whether renters like it or not, Asking rent growth is strong. If you have the means, you buy a house or condo, if you don’t, you have to rent. I simply do not see an end to the stability of the housing market anytime soon.

The next chart just shows where a potential pain point could be if things slow further and the fed pushes on the aggressive rate hikes and QT. There’s a significant amount of leveraged loans in the market, it doesn’t take much softness to put some pressure on repayments. HY defaults are very low right now but something to watch. This is yet another reason I do not believe the Fed can do what they say they would like to do to fight inflation, there’s simply too much leverage in the system for them to get too aggressive like Paul Volker did decades ago. The economic damage would be horrendous.

Inventories are building everywhere - great post from @gavinSbaker

Tuesday March 15 - A chart storm!

The wall of worry is large - as we pick away at these 1x1, uncertainty will turn to more certainty and that’s great for markets. Next chart shows what risks are most prevalent currently.

Great stats on corrections, bear markets, time, etc.

Supply chains are NOT fixed. Why? Because China does not want them fixed. Policy makers over-reacting to Covid are not doing what they need to do to fix them either.

Nobody wants tech stocks thats for sure, my gosh they are fickle, Tech is only the best performing sector for 3,5,10,15,20,30 years. Maybe tech just needs to cool off a bit? If you want growth and stability of balance sheets, mega cap growth is the place and they are on mega sale right now! They can hate tech for longer and get more underweight like towards the bottom in 2003 but that’s an extreme case and if we see that I think I’ll have to be 100% tech!

This will put a dent in your dinner plans when you spend dinner putting gas in your car to go to dinner! Get an EV please, I spent 2/3 less on my car across service, no gas versus a charge, and general maintenance.

When nobody expects something, does it happen? Generally. So nobody expects a good economy?? I mean these are back to 2008 and 2000 levels for heavens sake.

Everybody citing they aren’t taking much risk relative to “normal”. That’s obvious when we see daily volatility - there’s clearly a buy strike for now.

Empire Manufacturing General Business Conditions - Attention Federal Reserve, the data is clearly weakening, will you be aggressively hiking into it? NOT a good idea

Hedge fund exposure also quite low. I don’t know when but my god at some point the amount of cash that’s going to get put to work will be epic.

60% of market participants surveyed expect a bear market. Well, the Nasdaq is already in a bear so DAH

Weightings to cash are quite high. Cash in money markets also epic at $4.5 trillion! Consumers still have >$2.5 trillion in savings accounts as well. One day some of that money gets put to work. When we have some catalysts, sweet Jesus the rally will be robust.

Here’s a disconnect, fund managers are not bullish on global growth yet they havent de-risked as much as they typically do when they are this bearish. Second chart also shows how bearish folks are currently. Maybe they are hedging with put?

Inflation and stagflation is now the most believed narrative, any change will require much different positioning.

Nobody believes a steeper yield curve is in the cards at this point. What a few months make!

Current positioning clearly towards defensives and commodities and away from European equities and discretionary stocks. In my experience, betting against the consumer has largely been a bad bet,, particularly when their overall balance sheets have been so strong.

Monday March 14

Groundhog day for growth stocks, still getting pounded, regardless of business fundamentals. This too shall pass, It’s always painful to watch but the opportunist in me loves getting better prices for great businesses. I continue to build the next 12 month portfolio into this absurd weakness. Full buy strike and uncertainty everywhere. IN HK, china stocks are getting destroyed, I don’t think the chinese consumer is loving Xi, even if they can’t say it out loud for fear of their lives. Lockdowns in tech hub, Shenzhen, now so supply chains will get messy again and the production of tech supplies will grind to a halt.

Make no mistake - China has a vested interest, just like Russia, to keep the heat on the West, keep inflation high, and economic prosperity in question. This is an economic war folks.

Not that I believe chinese data but the data today is actually pretty solid, even if its rolled over since.

Private equity stocks are like 2x levered high beta stocks when the economy is slowing or accelerating. Right now, these stocks, BX and KKR are holdings, are getting clocked due to high inflation, higher rates and slowing economic growth, but these firms have raised so much money in the last 3 years and have so much dry powder to put to work in tumultuous times, they get me very excited as they come down. They are cheap, have great dividends and/or great dividend growth, are always buying back their own stock, heavily owned by insiders, and are superior capital allocators. Here’s a few charts to remind people of the biz trends vs their stocks, which can be volatile in wild markets. An estimated $3 TRILLION in capital is ready for deployment at the right time and in the right places. Once this happens, the fee revenue machines get a new boost and these stocks all beat estimates and they go higher.

Sunday March 13

Lots of ugly newsflow over the weekend. More bombing in Ukraine, China locking down because of 1-3,000 covid cases, lol, mind you China has like 1.2B people. These lockdowns are not about protecting citizens, they are about keeping inflation high and shutting down supply chains on a periodic basis. IMO China is already at war with America and maybe the west and likely working behind the scenes with Russia. These two countries want everyone around the world to bend a knee as they control more of the worlds resources.

REMEMBER THIS: IF THE WORLD IS FOCUSED ON CLIMATE CHANGE AND A MORE SUSTAINABLE EXISTENCE, THOSE THAT SELL AND CONTROL THE LEGACY RESOURCES HAVE A VESTED INTEREST IN KEEPING VOLATILITY AND PRICES HIGH SO THEY CAN MILK THIS COW FOR AS LONG AS POSSIBLE. THE BRIDGE FROM HERE TO A MORE SUSTAINABLE WORLD WILL BE ROCKY AND VOLATILE SO JUST ACCEPT IT AND TRY TO MANAGE THROUGH THE VOL.

Turning to market breadth, here’s an observation:

At the close on the last market low of 2/24, there were washout readings when I look at breadth stats.

On 2/24, just 6% of the S&P 500 and 15% of the nasdaq stocks were trading over their 10 day moving averages. JUst 17% of the nasdaq names were trading over their 150 day moving average. 29% of the S&P 500 was trading over the 150DMA.

At fridays close on 3/10, 26% of the S&P 500 was trading over the 10 day and 33% of the index names were trading over the 150DMA. So 33>29 - close to each other but slightly less bad while the SPY closed lower than the close on the 24th. The index closing low was lowest on 3/8 vs 2/24 and short-term washout breadth was still much worse on the 24th closing low. The 150DMA data was basically the same. The same is true of the Nasdaq.

What’s this mean? Its just data in the end but it says that for now, we are still seeing some positive divergences between the individual stocks making new lows and the indexes finalizing their capitulation, washout process. As in 2008/2009, this current period could be like the late fall of 2008, we have a washout low, wicked rally, then had a final horrendous plunge into March 2009. I do not know the future but this market seems to be holding until it gets the data and trajectory from the Fed this week on the 16th. Then it can make its next move.

With all the geopolitical issues, and likely earnings rolling over, I would be absolutely shocked to see the Fed being as aggressive as the world believes they will be. There is simply no reason to be aggressive on rate hikes and QT in this environment, they missed their window, now they will need to sit tight, move very slow and give the market that certainty.

Week of March 7 Market Notes

Consumer sentiment, not shockingly continues to fall due to high inflation and prices of gas in particular.

The year-ahead expected inflation rate rose to its highest level since 1981, and expected gas prices posted their largest monthly upward surge in decades. Personal finances were expected to worsen in the year ahead by the largest proportion since the surveys started in the mid-1940s. Consumers held very negative prospects for the economy, with the sole exception of the job market.

Here’s the thing though: Humans have recency bias, when they have great experiences, they tend to think they will last forever, when they are very concerned, most of the time, the hurricane is almost over. The current inflation issue is NOT going away anytime soon, however but this is the first time I can find when corporate and household balance sheets were healthy during this kind of economic issue. It doesn’t mean there won’t be pockets of issues, there will be, particularly at the lower end of the income spectrum. The average tax refund coming this year is $3500 per Morgan Stanley, thats higher than normal, this could give the lower income cohort a bit of breathing room at a time when they need it most. Because of higher gas prices, the average household has an extra $1600 a year energy burden, consumers are resilient, when they need to tighten their belts, they begin to change behavior: only buy gas at Costco, the cheapest place in town, shop more at Trader Joe’s, much cheaper than other markets, don’t go out to eat as much, defer that discretionary spending this month, take a different, experience based vacation, spend more time in nature etc.

Bottom line: we should expect consumer sentiment and spending to stay volatile, but historically, when the data is as low as it is currently, sentiment reversed higher and stocks had pretty robust forward 12 month returns. We are lapping unprecedented stimulus and policy accommodation as well as very strong corporate earnings, things need to normalize which is why the stock market has already pulled back. Over 75% of the Nasdaq stocks have already fallen 25%+, the correction to this stimulus is well under way. We just need to get through the next few months of wild swings and earnings resets. The highest quality companies are in the best possible situation to ride these storms out and they have oodles of cash and are aggressively buying back stock when they get beat up, over time, those will be accretive buybacks and be shown to be strong capital allocation decisions.

A great look here on the tiger cubs hedge funds and the hyper growth stock ownership. There’s certainly been a ton of pain in the most speculative names and most are off 60%+, by the end of this could be 80%, some are already there. Picking through the rubble will be fun.

Monday March 7

Not a pleasant day in markets with idiotic moves down in some travel and private equity favorites. Good news: for now the close showed many more stocks trading above the 10,20,50 day moving averages than the last time we were around the Feb 24 levels. Other than the intraday low on the 24th, the indexes are lower but the number of stocks trading above these moving averages was higher. That’s a positive divergence which tends to mean the markets and rubber band is stretched too far and we could be due for an oversold bounce.

Tuesday March 8

Well the wild volatility continues. My buddy Sean at Avory & Company sent a great post that everyone needs to be reminded of during these times. High VIX means there’s a ton of uncertainty and it also means the daily trading ranges should be expected to be wide=great trading environment versus buy, hold investing. Maybe a strategy that buys and holds great brands PLUS trades around these brands in periods of high VOL can add value over time? I think it does.

Here’s a longer term look at cautious periods when VIX is elevated. My rule is >20 hereto stay for a while? Take trades when you have good set-ups. >30 get more cautious but look for washout signals which happen closer to 40 and above. Then there’s always the pandemic and 2008/2009 crisis when VIX can get >80, very rare and painful but offer wildly bullish opportunities in major capitulation. That capitulation typically happens when we see <5% of stocks trading over the 10,20,50 day MA.

I know people hate tech now, valuations were absurd and rates and low inflation were a great tailwind but the secular drivers of innovation have never been stronger and looking at the chart below, SAAS valuations have collapsed back to “normal range”. Just remember, there’s a ton of recurring revenue and stability in the businesses of the best tech companies so don’t expect the greatest companies to be outright cheap alot. Relative valuations also matter.

Wednesday, March 8

Bear markets, bear rallies, VOL, and uncertainty

We have already established that there is about as much uncertainty as I can remember having for many decades. The economy, Russia/Ukraine, interest rates, inflation, stagflation, the Fed and its QT trajectory, consumer spending, supply chains, shipping lane congestion, input cost inflation, commodity inflation and scarcity, etc. All of this uncertainty will keep the VIX higher than normal which simply means each day investors/traders HAVE to expect wider swings between peak and trough levels. That makes “investors” sea-sick, it makes traders giddy. If you are willing and capable of active trading around the core, you have the potential to add short-term gains that can build up over time and add to the short term unrealized losses you have on your core, long-term holdings. In time, the uncertainty will be replaced with less uncertainty and eventually some actual certainty and the market loves certainty, even if its bad certainty versus having persistent uncertainty. When the uncertainty peaks, maybe its now, maybe its later, markets can begin the re-risking process. That’s what I am positioning for currently with the understanding that the timing is uncertain. All we can do is have a small group of companies that we have high degree of confidence in and be willing to build bigger positions in them as they come down so when the bottom comes, likely due to more certainty, your recovery is more robust because you’re in the right recovery stocks. Having said all that, here’s what bear markets and bear rallies look like. We never know if a bear rally is THE beginning of the recovery but for now, I suspect these bear rallies will be sold. With some luck we get some more certainty in Ukraine which could lead to more sustainable gains.

One thing is for sure: the bear rubber band is stretched pretty far, it can always go further down but the bigger the snap back when there’s some certainty.

We are certainly set-up for one heck of a rubber band rally at some point, maybe its for a much better full year of 2023, I’m not smart enough to know the future.

Friday, March 11

Well, I get the reasons but there will be massive massive opportunities in european stocks when/if the uncertainty is removed. There will be an epic amount of money incrementally moving back into european equities at some point. Think of the iconic brands trading there: Ferrari, LVMH, Hermes, Kering, Nestle, etc. Time to get my shopping list ready.

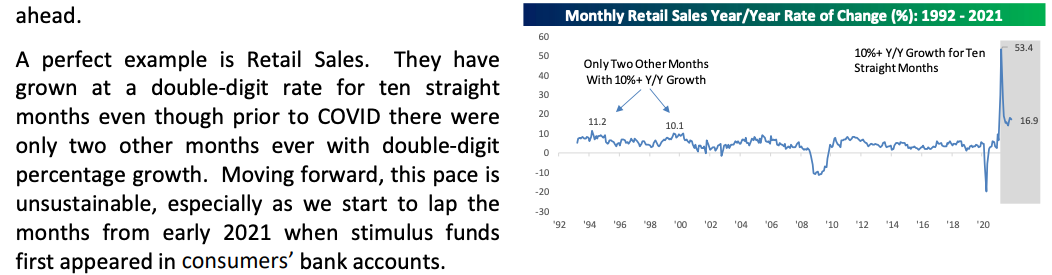

Visa spending index update:

It looks at YOY momentum, strong momentum in US spending volume but we should expect a decelerating trend when March data is reported. June 2020-Feb 2021 it had negative data. This data is so distorted with the stimulus payments so we should all expect unbelievably volatile data. March is a comp versus the bigger stimulus last year so it will look bad given the lack of stimulus now. I know analysts use ROC and comps but using this data seems worthless now as its not incredibly important when comping historic non-recurring payments. Let the data settle, then we get back to normalized numbers.

Week of February 28 Market Notes

Wednesday March 2

Well well well, AAII bearish sentiment rose to 53.7% - that’s at the 100%tile for 2 years and 97%tile for 20 years. YES, we can get more bearish given all the Russia/Ukraine news and collateral damage to economic growth and sentiment as well as the uncertainty from the Fed policy direction and timing but historically it was a pretty good time to begin sifting through the rubble in stocks to find some bargains. VOL will stay high which means trading opportunities in both directions should be solid but for long term investors, buying when the masses are bearish has been a pretty solid outcome.

I’ve said for a while now, the FED has zero shot at doing 5+ rate hikes let alone starting Quant tightening. With the economic data to begin cooling off a wicked strong base rate in Q2, potential geopolitical issues lingering for longer and inflation data cooling ever so gently, there’s a strong possibility some slight dovish pivots are coming our way. And when that happens, the world will realize they are much more bearishly positioned for an outcome thats less severe. These wicked rubber band moves can work in both ways and I suspect at some point in a few months, the upside opportunity with clarity could be quite robust. Thanks for the tweet Mike!

Week of February 22 Market Notes

Friday, February 25

Loathing of tech and “beta” is getting extreme…there will continue to be some wicked short covering rallies in QQQ names. WHY? Because they are being heavily shorted and many of the member in QQQ and XLK in particular are among the most impressive companies ever created. There will always be demand for industry leaders, strong profitability and mega sales when they collide. All we need is a match, the wood is ready.

Valuations were stretched across most asset classes, some are still stretched even after massive drawdowns, some are very attractive but overall, the argument that the market is too expensive is giving way to, “the market is more reasonably valued, particularly versus fixed income and real yields still under zero when you consider inflation”. I say again, NO WONDER BX, KKR, CG, TPF, and APOLLO are raising so much money, there’s hundreds of trillions in global fixed income that will generally earn nothing and be more volatile than it’s ever been. And I’ll say it again, with all that, why does everyone worry so much about equities? My gosh, I’d much rather own high quality equities with good growth characteristics and a basket of real assets than anything related to fixed income. Maybe I have lost my way.

There’s been a lot of chatter about the real estate market thats still red hot and it’s ultimate cooling because rates have headed higher and home affordability is now low. I think directionally that is an ok assessment except we need more data to really understand the complex real estate market. 1: wages are also rising and in most cases, wages and income have risen faster than mortgage rates that been pushing affordability down. 2: if you own a home and likely have nice appreciation embedded in the value and want to sell, you sell one appreciated asset, capture a good cash return and have the ability to roll all or part of that cash into a new home. Having the excess cash from the highly appreciated asset really takes the edge off the appreciated price of the new asset you are buying. 3: institutions are the primary driver of real estate purchases these days and they are buying for different reasons than individuals. Traditional fixed income, income + capital appreciation of the bond as rates fall, should offer a negative real return over time so large institutions are looking for non-traditional income and inflation protection via assets that can appreciate in inflationary times and generate attractive and predictable monthly income. Housing does that quite well typically and these institutions are not investing in real estate for a quick trade,, they are taking inventory off the market and it will stay off the market for years and years. That keeps inventories low and prices stable and rising. 4: demographics matter and the charts below from Alpine Macro highlight the demographics are quite favorable for the housing market as younger people begin the household formation process. I do believe the home market will require smaller footprints as younger people tend to get married later in life, have less kids and thus will require smaller homes. But the demand should be stable and growing and every pullback in rates should bring in pent up demand. Homes and the home improvement thematic is still a big one for the brands portfolio.

A very large portion of the population is less than 35 years old, this cohort will provide lots of firepower for consumption over time.

Thursday, February 24

As many of the charts and notes below show, bearishness is getting extreme and at least a wicked oversold bounce is likely at any time for any reason. BUT the biggest worry I have now is not really being talked about. It’s impossible to put a percent of odds on this outcome but China has a history of being ruthless so nothing would surprise me. Here’s my worry:

Russia is now invading Ukraine - why? Well lots of reasons but as always, resources that are vital to the USA and other world players is a likely motivation. The tech sector and growth depends on vital resources like Palladium, Neon, and C4F6 (thanks @convertbond). These resources are vital for semiconductors and lithography machines that make semiconductor manufacturing possible. Neon is found almost exclusively in Ukraine and Russia as are the other resources. So it is certainly possible that the sanctions placed upon Russia could force them to try and seize control of these resources in Ukraine and withhold them from the US and other countries. This could create quite a supply interruption and drive prices straight up while Russia benefits greatly. The same is true of oil.

Then enters China. We already know they believe Taiwan is still part of China and they want to bring the country back into the empire’s control. Taiwan is a key and vital country for semiconductor manufacturing and supply with TSM being the leading partner to all global semiconductor brands. So two very bad actors, Russia and China control a large part of the vital supply of resources that are crucial to have for tech growth in a tech focused world. That gives them way more leverage than a group of bad actors should ever have. Shame on every country for allowing bad actors to have so much leverage over the world. That’s what keeps me up the most at night.

For now, the markets are front running an earnings slowdown that has yet to materialize. BUT we know the April earnings will show some of that weakness. The question is: will the weakness be correlated to the horrific drawdowns we have already seen, particularly considering the Fed will have hiked in mid March and offered some more clarity in guidance at a time when we have so many geopolitical risks?

Good summary from Potomac Management, a OCIO and great technical analysis shop:

Breadth metrics have weakened across the board as equities have come under pressure this week. Advance/Decline data remains under pressure for all markets, and new lows remain elevated on the NYSE. Interestingly, short-term trend data is not yet at levels that we would classify as washed out. I’ll add, we are very close to those wash out levels but with sentiment this bad and geopolitical news happening fast, anything is possible in both directions. This would be a good time for China to make a move on Taiwan while the world is focused on Ukraine and Russia but let’s hope that doesn’t happen.

Here’s the % over the 200DMA going back to 1996. We are stretched but we can get more stretched, certainly do not have to, every sell-off, correction, bear market is different

VIX curve inverted for now, which simply means there’s a scramble for near term protection which is often a ST capitulation signal. Put/Call ratios are NOT at full extremes yet but they are certainly close. These are ST bullish contrarian signals in a very news-driven market. Great chart from Larry McDonald @convertbond on twitter in his Bear Traps Report today.

Just an update on the chart I posted from Schwab in December, there’s been massive damage to the stock market. It always feels bad, one never knows if a pullback will become a bear market but the data says, we have already had massive destruction, yes we can have further destruction but if you have a bigger picture and long term focus and are saving for retirement, these kinds of drawdowns are wonderful times to be putting money to work. Short-term, its anyones guess where markets will go. The tensions in Ukraine and Russia, inflation, earnings slowdowns, quantitative tightening, and the potential for China to try something similar to Russia in Taiwan are always possible.

Great chart from Bespoke on the corrections/bear markets in the Nasdaq. Just remember, the QQQ has radically outperformed the S&P 500 since 2007, so if one wants the potential for strong performance, one needs to be willing to assume higher periods of volatility at times and even better, to take advantage of that volatility when it appears to be extreme. The current drawdown in the Nasdaq is right about the average drawdown so while it sucks and feels bad, it’s just part of the program. If you don’t like heat, don’t travel to warm climates, its just that simple.

Tech has been the top performing sector for 3,5,10,15,20,30 years. Maybe its because of a falling rates tailwind but its primarily because of the innovation and revenue growth opportunities Tech offers. For most professional investors, Tech has been a persistent overweight, that’s clearly been a smart call. Now, the underweight to tech is quite prevalent, yes fund managers have been even more underweight tech but those were often some of the best buying opportunities so be careful how bearish you get here on tech. For me, Tech is a buy on every dip from here.

AAII Bullish Sentiment is in the dumps, yet more contrarian bullish signals even though we have so much to worry about. Tick tock the boat is getting too lopsided bearish.

There’s always a chance that an inflationary regime is NOT what’s in store but a more STAGFLATIONARY regime. Stagflation is when economic growth is slow but inflationary pressures are stubbornly high. Yes, this is mostly man-made, thanks politicians and policy makers all over the world for a massive over-reaction to Covid. This time around, if the Fed gets too aggressive, I do not believe they will, they could cool the economy to the degree that layoffs begin to rise and stagflation really bites when unemployment rises, growth cools and inflation stays high. For now, the employment picture is full but wage pressures are real and will be lasting. Here’s what the stagflation environment looked like in the 1970’s period. There were some real bear markets in 73/74 if memory serves me but no two periods are every exactly alike.

The indexes, particularly the Nasdaq and growth stocks continue to struggle catching a bid for more than a few hours or days. No one knows when this will change but it will change at some point. There’s some real value building inside the index, particularly in the mega cap, high quality portion of the Nasdaq. We just need more clarity and the removal of some big uncertainty. Lots to worry about currently and markets and stock action reflects this. The best long term returns are born from terrible market environments however. Here’s an interesting look at the Nasdaq Index and the spikes in the number of new lows looking backward. With the exception of the 2008/2009 time period and thus far since 11/30/21, the forward 1 year returns in markets and particularly the QQQ were generally quite positive. Anything is possible though, we never know how far this correction goes but with some clarity and uncertainty, and likely in the form of Russia cooling down and Fed tightness being less than expected, the forward returns should be better than the current poor sentiment indicates. That’s why I’m selling some defense on big red days and adding to the offense basket of great brands. This dollar cost averaging strategy should pay well looking out 1 year+.

Week of February 14 Market notes

Monday, February 14: That would be nice Sean, I hope you’re right!

As of last week, there’s still $4.59 TRILLION sitting in money market accounts not losing anything other than via inflation but certainly NOT earning anything. Leave your money earning nothing for a long time at your peril folks