“From January 1, 1992 to December 18, 2019 Electronic Arts stock has returned roughly 4453% versus the S&P 500 return of roughly 664% or 6x the return of the market. Video gaming is only getting bigger, more global and e-sports is in inning #1.”

COMPANY PROFILE

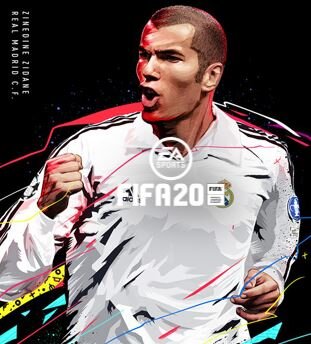

Electronic Arts Inc. is a global leader in digital interactive entertainment. EA develops and delivers games, content and online services for Internet-connected consoles, mobile devices and personal computers. EA has more than 300 million registered players around the world. EA is recognized for a portfolio of critically acclaimed, high-quality brands such as The Sims™, Madden NFL, EA SPORTS™ FIFA, Battlefield™, Need for Speed™, Dragon Age™ and Plants vs. Zombies™.

Recent Earnings

Strong earnings

Apex Legends has had 70M players life to date

FIFA Unique players +22% y/y

$1.3B revenue. +4.8% y/y

54.3% live service revenue

$1.75B op cash flow T12M

75% 12M gross margin, highest Q2 ever

$4.9B in cash +7.4% y/y

Strong guidance

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Electronic Arts scores well as of 12/18/19:

88% high free cash flow yield (FCF/EV)

82% Low Debt to EV

88% High R&D + SGA over net sales - innovator metrics

98% High ROIC over weighted cost of capital (WACC)

98% high cash to market cap ratio

I’m a huge believer in the mega trend called video gaming. It’s a global phenomenon with multiple demographics enjoying the experience. Today’s video games are nothing short of miraculous from a development and design perspective. Most of the gaming industry produces games that are Pixar-worthy. In fact, it would not shock me if we started to see gaming and tradition media blend together. Where is the Netflix movie called “Red Dead Redemption” provided by Take Two Interactive. Or a Call of Duty movie? And then there’s e-sports. This new phenomenon is early in its life cycle and right now there doesn’t seem to be a clear winner from an investment perspective but make no mistake, EA will be there and in a big way. Most of the video gaming companies have been monster performers over time but they have been consolidating big gains by doing nothing for the better part of 2 years. EA stock is basically flat over 2 years when the S&P has been +18%. The current price action of EA appears to show a positive change is afoot and video gamers seem poised to have a great 2020. E-sports is gaining traction and EA has just announced some exciting news about their e-sports plans.

EA likely has the most valuable gaming IP of anyone in the group and their games are not focused on the violent ones that seem to be changing peoples behavior for the worst. Madden Football, FIFA, now Apex Legends are all doing very well with consumers. The stability of their revenues is impressive and the big cash position should all give us comfort in holding the stock if things turn sour. It would not shock me if EA was ultimately acquired by a large media company, the demographic is so important and time spent gaming is not going down versus traditional streaming of movies and shows stagnating.