“From the February 1995 IPO of ASML to February 22, 2022, ASMLstock has returned roughly 29,130%, or roughly 23.4% annual since the ipo in 1995. In the same period, the S&P 500 returned roughly 1360% or roughly 10.4% annualized. In a world where technology is at the center of everything we all do, the need for the machines that allow semiconductors to be mass produced seems quite certain. ASML has been a monster stock and has driven serious innovation across the semiconductor industry.”

COMPANY PROFILE

ASML gives the world's leading chipmakers the power to mass produce patterns on silicon. ASML provides its customers with everything they need – hardware, software and services – to mass produce patterns on silicon, allowing them to increase the value and lower the cost of a chip. The company is likely one of the most important companies driving technological innovation that you have never heard of. ASML began in 1984 with a partnership with Philips Electronics. Through multiple acquisitions and very impressive R&D, ASML has become a key partner to every major semiconductor manufacturer. There are some massive mega-trends happening around the world and most of them require more and more computing power that’s more energy efficient, produces less green-house gases and allows companies to produce more semiconductor chips. More importantly, as Covid has taught every country, the need to control technology and semiconductor manufacturing is of vital national security so an unprecedented cap-ex boom is now beginning around the world. The semiconductor industry has always been cyclical and has had some over-capacity issues at times which will never go away completely but as more and more technological advancements occur across more and more industries, this industry should get less and less cyclical over time. ASML thrives from demand from the smart-phone & data center industries but demand will continue to thrive further as the Internet of Things evolves along with artificial intelligence, 5G adoption, virtual reality, video gaming, visualization technologies, cloud and edge computing, and autonomous driving and industrial electronics innovation. There’s simply so much innovation happening that ASML appears very well situated as a key winner as broad semiconductor adoption continues to advance.

Consider some powerful facts:

There 40+ billion connected devices in use today, projected to be >300b over the next decade - these all need brains that are semiconductor chips.

All major semiconductor companies use ASML machines making it very difficult to un-tether from this brand.

All the electronics we use across consumer and industrial use cases would not exist without the machines made from ASML and peers.

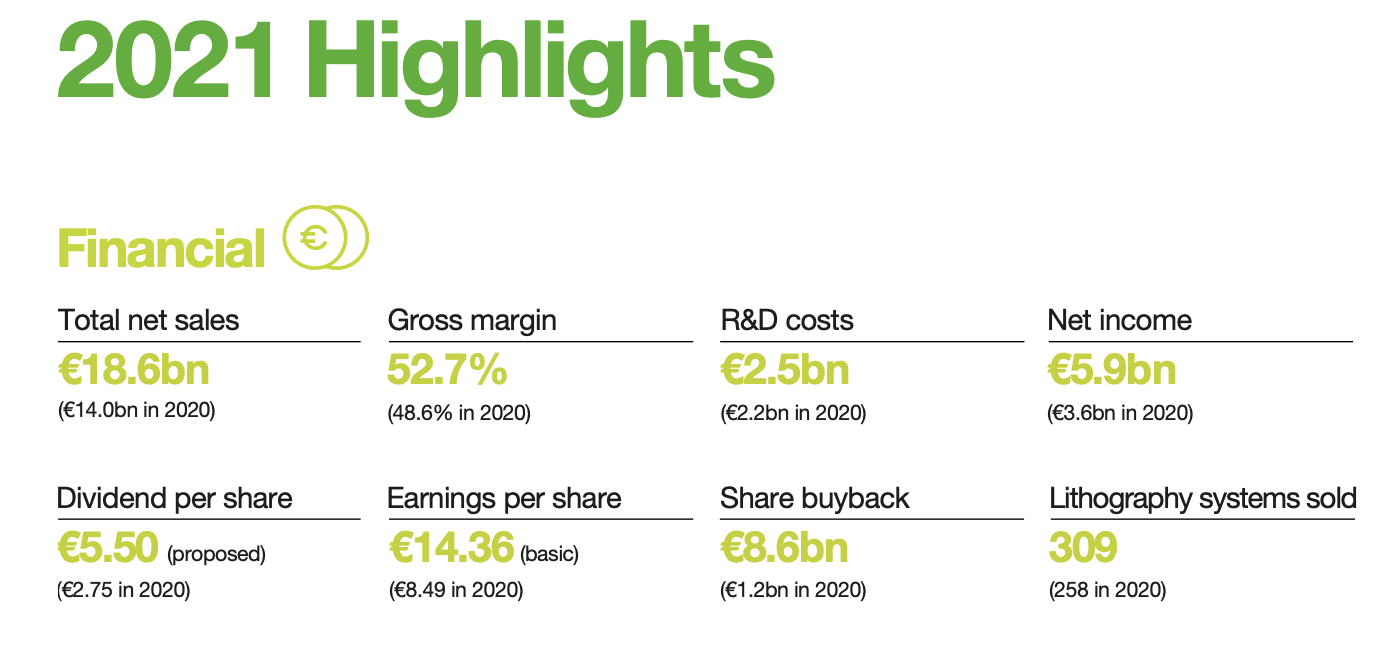

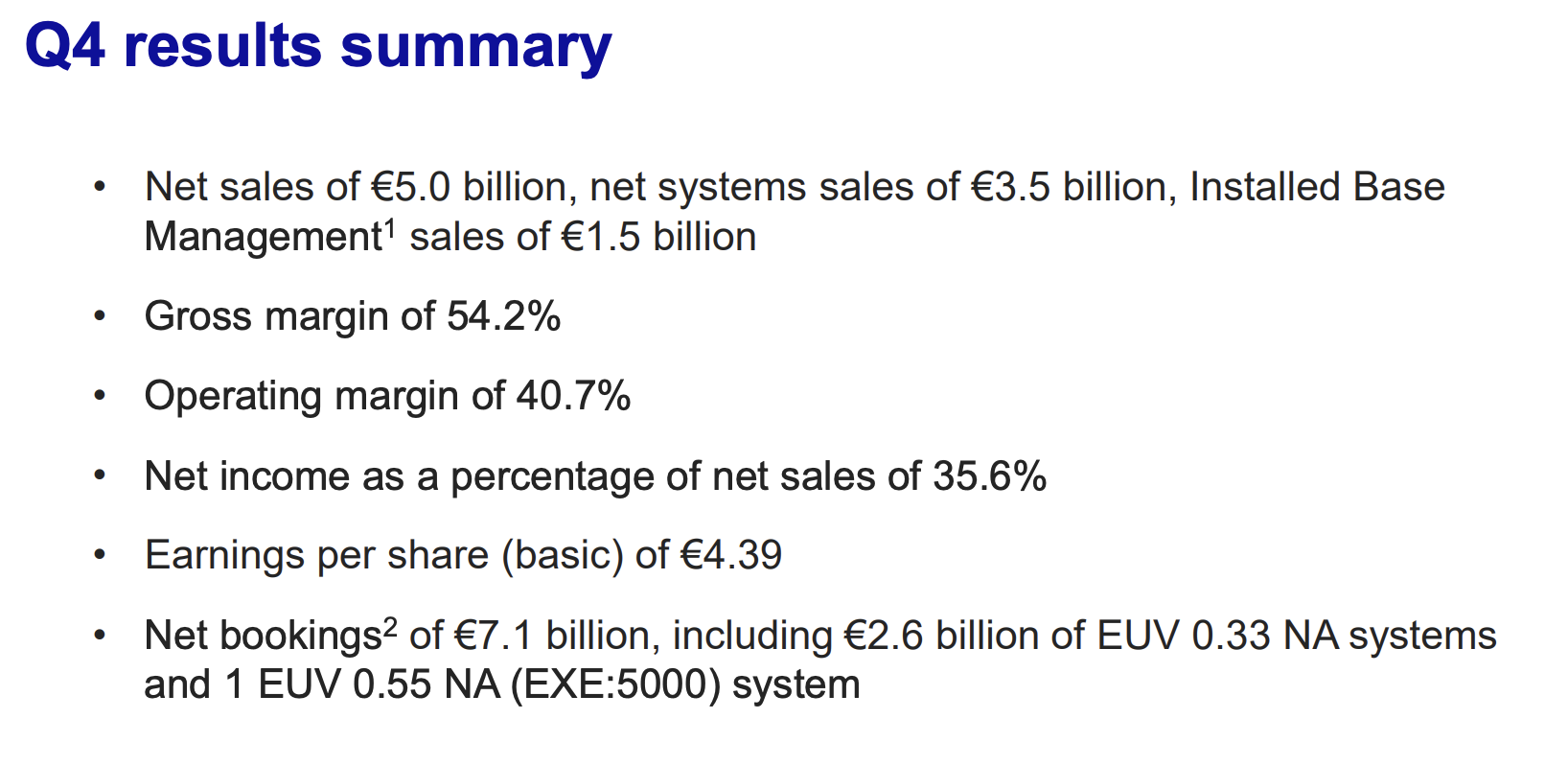

ASML had just over $18b in revenues in 2021 and they project to be at $30B+ by 2025 - the stock should grow with the revenue and earnings ramps over time.

Earnings, free cash flow, revenue growth is all strong but the stock has pulled back a whopping 28% from the September 2021 highs offering a solid entry point imo.

Talk about a sticky, high demand, important product. Currently, smartphone usage consumers about 1/3 of our waking hours. And my daughter wonders why we won’t get her a phone yet! Great chart from Professor Scott Galloway.

Style Factor Details

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where ASML scores well as of 2/23/2022:

77% high operating king - strong margins, revenue growth and margin expansion metrics

95% high projected dividend growth

83% high shareholder yield - shareholder benefits form of cash dividends, net stock repurchases, and debt reduction.

91% high operating ROIC

91% accelerating sales growth 1YR vs 3YR average

90% high absolute free cash flow

99% high ROIC over WACC - weighted cost of capital

86% low debt to enterprise value

98% strong blended wide moat score - this business has huge barriers to entry

86% high R&D spend to help extend their innovation lead for sustainable earnings and revenues

86% high free cash flow growth

2/23/22 Update

Tech has gone from the most loved to the most hated sector in the markets. Yes, most of tech was extended and expensive but there has been some extreme air coming out of the valuations over the last 5 months. ASML is a key leader and semiconductor equipment maker and the stock is 28% off the highs making it a very exciting entry to build my position. I have no idea where this market and sentiment bottoms, but I simply cannot sit back and not begin building positions in some of the most innovative companies driving tech innovation around the globe. ASML is absolutely one of these businesses. Today I started position in a few semiconductor brands, ASML is one of the 3 and what they do is vital to the mass production of semiconductors. As I stated above, there are some serious mega trends happening that require more and more computing power and that will drive demand for ASML products regardless of what the current macro picture is. I’m happy to build a position in a key player in an important industry that generates significant free cash flow, buys their stock back strategically, grows the dividend well each year and makes smart and thoughtful acquisitions when appropriate. Sales growth of around 20% is expected for 2022 and that’s worth paying for. Would you really expect a vital company and leader to trade at 12x earnings? There is one of those companies and its called Intel and they lost their way years ago and the stock has been a horrendous performer. In technology, don’t expect a Mercedes to cost the same as a Prius. The stock is down 28% from the highs just 5 months ago so I’m happy to start legging in with room to add on further dips. I’m very excited to own this company that I have admired for a very long time.