KKR - KKR

https://www.kkr.com/

“Started in 1976. From the ipo on July 15, 2010, with year end AUM of ~$61B in assets, KKR stock has returned ~897% versus the S&P 500 return of ~400% as of February 15, 2022 when KKR had total AUM of $441B. And they are just getting started from an asset raising and fee revenue perspective.”

COMPANY PROFILE

KKR is a leading global investment firm that manages multiple alternative asset classes, including private equity, credit and real assets, with strategic partners that manage hedge funds. KKR aims to generate attractive investment returns for its fund investors by following a patient and disciplined investment approach, employing world-class people, and driving growth and value creation with KKR portfolio companies. KKR invests its own capital alongside the capital it manages for fund investors and provides financing solutions and investment opportunities through its capital markets business. References to KKR’s investments may include the activities of its sponsored funds.

Style Factor Benefits

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where KKR scores well as of 12/31/21:

97% high margins versus industry peers

88-90% strong price momentum trends

70% strong dividend growth

87% low price to sales - the stock is still NOT expensive

80% strong ROIC > WACC

99% strong 5 year ROIC growth

100% top sales surprise last quarter

2/12/2022 Earnings Update

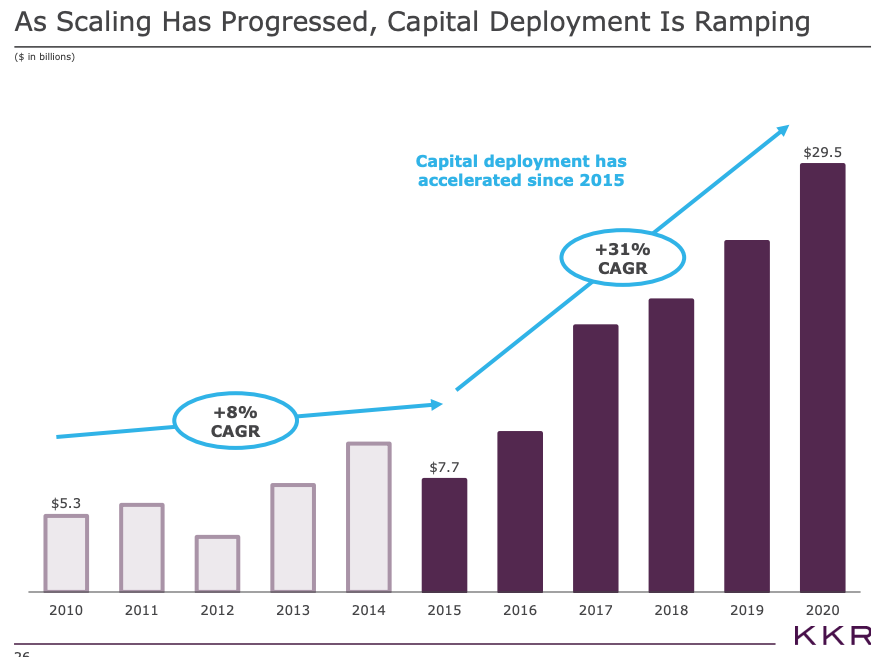

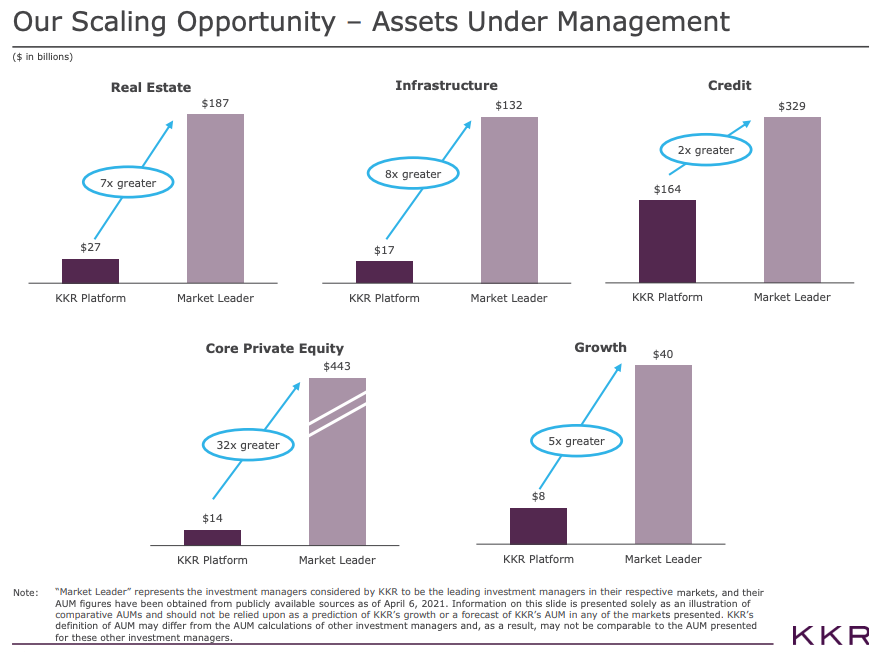

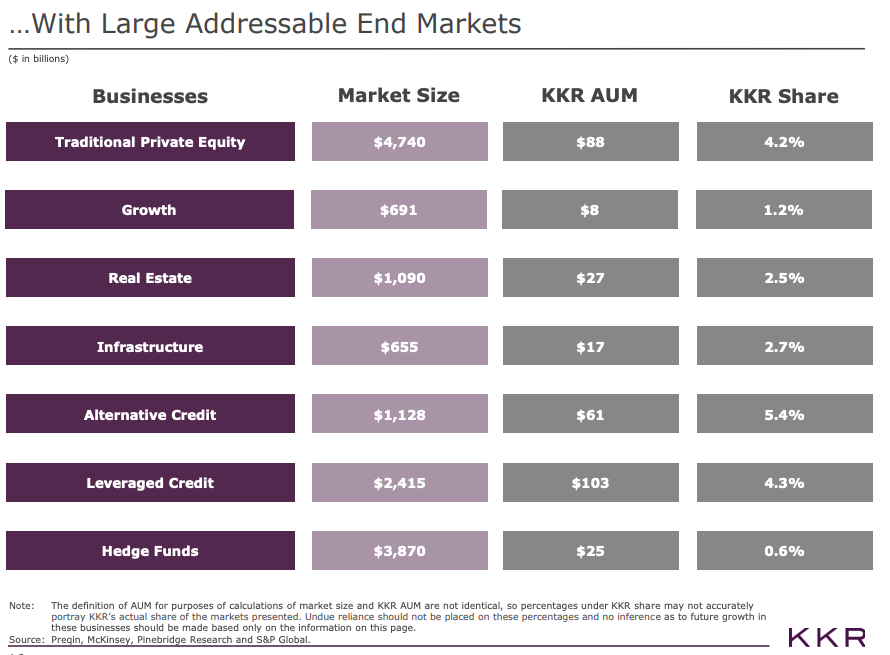

I won’t go into a ton of specifics on KKR’s quarter because the trends are incredibly favorable for the Private Equity, Real Estate, Infrastructure, Alternative Credit, Leveraged Credit, Hedge Funds and Traditional Growth categories. Just remember, these guys in PE are largely the smartest guys/gals in the room. They thrive in good times and they are sharks buying solid distressed assets in tough times. These are the people that win long-term. They don’t puke assets at the bottom because they have massive amounts of dry powder to double-down. Beware though, they are still stocks in the stock market so when markets are weak, these stocks tend to be weak and in many cases, weaker than the market. Why? They tend to act like a levered investment and leverage works in both directions but it’s important that the business trends and secular growth opportunity does not change with global rates low and peoples assets being eaten away by inflation. The moral of the story: to get the great gains these smart investors tend to generate, you need to accept some short term volatility sometimes. And in fact, use that volatility to add to your positions because the trends in their business are solid. Both BX and KKR have raised epic amounts of capital over the last few years and as they deploy these assets into investments, they begin too take attractive fees for managing the assets and ultimately for incentive fee’s with performance. Increasingly,, so much of the assets are permanent in nature so a wicked compounding effect occurs over time. These stocks buy their stocks back opportunistically,, they are raising a ton of new assets, much of the assets are permanent and they pay the firm high fees. Oh, and there’s trillions of dollars shifting away from important areas and the PE brands are the primary beneficiaries of this massive asset migration. Be patient, accept some volatility and you should do just fine. Below are some great summary slides from KKR’s recent earnings

12/31/2021 Update

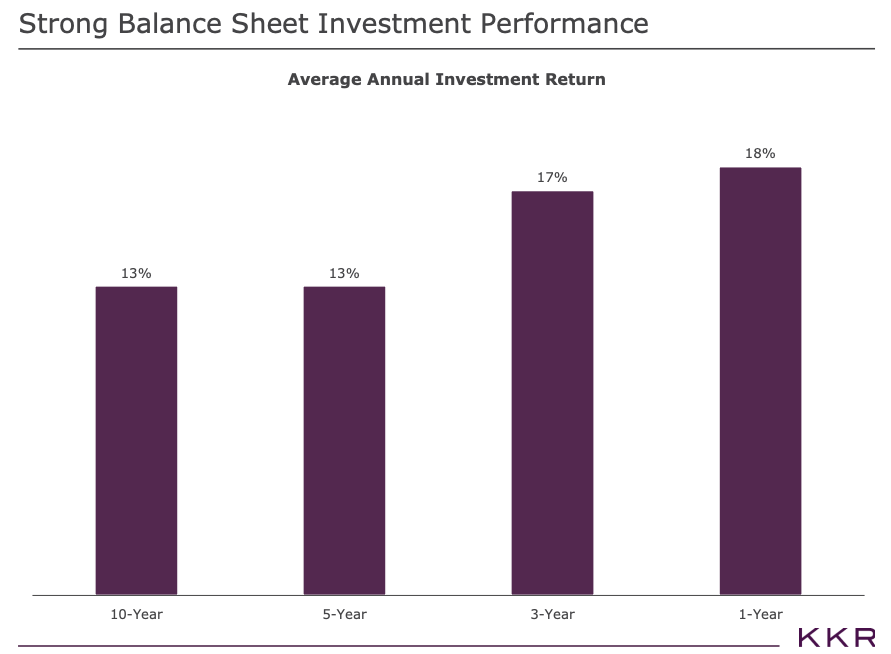

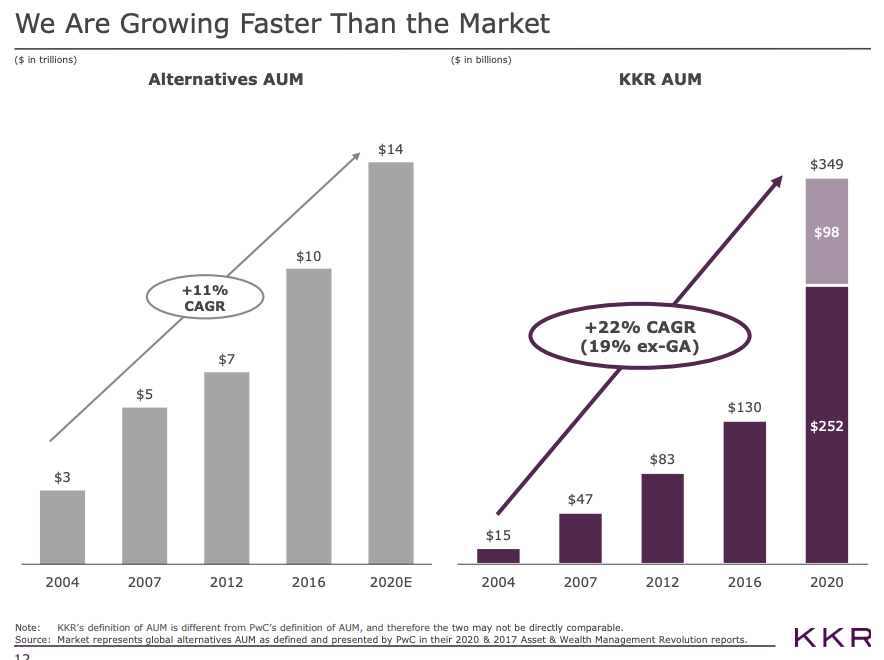

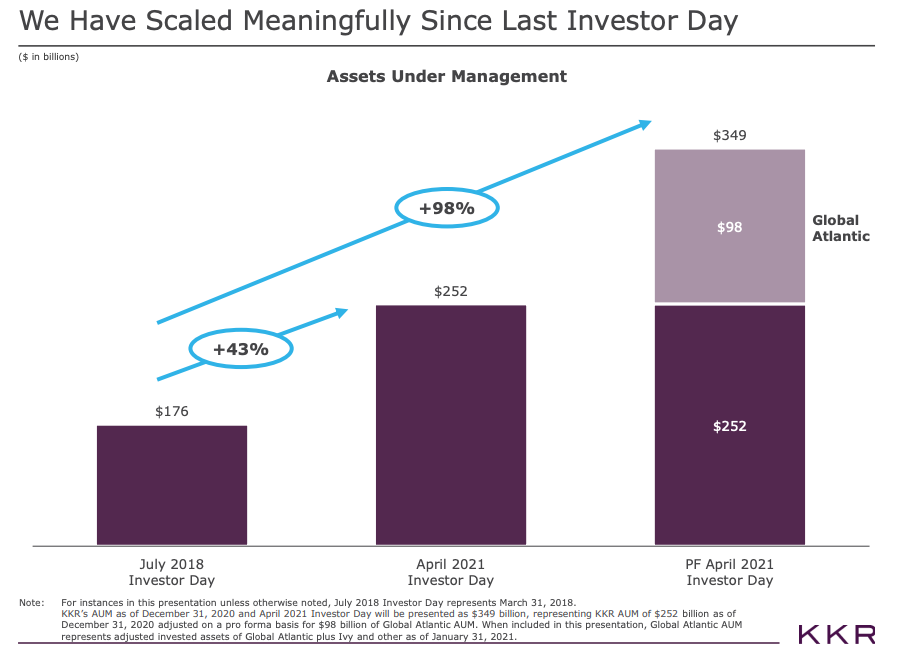

I feel about KKR the same as I do with Blackstone. BULLISH. The main reason is the secular theme of assets moving away from traditional fixed income and into alternatives. Plus the general investments towards private equity, real estate, infrastructure and venture investing. New capital raised in the quarter was $28B and last year they raised $44 billion. Over the first 9 months of 2021, they raised 2x+ what they raised last year. Business is good and its accelerating. Real Estate is a key driver to their growth of AUM. Deployed $15B in private market strategies and $10B in public markets. YTD they have placed over $50B. Real assets now are about 50% of deployments. Scale is everything in this business. They acquired Global Atlantic with $90B in assets. Like BX, these are exceptionally connected and smart executives and very strong capital allocators. KKR has about $460B of assets under management. Much of the capital is captive and keeps compounding over time adding to the fee’s they generate. The wave of money going to alternatives is simply staggering and we own the two top asset managers that should benefit greatly with this secular trend still in its infancy. KKR now has about $16B in embedded revenue and all at a time when the asset raising machine is firing on all cylinders. Their investment performance has been exceptionally strong which keeps their new assets growing well. In fact, YTD they have $100B in committed new capital to the firm, a record. From $45B to $205B of perpetual & strategic capital. Global Atlantic assets have gone from $75B to $120B now, a 60% increase. They have confidence they can double their assets over the next 5 years.

KKR employees are the largest owners of KKR stock. KKR has already reduced the free float by about 15% through buybacks and continues to be committed to raising the dividends each year.

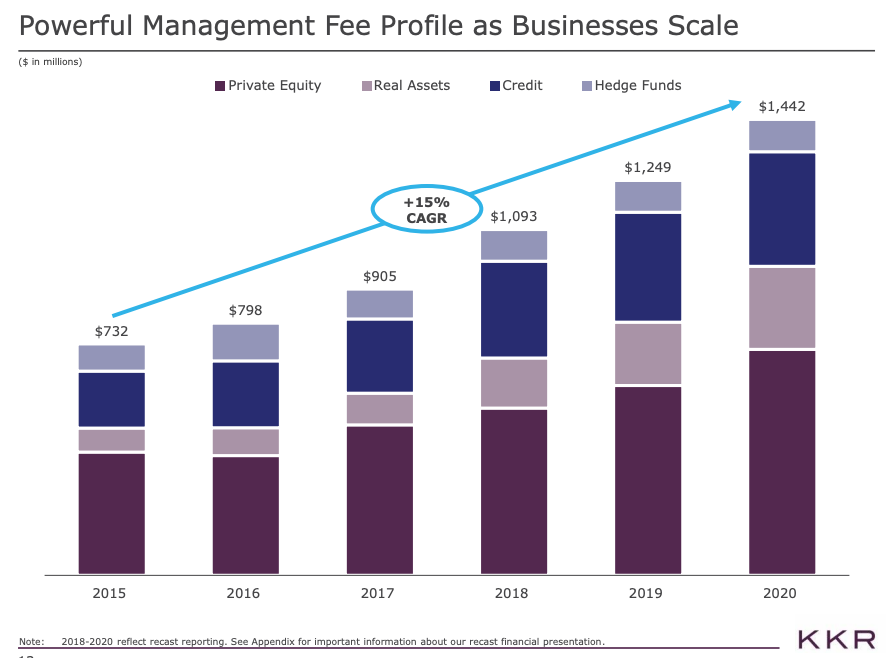

Recent earnings: Strong franchise, strong Asia opportunity, particularly in private equity. YTD new capital raised 2x last years record capital raise. Raised 102B YTD, 28B this quarter. This is long term capital so the fee revenue jump is massive for future results. New asset pipeline is robust. 460b AUM today. BX 800B, both will reach 1T I have no doubt, BX in less than 1 year and avg fee is much higher than most traditional asset managersManagement fees of $559.02M, compared with $369.44M in the year-ago quarter, according to its earnings report.

Transaction and monitoring fees of $249.7M also gains from $201.1M in Q3 of last year.

Asset management segment operating earnings of $1.07B in Q3 nearly doubles from $593.8M in Q3 2020.

Q3 EPS of $1.05 beats the $0.95 consensus estimate, up from just $0.53 in the year-ago quarter.

Q3 fee related earnings of $529.5M rises from $324.02M in Q3 of last year thanks to management fee growth and strong performance in capital markets.

Q3 assets under management of $459.1B jumps from $233.81B in Q3 2020.

Fee paying AUM of $349B in Q3 increases 97% from Q3 2020.

Uncalled commitments, known as dry powder, of $111B increases from $67B in the year-ago quarter. Big risk in all these: they r high beta market centric correlated so if market has correction these will too even though they will continue to raise tons of capital and have hundreds of billions in dry powder making them my favorite buy on market pullback positions