Dynamic Brands:

The Investment Portfolio Filled with the Blue Chip Brands We Engage With Regularly.

The Focus is Important Secular Growth Themes Across a Diverse Group of Consumption Categories.

Brands Matter.

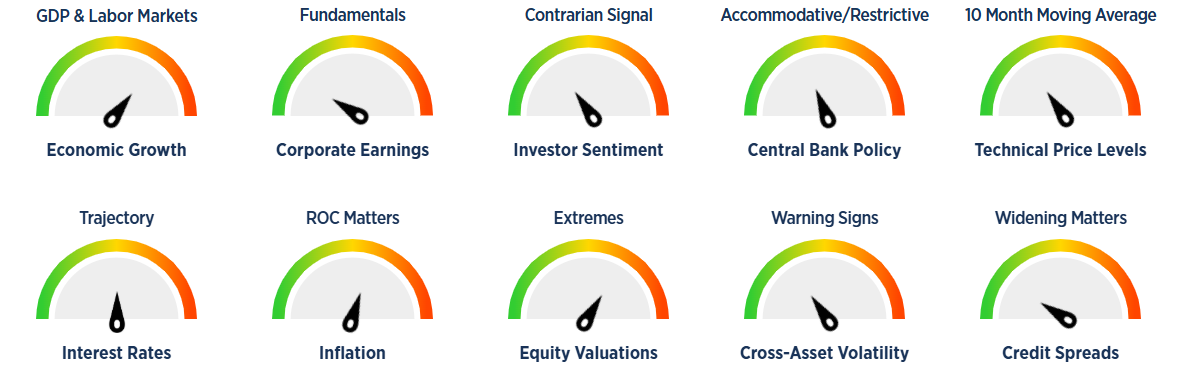

9/10/25: Flexibility to Dial Up or Down Weightings to Beta

Balance Between Economically Sensitive Businesses & Defensive Businesses

Current Macro Risk Status: Largely Goldilocks with Fed Easing On the Way

Third Party Validation on the Power of Investing in Brands:

Interbrand is the leading Brand Consultancy (Owned by Omnicom, a Top 5 Global Advertising Agency).

Ranking Brands Since 2000 and Highlighting, their Top 100 Global Brands vs the Major Stock Indices

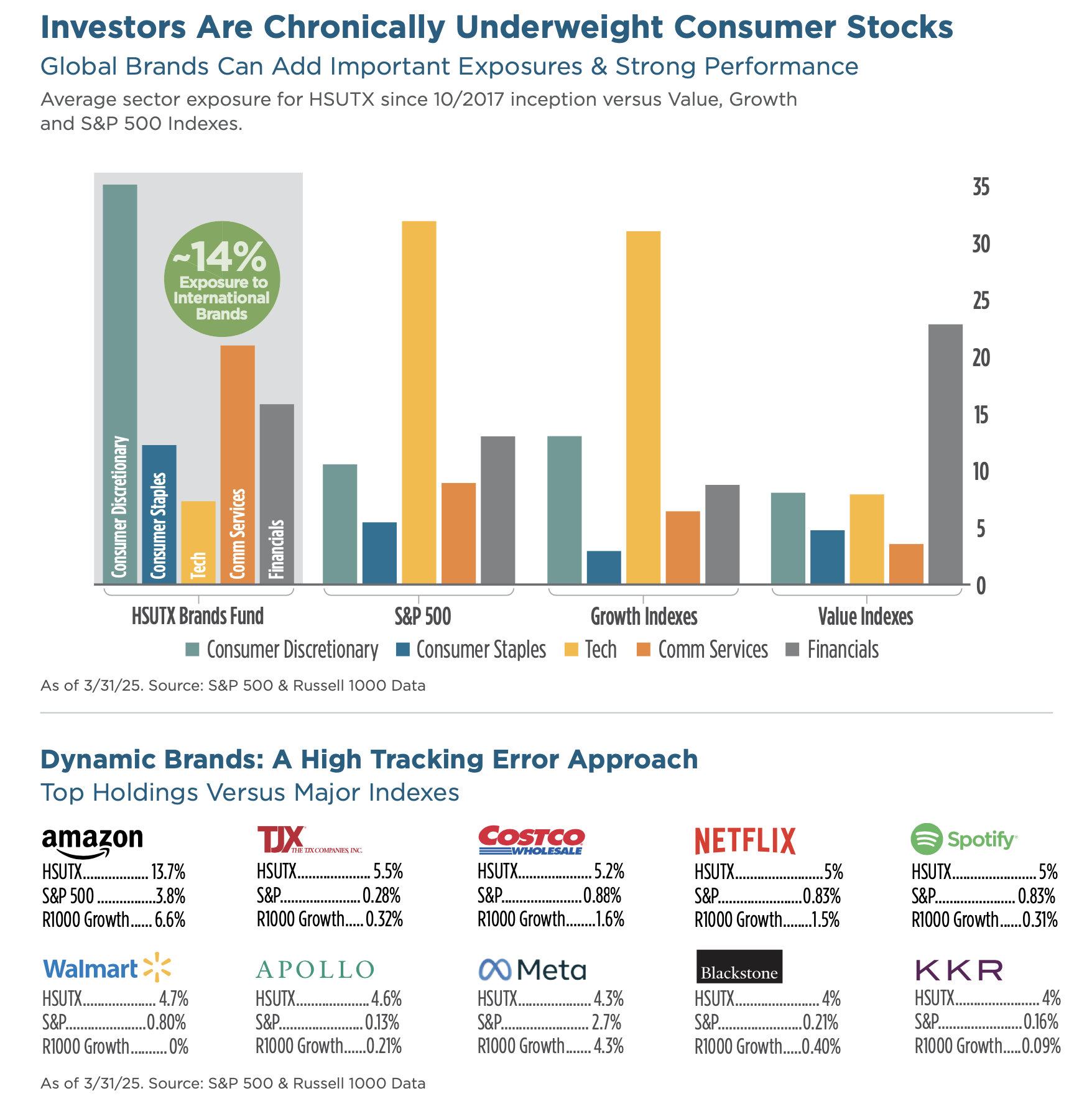

Everyone Owns Too Much Tech - Few Own the Sectors Where Brands Live

A High Tracking Error Approach: Top 10 Brands=55% of Total

The Brands Fund & Their Weight Versus the S&P 500 & Large Cap Growth Indexes

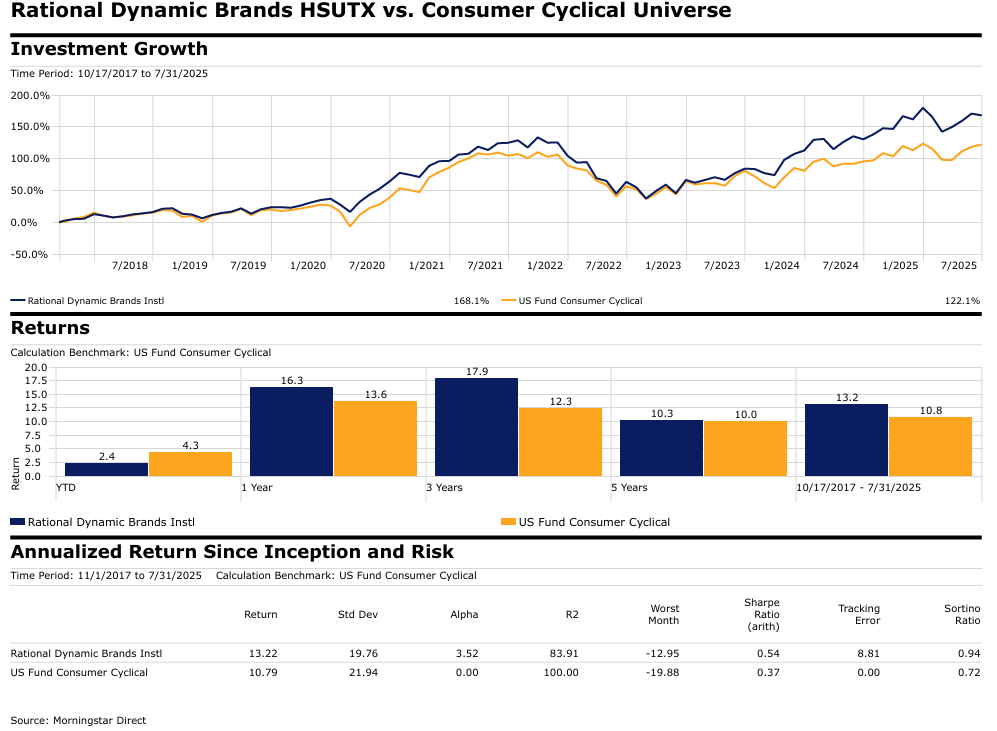

Dynamic Brands HSUTX vs US Fund Consumer Cyclical Universe

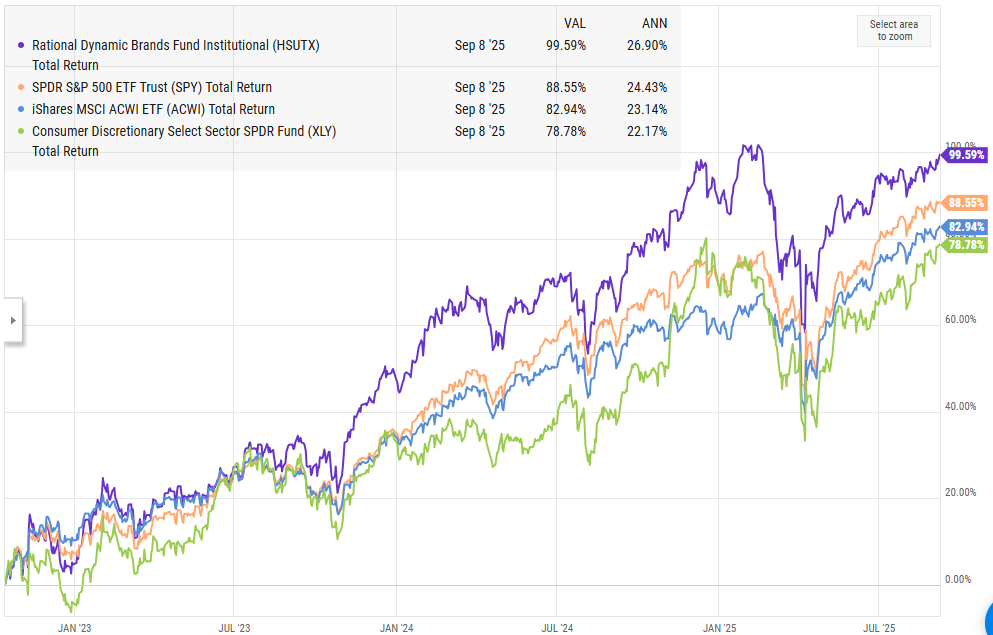

Virtually Every Portfolio Remains Underweight the Consumer, yet its 70% of the Economy

Investing in Mega Brands Has Never Been Easier via Dynamic Brands HSUTX

Holdings as of 10/15/25 (Listed by Size of Position)

Blue Chip, Mega Brands, Drive the Core of the Portfolio.

Currently 92% of the Total Holdings (Varies Over Time)

The Fund Invests in Key Consumption Industries via Brand Leaders

Innovator Brands & Emerging Consumption Categories

Dynamic Brands Historical Performance (Various Periods).

Our team took over HSUTX on 10/17/2017. Since 2017, we have experienced 3 stock market bear markets (down 20%+ in 2018 from peak, 2020 for early Covid, and 2022 with historic Fed tightening), multiple bouts of extreme volatility and uncertainty, a bout of 40+ year high inflation, rapidly rising and volatile interest rates, bank failures, and wars in Ukraine & Israel. That’s a lot of turmoil and uncertainty for markets to digest. From 2017 to the peak of the market in late 2021, the fund annualized at 23%, well above the normal average. In today’s “new normal” economic and rate regime, more normal equity returns should be expected and leading brands should continue to add value to a portfolio.

Bull Market Period: 10/17/2017 (Brands inception) to Market Peak, November 2021

Bear Market of 2022 - Rates/Inflation Rose at Historic Pace. Quality & Growth Stocks Were Sold.

Great Brands Performed Incredibly Well at the Fundamental Level - The Market Didn’t Care in 2022.

Our Team Took Advantage of the Weakness to Build Much Bigger Positions While On Sale.

Since the October 2022 Low to 9/9/2025: High Quality Brands Outperform

Virtually EVERY Portfolio is UNDERWEIGHT Consumer Related Stocks

Why is that a Bad Idea?

On a Calendar Return Basis Since 1989, Consumer Discretionary Has the Best Beat Rate Versus All Sectors Versus the S&P 500

The % of Time in a Calendar Year Each Sector Outperforms the S&P 500

Defensive Brands With Stable Business Models Can Protect Capital in Major Drawdowns

Every correction and bear market is different. However, certain defensive businesses and brands have a history of protecting capital during drawdown periods. Having this knowledge helps with positioning decisions. The chart below shows the average return during 12 difficult market periods going back to 2009 and how defensive, “staples of life” brands have performed during these periods. When our team see’s data that warrants adding more defensives, we know which brands to own.