1. What is the current total of your investment portfolio?

*

Understanding you may have multiple account types, IRA, brokerage, etc. What is the estimated total of assets?

2. Which answer best describes your view on adding money to the portfolio?

*

3. What long-term goals are you investing your money for?

*

Click all that apply

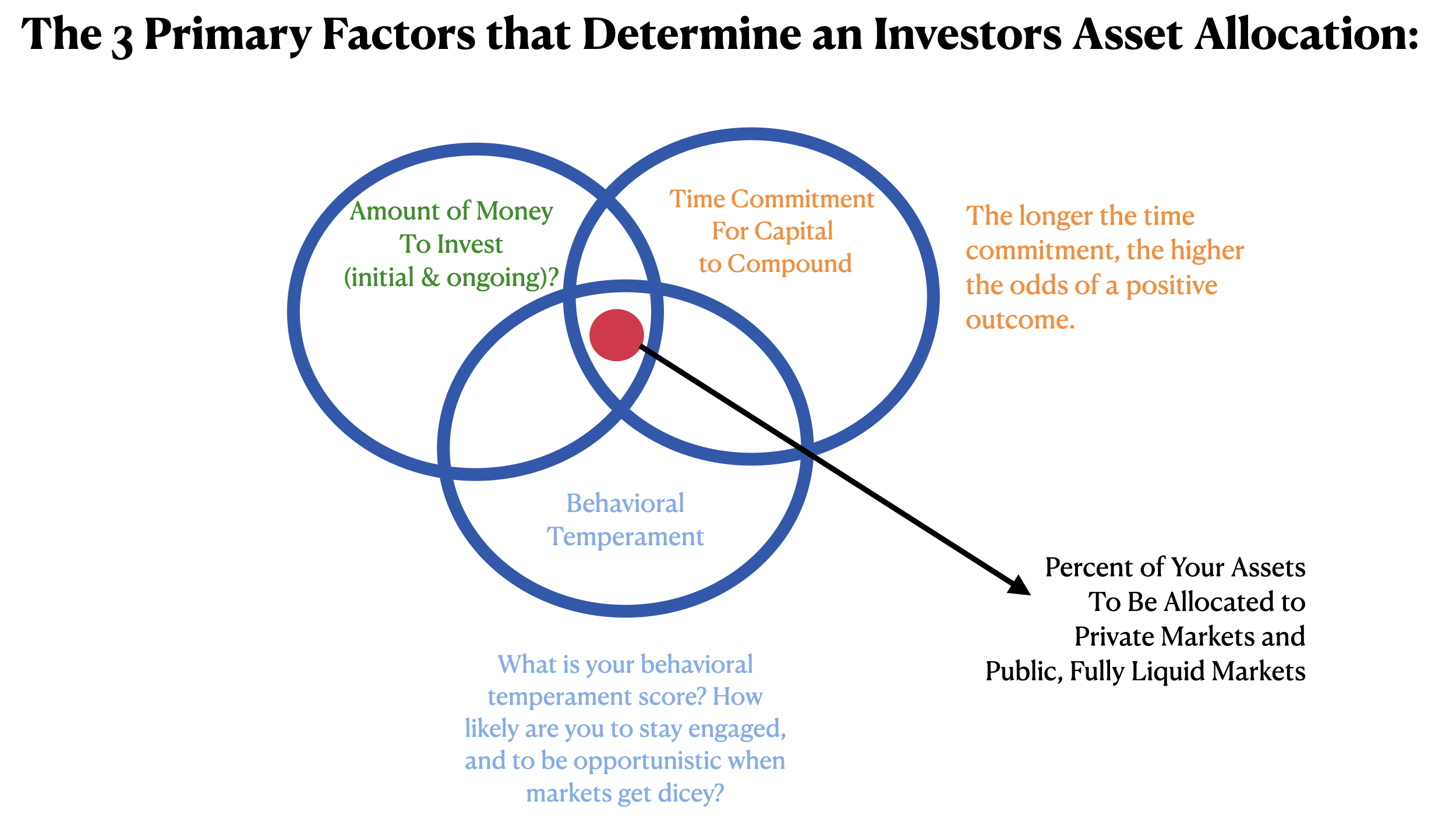

4. Understanding that "life happens and plans sometimes change", how long do you intend to keep the money invested for?

*

If you have multiple accounts with different time horizons, click all that apply

5. Understanding that all of these choices are likely important, what's most important to you?

*

Choose a max of 2 options. This helps identify what your overall needs are and what will likely drive your decisions during pivotal times over your investment lifetime

6. How does it make you feel seeing large daily swings in stocks and bond prices?

*

7. Understanding that things can change, what percent of your total investable assets would you be comfortable putting into strategies that are not readily accessible because they are invested for a long-term period?

*

FYI, the largest institutions, like Endowments hold a high percent of portfolio in less liquid, private market strategies because they tend to outperform fully liquid public market peers with lower volatility. They also use them to gain exposure to asset classes not typically available through public markets.

8. Generally speaking, private market, illiquid or partially liquid strategies have a history of outperforming their public market, liquid peers and/or with lower volatility. Would placing a portion of your assets there make sense to you assuming you understood & preferred the strategy?

*

9. How would you describe your understanding of your current investment portfolio with regard to all your holdings?

*

Please choose the option that best describes you. You can choose up to 2 choices. This helps us understand how engaged you are with your portfolio, and the process of building it. This flows into how likely you are to stick with the plan when storm clouds appear.

10. From a behavioral temperament perspective, what are you more wired to do when markets get volatile?

*

11. From an ongoing communications perspective, which apply most to meeting your needs?

*

Please choose up to 2 that apply. This helps to identify how best to keep you engaged along the way which flows into ultimate goal achievement.

12. If there's a compelling investment opportunity that requires more paperwork than simply buying a stock, ETF, bond, or mutual fund, does that keep you from considering the opportunity?

*

13. Which types of investment accounts do you currently have?

*

This helps get a complete picture of your investments which flows into the type of recommendations across asset types

14. If you were building a portfolio from scratch without help from anyone, which assets resonate with you best for inclusion in the portfolio?

*

Choose all that apply

15. Are you an accredited investor?

*

This qualification helps determine which strategies are available and potentially appropriate for an investor. Here's the checklist to check if you qualify as an accredited investor: Net worth >$1 million, excluding primary residence (individually or with spouse or partner), or Income over $200k (individually) or $300k (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year. Or, investment professionals in good standing holding the general securities representative license (Series 7), the investment advisor rep license (Series 65), or the private securities offering license rep license (Series 82) or a director, executive officer, or general partner (GP)of the company selling the securities or any family client of a family office that qualifies as an accredited investor. Also, if an entity owns investments or assets in excess of $5 million.

15 A. Are you a qualified purchaser?

*

This qualification helps determine which strategies are available and potentially appropriate for an investor. A qualified purchaser is: A person holding $5 million or more in investments, or a company holding $5 million or in investments owned by close family members, or a trust, albeit not one formed specifically for the investment in question, holding $5 million or more in investments, or an investment manager with $25 million or more under management, or a company holding $25 million or more in investments.

16. Generally speaking, what is more important to you with regard to your investment portfolio?

*

Choose the top 3 that apply

17. How long have you been investing your capital?

*

Choose the description that best describes you

18. Generally speaking, how would you describe your knowledge level of private asset classes like Private Equity, Private Credit, Real Estate, Hedge Funds, Venture Capital, Angel Investing, Private Lending etc?

*

19. Plans can change but for now, I plan on starting to take money from my investments...

*

20. As of today, my current and future income streams are...

*

21. Which 1 year scenario is most acceptable to you?

*

22. The average annual equity decline intra-year is ~14%, if you experienced a 14%+ decline, what would you typically be inclined to do?

*

23. Which 5 investments are you most interested in owning?

*

Choose up to 5 investment categories

24. Broadly speaking, choose the 2 most important investment focuses for you from a big picture perspective.

*

25. What might hold you back from adding partially liquid or illiquid assets in your portfolio?

*

Please choose the 2 choices that best describe how you feel.

26. What is your household combined income currently?

*

This helps us identify how much savings can be used to help meet long-term goals

27. Which description best describes you currently with regard to supporting others?

*

This feeds into your income and investment potential

28. Generally, what is your current view of markets and the investment climate?

*

This helps us understand sentiment toward risk taking. Sentiment is linked to behavior which is linked to overall returns .

29. Which description best describes you and/or your families current stance on discretionary spending?

*

This information helps us with how consumers are thinking about their spending which flows into economic growth and the investment climate

30. Have you either re-connected with your advisor or reviewed your investment portfolio recently to make sure it's positioned according to the environment we are in?

*

Name or unique identifier to be used for privacy

First Name

Last Name

Preferred email to send results

*

Advisors Name if applicable

First Name

Last Name

Advisors Email if applicable