“From January 1, 2006 to September 6, 2019 Live Nation stock returned roughly 430% versus the S&P 500 return of roughly 138% which is over double the return of “the market”. From a demographic perspective, LYV should have significant tailwinds ahead as “the experience” continues to be in high-demand”

COMPANY PROFILE

Live Nation is the global leader in live entertainment. Artist powered, fan driven. LYV is privileged to work with artists to bring their creativity to life on stages around the world. Whether it’s two hours at a packed club, or an entire weekend of sets at a festival, a live show does more than entertain. It can uplift, inspire and create a memory that lasts a lifetime.Bringing 30,000 shows and 100+ festivals to life and selling 500 million tickets per year is a massive undertaking, made possible by our 44,000 employees worldwide. But just because we are big doesn’t mean we do things the same way as other companies of our size.

Recent Earnings

Live Nation is the ultimate brand in a experience economy.

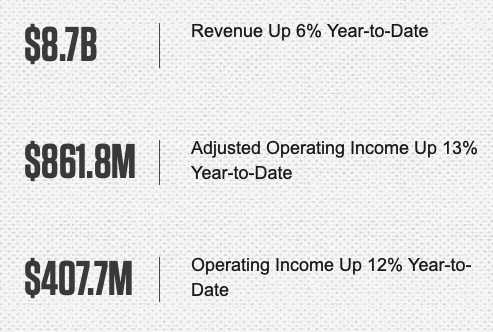

Highest operating income and adjusted operating income ("AOI") quarter ever.

Reported adjusted operating income of $427m.

This business is now in the process of scaling globally as the flywheel continues to add new revenue opportunities.

Operating income grew 11%.

AOI grew 11% in the quarter (adjusted operating income) & outperformed a record third quarter last year.

Fan spending is as strong as ever.

Have sold 92 million tickets through mid-October, up 6% or five million tickets - on track to have nearly 100 million fans attend our shows this year.

Concerts

$3.2 billion in revenue = a slight miss.

YTD, 73 million fans attended over 26 thousand concerts - just think about how difficult this model is to replicate. That’s really valuable!

$333 million in AOI, which is up 17% from last year.

International business particularly robust this year.

More effective in pricing tickets closer to market value, particularly with our platinum pricing tool.

Increased our average revenue per fan by $2.50 in our amphitheaters to over $29, while also increasing fan spending at our festivals, theaters and clubs.

Continuing to build new venues and find new venues to take over for additional reach.

Added 36 venues to our portfolio, ranging from the Brooklyn Bowls in New York and Las Vegas to the Danforth Music Hall in Torontoto the Sportpaleis in Belgium.

Sponsorship

Revenue of $215 million - Mid-teens AOI growth projected for full year.

The high-margin Sponsorship business delivered 17% operating income and 18% AOI growth for the quarter.

Provide unique value proposition of nearly 100 million fans on-site for brands looking to make a direct connection with consumers.

Sponsorship revenue has grown by 11% year-to-date at our venues, while festival sponsorship has grown by 31% year-to-date.

95% of our expected sponsorship revenue for 2019 now contracted.

Ticketmaster

Revenue of $388 million, a slight miss.

Grew operating income growth by 30% and generated its highest AOI quarter ever, up 20% from last year.

Every quarter in 2019 has been one of our top 10 gross transaction value ("GTV") quarters ever.

Key initiative: paper ticket business converted to a digital platform that drives better user engagement and further revenue opportunities.

Expect digital ticketing to be installed at over 700 venues, representing 120 million tickets, by the end of this year.

~60% of the fans at digital-enabled events now entering with their mobile devices - now they know who is there, where they are so they can deliver more value/revenue.

Ticketmaster app is now regularly in the Top 10 rankings for Entertainment in the Apple App Store.

Expect we will deliver operating income and AOI growth at Ticketmaster in the mid-single digits for the full year.

2020 guidance

2020 pipeline is up substantially.

Deferred revenue up 25% YOY which tells us concert demand is very strong for Q4.

1,500 stadium, arena and amphitheater shows booked already.

Expect to be up double-digits from this same point last year.

NOT built into estimates in 2020 is the Ocessa acquisition and the revenue that comes from adding these events.

OCESA promotes more than 3,100 events for nearly 6 million fans annually across Mexico and Colombia.

Ticketmaster Mexico, is a leading ticketing company in Mexico, with more than 37 million tickets sold annually. As part of the transaction, Live Nation will also acquire an interest in OcesaSeitrack, OCESA’s booking and artist management joint venture;

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Live Nation scores well as of 9/17/19:

90% high free cash flow growth

81% strong price momentum

76% low price/sales

81% high 1YR EPS growth

91% high cash balance over total market cap

11/1/2019:

First, this business can be lumpy at times and is seasonal as most businesses are. There’s absolutely nothing negative to find in the recent quarter because I don’t care about meeting quarterly estimates versus building momentum for future revenues. Trends across all the important metrics were positive and with strong demand. Any weakness in the stock due to beginning the seasonal weakness should be aggressively bought in my opinion. This is an international expansion story for an important category of live concerts. They continue to make strategic acquisitions in key markets to expand their local presence which drives significantly better economics than just doing partnerships and joint ventures. The major trend that’s not really focused on much is the pivot from paper to digital ticketing. Roughly 60% of tickets now are digital on the smart phone which allows Live Nation, artists, and brands to engage directly with fans. This drives higher per person, per venue spending and higher brand love for the brands that engage best. This new monetization process is early days and will continue to offer significant opportunities to build better relationships and better economics. People’s love for the experience is something that is not to be ignored. The stock is down 7% on the slight revenue miss now offering an attractive entry point for what should be a robust Q4 and 2020.

Older comments:

I love live events, I love music, so I love Live Nation! I also believe LYV would make a wonderful acquisition for Amazon, Spotify, Booking.com, or another media brand. This great company sits in the pole position to generate significant revenue strictly from working more closely with global brands who want to build deeper and more personal relationships with consumers. With AI at the core and their vast data-set, they have the ability to build custom programs for brands, digital and local via the personal touch, that drive deeper engagement and that remove all friction from purchase decisions. Given their global scope and connection to over 90 million event participants plus their second-hand connection to “future live events consumers & enthusiasts”, LYV sponsorship revenue has nowhere to go but straight up. Once you build trust and loyalty with consumers in an experiential way, you earn the right to build a deeper bond that can have meaningful impact across the brand and revenue. I see so many opportunities for Live Nation that it makes me want to buy more stock even after this move higher.

Live events are not cheap so the big risk for the stock is consumer’s pulling back on expensive discretionary spending and postponing that expensive concert. For me, the extensive flywheel that’s very difficult to replicate makes this business super intriguing long-term. Demographically speaking, LYV is in a sweet-spot for the next 2+ decades so I’m happy to buy more on any deep dips.