“From 4/1/1999 to 10/15/2019 or just over 20 years, Booking.com, formerly known as Priceline.com stock returns roughly 307% versus the S&P 500 return of roughly 132%”

COMPANY PROFILE

Established in 1996 in Amsterdam, Booking.com has grown from a small Dutch startup to one of the largest travel e-commerce companies in the world. Part of Booking Holdings Inc. (NASDAQ: BKNG), Booking.com now employs more than 17,000 employees in 198 offices, in 70 countries worldwide.

With a mission to make it easier for everyone to experience the world, Booking.com invests in digital technology that helps take the friction out of travel. At Booking.com, we connect travellers with the world’s largest selection of incredible places to stay, including everything from apartments, vacation homes, and family-run B&Bs to 5-star luxury resorts, tree houses and even igloos. The Booking.com website and mobile apps are available in over 40 languages, offer 28,913,672 total reported listings, and cover 154,111 destinations in 228 countries and territories worldwide.

Every day, more than 1,550,000 room nights are reserved on our platform. So whether traveling for business or leisure, customers can instantly book their ideal accommodations quickly and easily with Booking.com – without booking fees and backed by our promise to price match. Through our Customer Experience Team, customers can reach Booking.com 24/7 for assistance and support in over 40 languages, anytime day or night.

How’s that for global diversification across the travel and experiences category?

Booking.com B.V. is based in Amsterdam in the Netherlands and supported internationally by 198 offices in over 70 countries around the world: Accra - Amman - Amsterdam - Antalya - Athens - Atlanta - Auckland - Bangalore - Bangkok - Barcelona - Beijing - Berlin - Bilbao - Bogotá - Bolzano - Bordeaux - Boston - Bratislava - Brisbane - Bristol - Brussels - Bucharest - Budapest - Buenos Aires - Cairo - Calgary - Cambridge - Cancún - Cape Town - Casablanca - Catania - Chengdu - Chicago - Colombo - Copenhagen - Dallas - Denver - Dubai - Dublin - Dubrovnik - Dusseldorf - Edinburgh - Faro - Florence - Frankfurt am Main - Freiburg im Breisgau - Fukuoka - Grand Rapids - Guadalajara - Guangzhou - Haikou - Hamburg - Hanoi - Helsinki - Heraklion - Ho Chi Minh City - Hong Kong - Honolulu - Houston - Innsbruck - Istanbul - İzmir - Jakarta - Jeddah - Jeju - Johannesburg - Kiev - Koh Samui - Krakow - Kuala Lumpur - Kuta (Bali) - Las Palmas de Gran Canaria - Las Vegas - Lille - Lima - Limassol - Lisbon - Ljubljana - London - Los Angeles - Lyon - Madrid - Málaga - Manchester - Manila - Marrakech - Melbourne - Mexico City - Miami - Milan - Montpellier - Montréal - Moscow - Mumbai - Munich - Naha - Nairobi - Natal - New Delhi - New Orleans - New York - Nice - Norwalk - Orlando - Osaka - Oslo - Palma de Mallorca - Panama City - Paris - Phoenix - Phuket - Porto Alegre - Prague - Qingdao - Rennes - Reykjavík - Riga - Rimini - Rio de Janeiro - Rome - Saint Petersburg - Sallanches - Salzburg - San Diego - San Francisco - San Jose - San Juan - Santiago - Santo Domingo - São Paulo - Sapporo - Seattle - Seoul - Seville - Shanghai - Siem Reap - Singapore - Sochi - Sofia - Sorrento - Split - Stockholm - Strasbourg - Sydney - Taipei - Tallinn - Tbilisi - Tel Aviv - Thessaloníki - Tokyo - Toronto - Trabzon - Vancouver - Venice - Verona - Vienna - Vilnius - Warsaw - Washington - Xi'an - Yangon - Yogyakarta - Zagreb - Zurich

Recent Earnings

Third quarter, 2019:

CEO: “I’m philosophically opposed to wasting money on marketing and ROI is my focus”

The stock had a lower bar going into the print because it got thumped by poor results from peers: Trip Advisor and Expedia. The options market was pricing in a $116 move on earnings and the stock was down $165 on the day.

Gross travel bookings were $25.3 billion, an increase of 4% over a year ago.

Room nights booked in the 3rd quarter increased 11% over a year ago.

Total revenues for the 3rd quarter of 2019 were $5.0 billion, a 4% increase from the prior year

Adjusted EBITDA for the 3rd quarter was $2.5 billion, a 5% increase versus a year ago.

"Booking Holdings executed well in our busiest quarter of the year as we booked 223 million room nights, which is up 11% year-over-year".

BKNG’s size and scale is a distinct competitive advantage.

While they are the 800lb gorilla worldwide, they still are a small piece of the overall global travel opportunity so their size and scale gives them a huge competitive advantage to gain market share, particularly in slow times when peers are slowing spend.

The mother ship and its finances are a great meal delivery mechanism to their individual brands from a marketing perspective. Their significant collaboration happening between brands for the Connected Trip process.

When they have collaboration through technology, they have significant data via their AI engines to understand what people do when they travel, what they need, so they can deliver more custom experiences going forward and also drive more merchandising opportunities.

AI is here to stay! This continues to be a hidden opportunity for most companies who utilize it and learn from the data while building new capabilities based on the data.

The “connected trip” focus is driving strong adoption and value to consumers.

Europe was stable even though economically challenged. S.E. Asia doing well but China slower.

Google does not operate in China currently so they have a distinct advantage,

Their goal is to drive further to a direct to consumer model so they do not have to rely on places like Google, who is also competing with them, to drive volume back to their platform.

The over-arching goal is to build an end-to-end solution directly with consumers that allows them to come back again and again because the experience was so good it can’t be ignored.

This management team are solid capital allocators. Discipline is hard to find these days. They invest when they see highly attractive ROI’s and have significantly more dry powder than competitors allowing them the ability to grow through slow times and take market share. We likely saw this as Expedia and Trip Advisor severely missed earnings and their stocks got hammered.

$1.8B in free cash flow for the quarter

Bought $1.3B of stock in the quarter and have $12.96B left on their current authorization. Their goal is to extinguish this authorization over the next few years and be opportunistic.

$Currently have $11.8 billion in cash with $8.6 billion in cash.

Growth driver drags: Tariff concern related to travel, Hong Kong slowdown, foreign exchange headwinds.

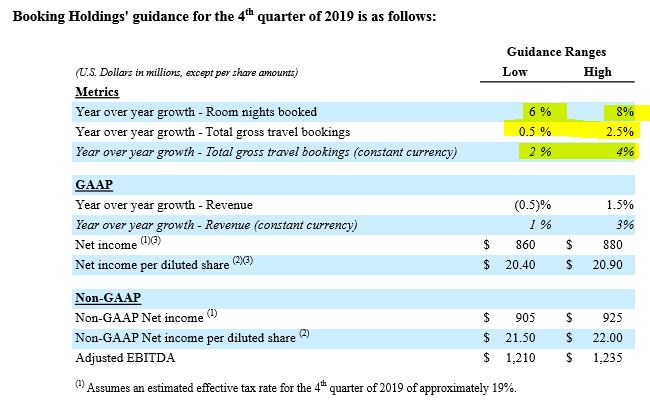

Guidance below

Eric’s Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Booking.com scores well as of 10/14/19:

91% for high operating margins

99% high margins versus industry peers

80% 3YR compound annual sales growth

76% margin expansion

90% positive change in short-term price momentum

90% high shareholder yield

80% high 1YR EPS growth

88% high return on invested capital

90% attractive ROIC vs weighted average cost of capital

83% positive latest quarter sales surprise

11/7/19:

First, this management team is very methodical around capital allocation decisions and being willing to rotate dollars to the areas that offer the best ROI. I love that.

BKNG has the size and scale to weather economic storms and actually is a share taker in times like this. Witness Trip Advisor 7 Expedia’s woes when BKNG was steady-eddy.

The global slowdown will trough as they always do and when that happens BKNG will benefit from the investments they made in the slowdown. Their peers just cannot compete with their capital allocation capabilities.

They create meaningful Free Cash Flow now and that FCF will accelerate as the business gets better.

They hired a new CMO a few months ago and have strong goals for more meaningful ad sales.

They have significant leverage to the China market and I believe that will pay huge dividends over time.

The travel industry is a difficult business and highly fragmented. Once a middle man business, travel is now an asset-light, tech-driven platform business. I loved Priceline’s re-brand into Book.com, it truly signified what the company was really about and where the opportunities live long-term. This isn’t just about finding a hotel, car or cruise, this is about being able to go to one place and book whatever experience you want/need. Booking has been a serial acquirer of marquee properties and has built a global mousetrap that is very hard to replicate. Google travel is certainly trying but in my experience, Google has so many projects, they rarely seem to do very many of them really well. I like leaders with a moat and BKNG has a large lead on every other travel related brand, worldwide.

“With over $92.7 billion in gross bookings in 2018, Booking Holdings is the world leader in online travel & related services.”

As the global economy has slowed, so too has Bookings business lines but make no mistake, it’s in slowdowns that BKNG can take the biggest market share swings. The best, most well funded, most strategic brands always use economic weakness to their advantage so when the economy troughs, they have a hockey-stick type recovery. Booking is setting the stage for a significant ramp in free cash flow generation and revenue growth once they get past the peak comparisons this quarter. The company has huge exposure to the European Union so any weakness in the next quarter, reported in November will be a wonderful opportunity to add more to the current position. I am not a believer in the global recession theme so this weakness across the globe, which I believe is mostly manufacturing and supply chain based should not last long and will not affect the consumer travel categories for much longer. Most companies are simply easing from unsustainable growth trajectories and I like buying leading brands with strong balance sheets, visionary management teams and significant buyback capacity when the stock market acts irrationally.

Over time, I would not be surprised to see BKNG expand into more “experience” categories and if I were them, I’d buy Live Nation and tuck global live concerts and digital ticketing capabilities into my jacket. There’s so much more for BKNG to add to the experience flywheel. I look forward to watching the business inflect and for growth to resume its former trajectory. All the while, the stock is not too expensive and has significantly attractive operating metrics, as witnessed in the beginning of this section.