“Customers don’t know what they want until we show them”

“If you dissect today’s traditional grocery model and laser in on each component of the store, there’s some serious upgrades that should be done to the model. The model seems to be begging for an asset light, brands matter approach. How? 1) The store can be 2/3 smaller than the normal 30-40k square feet because consumers do not want or need 27 choices for each food & beverage category. With a trust and advice-based selection process, consumers can think less and enjoy more. 2) Experienced chefs should drive the prepared foods section and the food should travel well & be diverse across popular comfort foods. 3) An urban eatery could be connected to the store with hand-picked sandwich and pizza brands driving traffic and customer delight. 4) The meat counter should only stock the most popular meats and be outsourced to a top purveyor and 5) The wine list should be small but well sourced by a sommelier, and the beer and spirits section should only stock a few brands in each popular category. Why shouldn’t a grocery center become a foodie’s favorite place to visit? If this differentiated real estate space existed, it would be Nirvana!”

The Trends are Undeniable:

Smaller footprint grocery & convenience stores are more intriguing to consumers than ever. 7-Eleven was a very compelling model once upon a time but the brand didn’t change as our tastes changed. Perhaps that’s why 7-Eleven Lab Stores are the company’s big new focus. A facelift was required and it’s finally happening but legacy DNA could keep it from a major facelift. Another key growth brand in grocery, Sprouts, has also gotten the memo. On a recent quarterly earnings call, management talked about being focused on smaller footprints, while still being much larger than a typical convenience store. Whole Foods has been testing new concepts centered around a smaller footprint as well. Consumers have shown an interest in making several quick shopping trips per week to pick up fresh and/or prepared foods. In our opinion, Trader Joe’s should be at the center of every grocery format decision. This amazing brand has the highest revenue per square foot of any grocery business in America. As a foodie, there’s not a ton of things that interest me about their inventory but the brand serves our family well, particularly for the staples of life. There’s a reason Trader Joe’s has become such a consumer favorite, the stores are smaller, the number of SKU’s is far less than traditional grocery stores, the staff is incredibly friendly and knowledgeable and the prices are attractive. Trader Joe’s, and the trust they have built with consumers, shows us that consumers are willing to have less choices and to trust their grocery brands to offer solid choices.

We want to take that knowledge one step further and be the brand that acts like the consumer reports for grocery. As a “consumer psychology” expert, I know through experience that consumers want well-research advice on everything they buy. Somehow, that memo never made it to the grocery industry. Their desire to stuff each aisle with an excess number of choices has just created confusion and paralysis for consumers. Maybe we have a few well-researched favorites in a category but largely, we keep buying what we recognize and likely are missing some terrific brands and foods because we are afraid to try something new. Wouldn’t it be great if we had a “top rated” choice for every SKU category? I can assure you, more diversity and switching would occur. Taste is clearly subjective but there are absolutely a small group of brands that rise to the top of their peer group. Our goal is to identify those brands and only offer the best of the best while also offering a solid low price option to serve all consumer needs.

Big growth is ahead in smaller-format, differentiated grocery. The major opportunity we see: bridging the gap between <4000 square foot convenience stores and the $20k+ square foot typical grocery stores. We like filling important white space with something fresh, well thought out, and differentiated. New convenience and corner store brands are popping up all over the country. One urban corner store, convenience concept in particular, Foxtrot, has done an exceptional job raising about $160M in capital since 2014. Many more will follow. For consumers who care about the store shopping experience and the quality & taste of the food they consume, updated concepts will become very compelling. We expect the legacy grocery brands to take notice and acquire the concepts that show they can scale.

Traditional Grocery: A SnapShot

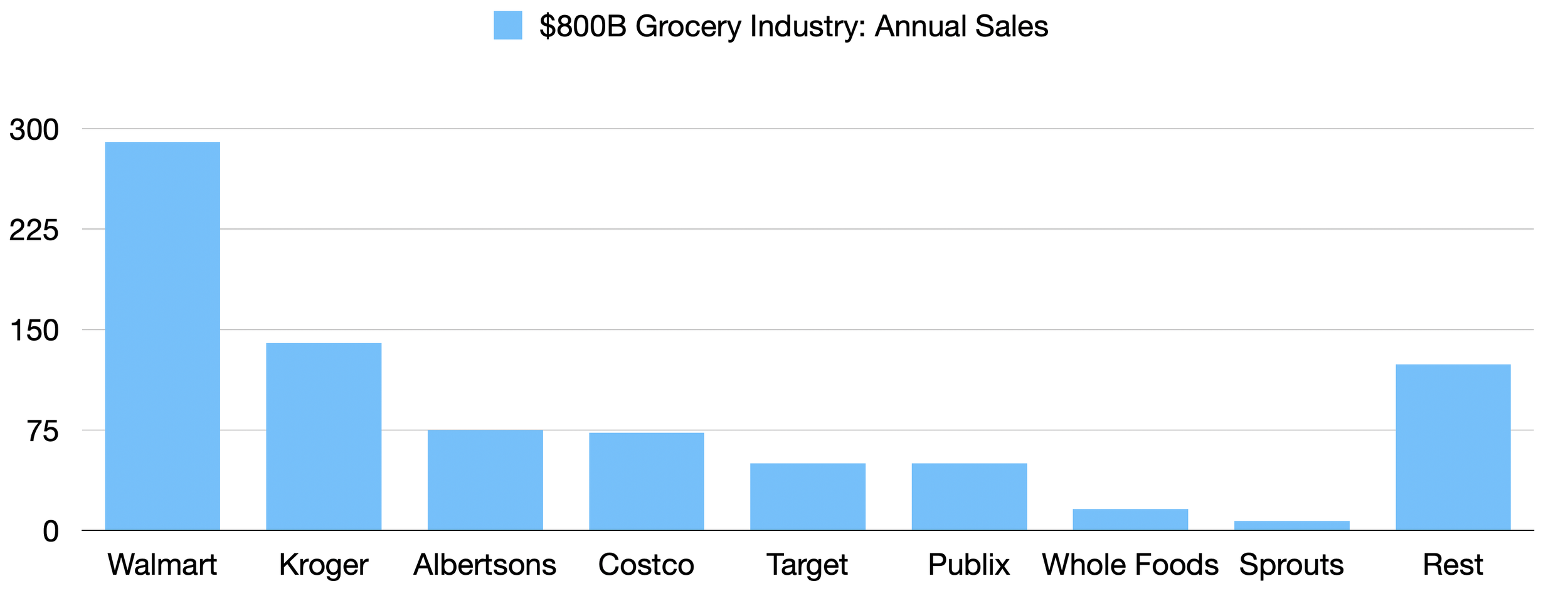

The U.S. grocery business is an $800 billion a year industry. The industry is dominated by big box retailers and a handful undifferentiated national and regional grocery chains.

Generally, we think the shopping experience is average at best, the quality of SKU ingredients is questionable, there’s far too many options to choose from, and identifying the best of the best SKU’s is nearly impossible. It’s time for a fresh, new brand to be created.

Here’s the U.S. Grocery Industry by annual sales:

Boutique, mostly local grocery stores are where the magic happens. These account for about $150 billion in annual sales. There’s alot of room for differentiated grocery to thrive currently.

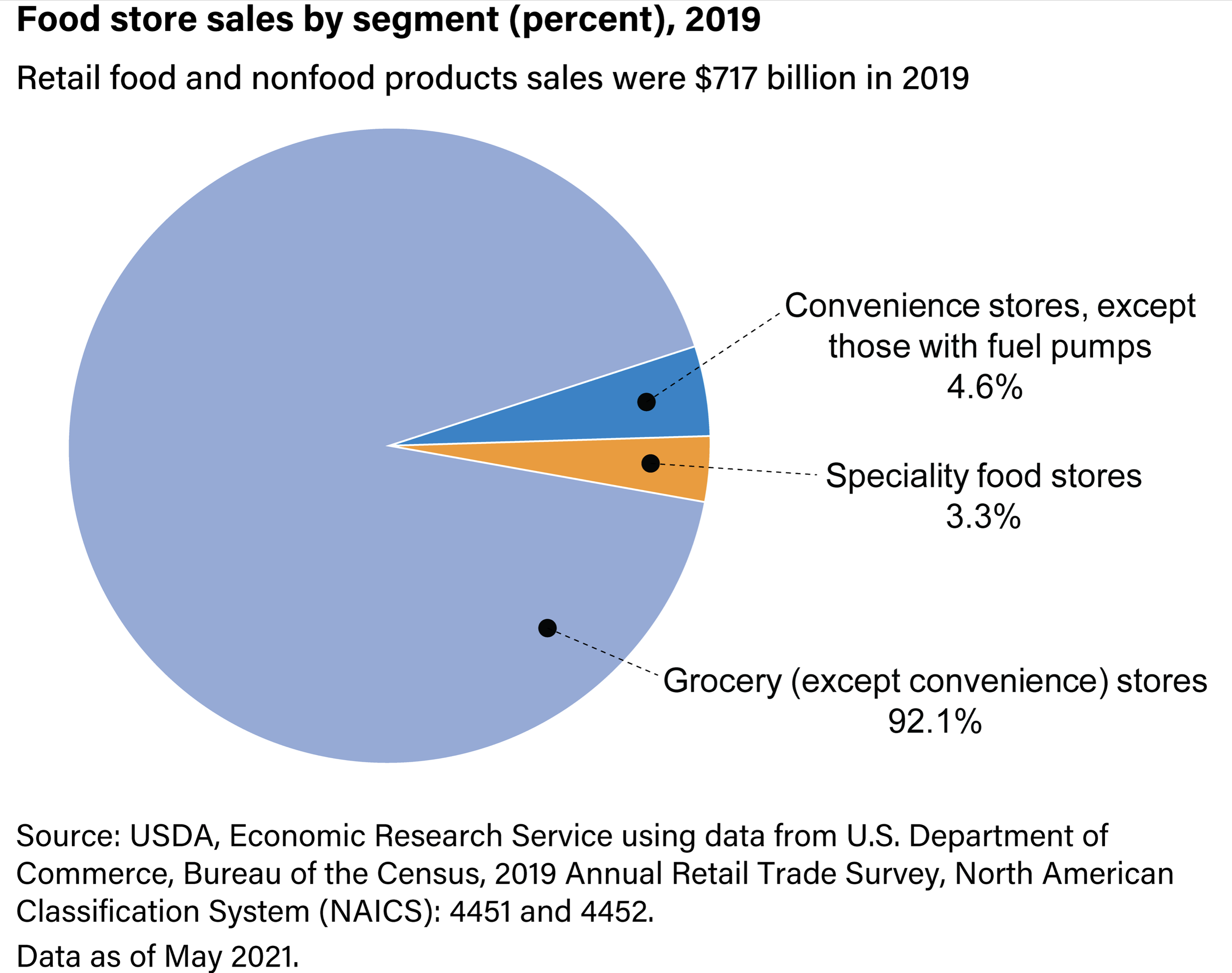

As the image below highlights, the convenience & specialty food stores only accounts for roughly 8-10% of the total.

From a demographic perspective, younger consumers (<60 years old) tend to prefer more health conscious options, more intriguing store aesthetics and more frequent trips with smaller bag sizes.

From a behavioral psychology perspective, convenience, strong advice, and upscale food & beverages are an early days idea. There is now two back-to-back generations (millennials and geez) larger than the baby boomers. These consumers are digitally native and care about the experience, the brand message, the aesthetics, and the quality of products.

After the top 5-7 grocery brands, the grocery industry is largely fragmented and locally driven. There’s an estimated 40,000 supermarkets in the U.S. and they all generate stable profits.

Whole Foods does roughly $16B a year in sales across 520 stores. Each store is about 36,000-40,000 square feet in size.

Sprouts does $6.3B in sales with a public market cap of $3.3B. Each Sprouts is about 23,000-32,000 square feet in size.

The average local grocery store does between $8m to $15m in annual sales. This is a counter-cyclical business and consumer staple making it a great investment.

The prepared foods and deli/pizza portion of a typical grocer accounts for about $10-15% of total sales (this is a clear benefit to customers) but the quality and taste is largely disappointing.

Do consumers really need 27 choices for frozen pizza? 37 options for salad dressing? 16 options for potato chips? 64 options for cereal? We think not.

The average grocery carries >40,000 SKU’s - this creates the need for large spaces (>45k square feet), with high labor, rent, and food costs. This creates low margins.

We think we have a better model.

Reality: We estimate about 95% of our daily food, beverage, supplement needs can be met by offering no more than 300-450 SKU’s versus the tens of thousands of SKU’s of typical grocery stores.

Grocery2.0: Nirvana

Our process is simple: Dissect the typical grocery store and break each section into parts. Analyze each part, upgrade it for a “best of the best” solution then put the parts back together.

Thanks grocery2.0, Food Nirvana:

<500 SKU’s

Upscale urban store design. This market has a youthful, edgy vibe.

Smaller convenient store size, higher margins and per square foot revenue expectations.

Only top rated, heavily researched and taste tested food & beverage choices for consumers.

Most importantly: A relentless focus on the customer.

With <500 SKU’s a great market can offer top choices across fresh produce, refrigerated & frozen items, the pantry, pets, personal & household items, beer-wine & liquor, nutraceuticals, prepared foods, meat counter, deli counter, and eat-in or take out pizza. As a consumer, I want great choices, not so many choices I feel paralyzed. I want my trusted grocery brand to do the research and simply offer me great choices with different price points. Oddly, that does not exist.

Some details:

Everything we build is designed to be a “best in town” offering. From the grocery to the meat market to the sandwich shop to the pizzeria to the prepared foods section. It’s all chef-made.

If you are a foodie, you will instantly appreciate this market concept. If you are not a foodie but you want to become one, this market will offer the eye-opener you desire.

If you do not appreciate great food, quality ingredients, and wow-aesthetics, please continue enjoying your experience at Vons or Safeway, we have nothing to offer you!

Every community deserves to have a differentiated, wellness focused grocery option that includes trusted product advice, chef-made prepared foods and technology that enhances the shopping experience.

Every community deserves to have a quick, grab-and-go focused grocery option that serves our daily needs in a health conscious, taste-driven way.

Consumers are busier than ever. Our diet and nutrition has taken a hit. We know what we know and have little time for doing research. We need help from our trusted grocers yet it does not exist.

Imagine a convenience market that didn’t overwhelm you with choices you couldn’t possibly ever research. A brand that meant “trust and well-research options only”. A market that was much smaller than typical grocery stores (higher margins & profits, with less staffing needs and rent costs), that had a differentiated, urban aesthetic with a fun common area for social meet-ups and that only offered a select list of well-researched brands that covered the “best low cost” item as well as the “best tasting, highest quality ingredients” options across the most important, everyday food & beverage items. A market that offered roughly 300-450 SKU’s (a typical 7-Eleven stocks ~300 SKU’s) versus the roughly 4,000 at Trader Joe’s and >40,000 of a typical large grocery store. Then imagine a “best in town” pizzeria, sandwich shop, and prepared foods section (eat-in or take-away) that allowed a busy household to maintain its “foodie” status without the hassle of shopping and cooking every time. Imagine having a group of well trained chef’s at your disposal for special requests and help with menu choices. Then imagine a tech stack that remembered each shop, added it to your app for future use, and allowed you to 1-click future orders, and set pick-up or delivery windows. As the chef in my household and the extra shopper each week, this model would make my life a lot simpler and my job as family chef, a lot better. The success of Trader Joe’s is a solid example of a consumer’s willingness to trust a brand to deliver acceptable choices. I want to take this trust 1-step further by creating an upscale convenience grocery brand that only carries, the most important everyday categories and only stocks one or just a few options making the shopping experience much more pleasant, resourceful, and useful. Trust & knowledge of the tastiest items will be the hallmark of the brand.

Welcome to Nirvana!

Nirvana Foods: A new asset-light, convenience grocery brand.

The customer matters. We work for you.

What we put in our bodies matters.

The best ingredients matter.

A High taste quotient matters.

The best prices matter.

Our message is clear:

· Upscale, contemporary urban aesthetic design of stores. You’re going to want to shop & hang here.

· One third the size of normal grocery stores and closer to a Trader Joe’s size market for convenient shopping (~9,000-10,000 sq ft).

Grocery section - roughly 5000 square feet (perspective: the avg 7-11 is 3,000 square feet).

Prepared food section - roughly 500 square feet - this is not your grandma’s prepared foods section.

Partner tenant - Pizzeria - roughly 1,000 square feet - has its own brand. Connected to grocery but has its own separate entrance.

Partner tenant - Deli - roughly 1,000 square feet - has its own brand. Connected to grocery but has its own separate entrance.

Partner tenant or grocery owned - Meat/butcher - roughly 1,000 square feet - has its own brand. Connected to grocery but has its own separate entrance.

Common area with high tables - roughly 500 square feet.

Partner tenant or grocery owned - Exotic coffee bar - roughly 500 square feet.

· A fraction of the number of SKU’s (350-500) versus normal grocery stores driving significantly higher profitability and margins.

· We reduce spoilage by offering more high quality options in the frozen section. No longer is frozen a dirty-word when you use chef-prep.

· Less staffing requirements = less wage pressure & difficulty in finding workers.

· Significantly less rent costs and store build costs given smaller footprint.

· Only well-researched food & beverage choices are offered to consumers which drives significant brand loyalty.

We know which apples are the tastiest and which pasta sauce is worth the extra money. You get the benefit of our rigorous, unbiased research.

· A chef-operated prepared foods section that becomes your go-to partner for take-out and delivery food.

· A chef-driven pizzeria for eat-in or take-away meals. Goal: this is the best pizzeria in town.

· A hip, upscale common area for meeting friends, eating a quick meal, or doing some work on your laptop.

· Attached to an app that remembered every purchase for future buying.

· The app and each SKU offered nutritional information, our product review video, and recipes for home chefs.

· Rewards program that offered cost savings and perks for trying new items and staying loyal on a weekly basis.

· Created and operated by Chef’s who know food and beverages and are constantly looking for the next great SKU’s.

· A market that stocks top choices for ~90% of our everyday needs: personal care, household products, fresh & packaged grocery, ready to eat meals.

Consumer Benefits:

1. Simplified shopping experience & great prepared foods for those take-out nights.

2. Wow-factor aesthetics, it’s the coolest market in town.

3. A local, family grocer feeling with a high tough approach.

4. You have a personal chef-on your team. Let us do all the research while you benefit.

5. Less choices & better options provided by your trusted chefs & our “tasting board of advisors”.

6. Save money in non-important SKU’s so you can spend more on high flavor categories.

7. Easy 1-click future ordering because tech is at the center of the brand.

8. Allows you to consolidate your shopping and get better food in one location.

9. Significant food & nutritional information plus QR codes on items that give you meal ideas & recipes.

10. One location that serves your grocery needs plus any needs for the most popular fast casual, comfort foods, and all chef-prepared & the best in town.

Corporate Benefits:

1. A differentiated brand is created.

2. Higher profitability per square foot versus grocery peers.

3. Higher multiple business at IPO or through M&A.

4. Less staffing, costs, and training than peers.

5. Less food waste and operational drag from 2/3 more SKU’s.

6. High customer trust = high brand loyalty = strong pricing power.

7. Strong consumer mind-share & word of mouth given the differentiated model.

8. Strong market share gain potential as the new, differentiated entrant.

9. National growth opportunities at scale.

10. Upon proof of concept, lower cost of capital for future growth given better metrics.

Investor Benefits:

1. Less risky business model & industry for an uncertain economic environment.

2. Significant opportunity to compound capital at attractive rates and/or that is a “forever” cash cow.

3. An investment in something you believe in and would want to utilize each week.

4. A concept that will be very valuable to cash-rich peers.

5. Clear path to going public or M&A.

6. Be an early investor in the next great consumer staples brand.

7. Investing in experienced professionals that understand the power of brands.

8. Strong commitment to building the grocery2.0 in every upscale community.

9. Offers exposure to a huge end market: consumer spending ($21 trillion per year) with global scale.

10. Helps build a healthier, less obese society while enabling a true appreciation for chef-quality foods.

A Few Images To Tell The Story:

Simple Wow-factor store design & aesthetics. Here’s an example of what we want to build in a smaller footprint store.

Here’s an example of a simple store template might look like

Upscale, chef-made prepared foods that are also available through food delivery services. Let our chefs marinate the chicken or slow-cook the baby back ribs.

The Dean & Deluca brand served consumers very well but was incredibly mis-managed as a business. They were on the right track.

Drastically less SKU’s (~500 versus 30,000+) offers a less-cluttered, easier shopping experience leading to less time needed for shops and greater dependence on the brand.

A old-school butcher shop with it’s own brand & with a distinct external entrance for meat-only shoppers. Sometimes we will built it from scratch, sometimes we will be the delivery mechanism for a local butcher.

A “best in town” sandwich shop with its own brand and entrance - serving house-made bread and using only the tastiest meats and ingredients. We already know which brand we want as our partner!

A “best in town” Pizzeria with its own brand and entrance serving the tastiest pizza. This will be expected to do very large pick-up, to-go order revenues. We will build or partner depending on the community.

A well-researched, “top choices only” format for beer, wine & spirits…Let our trained experts introduce you to winners. There are simply too many choices for consumers to break out of their comfort zone.

Eric M. Clark

I’m a brand-evangelist and brands-dedicated investor. I analyze global brands every day. I understand consumer trends and consumer behavior. I know what makes consumers tick because I am a consumer myself. I understand the factors that allow a company to become the dominant brand in its category. I will continue to invest solely in leading brands and it’s now time to create a new brand from scratch. Why Nirvana Foods? Because I am a foodie, a self-taught, amateur chef, and a Dad who wants his family to eat well and enjoy great food & beverages. Google Search and its success proves consumers want advice. The grocery and prepared foods businesses need a major facelift on a national basis. A new brand needs to be created. Once that stands for something important. One that we can trust. A brand that teaches us which food & beverage brands offer the most value, taste and health benefits. Every community deserves to have a “best in town” option for the most important comfort foods. Wouldn’t it be amazing if consumers actually loved food shopping? Wouldn’t it be cool if consumers knew which foods should be organic, which apples had the best flavor, and where it was best to save money? How amazing would it be to have a group of local chefs at your disposal for this weekends meal or that for that Super Bowl party?

The definition of Nirvana is: a state of perfect happiness; an ideal or idyllic place.

Nirvana Markets will be our ideal grocery brand choice because it serves our needs better and with great convenience. It helps us save money and introduces us to amazing new brands that deliver powerful taste and health benefits to our bodies. A market that counsel’s us when we need advice and aims to deliver a consistent, wow-factor experience during every visit. Grocery2.0 is coming.

ABOUT ME:

I’m the proud dad of a 12 year old daughter and a devoted husband. Family is everything to me. I’m a builder and fixer by nature and a foodie since discovering San Francisco in 1995. I have 30 years of experience in financial services. I have worked in virtually every division of an asset management enterprise including sales, marketing, distribution, new product creation, and portfolio management. I understand the power of brands and how to identify the factors that create and sustain a top brand. I am the creator of a one-of-a-kind investment strategy called Dynamic Brands as well as a top brands Index called the Alpha Brands Consumer Spending Index. I have been investing in leading brands for 30 years and nothing is more important than high brand relevancy. As an investor in brands, I am uniquely qualified to build a new brand because I understand the inputs required more than most. As a foodie and chef, I understand what consumers want in a top grocery experience and largely, it is not being delivered at scale in every community. Consumers shouldn’t have to settle nor should they have to drive all over town to get what they want and need. Grocery2.0 simply needs to be created. Enter Nirvana Foods.