“From May 23, 2002 to December 31, 2021 Netflix stock returned roughly 51,060% versus the S&P 500 return of roughly 533% making Netflix one of the best performing stocks over the last 20 years.”

COMPANY PROFILE

Netflix, Inc. provides entertainment services. It offers TV series, documentaries, and feature films across various genres and languages. The company provides members the ability to receive streaming content through a host of Internet-connected devices, including TVs, digital video players, television set-top boxes, and mobile devices. It also provides DVDs-by-mail membership services. The company has approximately 214 million paid members in 190 countries. Netflix, Inc. was founded in 1997 and is headquartered in Los Gatos, California.

Here’s how Netflix feels about the long-term opportunity they are operating in: Click here

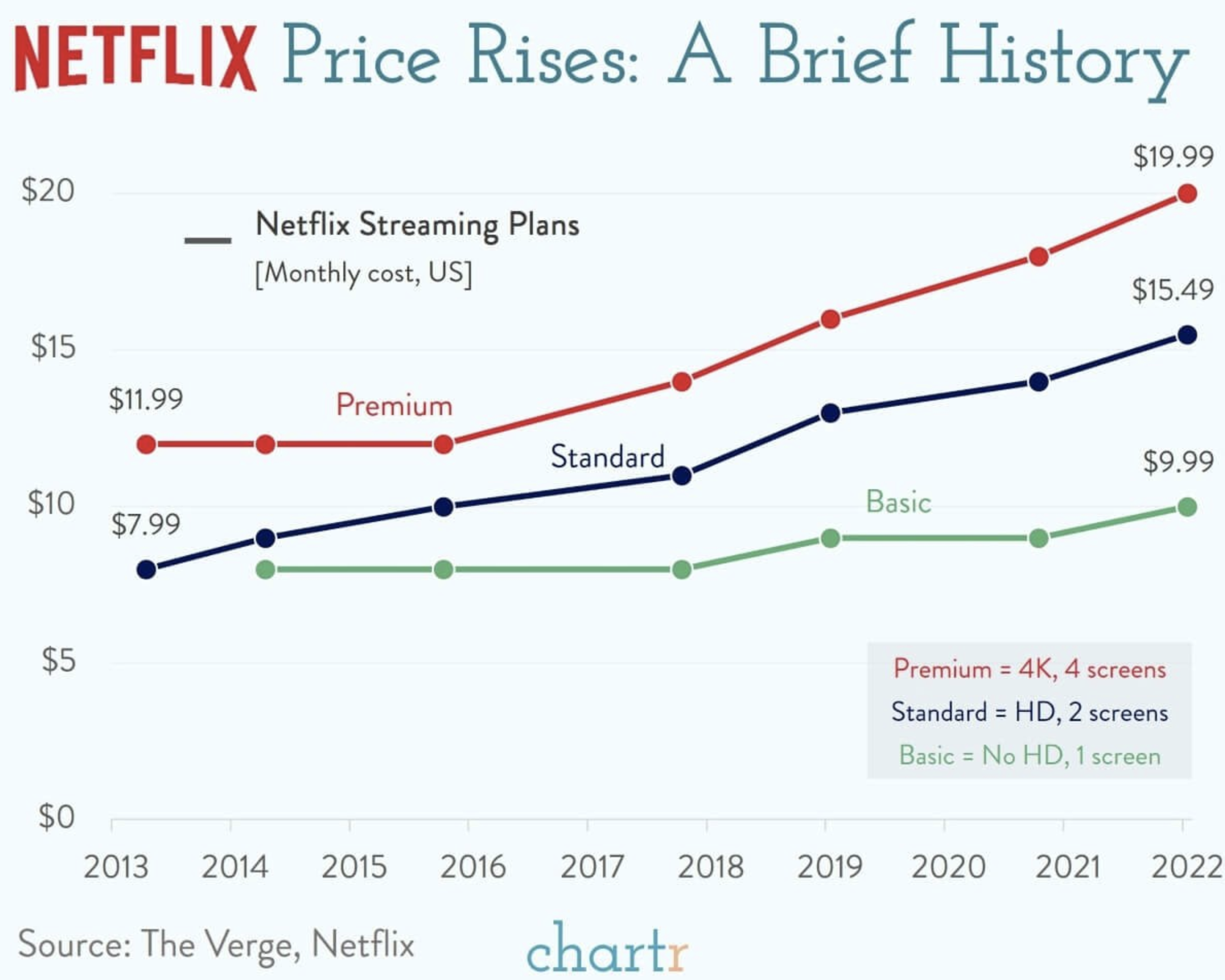

That’s called strong pricing power!

Style Factor Benefits

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Netflix scores well as of 12/28/21:

84% strong operating king - proprietary screen using margins, margin expansion and high revenue growth

82% high ROIC > WACC (weighted cost of capital) - they can borrow cheaply and are strong capital allocators

94% low debt to EV

96% high 5 year ROIC growth - a key growth metric

71% high total sales

99% high sales surprise last quarter

71% high 1 year sales growth

79% high 1 year EPS growth

86% strong cost control acumen, a proprietary metric

Update

Pershing Square’s Bill Ackman on their Netflix buy:

We have long admired Netflix and had initially researched and analyzed the company as part of our investment due diligence on UMG. We then updated and completed our work in January when the stock price declined due to disappointing subscriber guidance. Much like UMG, we believe Netflix is well positioned as a leading beneficiary of the long-term secular growth in streaming, a high-quality business overseen by a world-class management team. Netflix established subscription video streaming when it launched its service in the U.S in 2007. Over the subsequent fifteen years, it has achieved global scale with 222 million paid subscribers today in more than 190 countries. Despite its large scale, Netflix is still in the early stages of capitalizing on the decade-long secular growth in streaming video and corresponding decline in linear Pay TV. Current subscribers amount to less than a quarter of today’s estimated total addressable market of 800 million to 900 million households that have either fixed broadband access or subscribe to Pay TV (excluding China).

Netflix offers consumers on-demand, commercial-free, binge-able content with ubiquitous accessibility at a price point that is approximately 80% less expensive than the average Pay TV package in the U.S. A Netflix subscription is one of the lowest cost forms of high value entertainment, with cost per hour of engagement of about 30 cents. The company’s vastly superior value proposition relative to Pay TV and other forms of entertainment should drive substantial pricing power and meaningfully increase its penetration across its addressable market over time. We expect the company’s addressable market to grow materially with global improvements in broadband connectivity and the continuous proliferation in the number of connected devices (SmartTVs, tablets, and smartphones).

Netflix is well positioned as the dominant market leader with several advantages relative to existing legacy media incumbents and large-capitalization technology entrants. The company has a diverse library of “content for everyone” that is replenished at a much faster rate than competitors. It releases 150 to 200 original content episodes per month, more than the volume released by Prime Video, Hulu, Disney+ and HBO Max combined. Netflix’s industry-leading subscriber base has enabled the company to establish a very profitable business while spending more on original content than competitors.

Netflix’s competitors are not currently profitable on a standalone basis and may struggle to spend ever increasing amounts on content unless they achieve significant future subscriber growth. Legacy media incumbents rely on existing profit pools from Pay TV to fund content spend today, but these sources of funding are quickly eroding due to Pay TV cord-cutting. Large- capitalization technology competitors such as Amazon and Apple have deployed cash flows from their significantly larger core businesses to fund video content, but we believe they will not spend unlimited sums to advance video streaming businesses that remain unprofitable and are ancillary to their core businesses.

As Pay TV cord cutting accelerates in mature markets, we believe there will be consumer appetite to subscribe for multiple streaming services over time. In the U.S., we estimate that wallet share released from declining linear Pay TV subscriptions, which are priced at approximately $80 per month, can easily sustain a streaming bundle of three to five streaming services per household, which are typically each priced around $10 to $15 per month and offer a significantly better customer experience.

Netflix has the lowest churn rate by a wide margin amongst streaming services, highlighting its core position as the anchor, utility-like service of any “streaming bundle.” Netflix’s retention in the U.S., its most competitive market, has remained consistently stable at industry-highest levels despite the launch of several new competitors. International markets are earlier stage growth markets where Netflix has an even more formidable first-mover advantage and significant competitive position in local language content. Only Netflix has the unique and proven track record of elevating regional productions like Squid Game, Casa de Papel and Lupin into the global cultural zeitgeist.

As Netflix’s business has achieved scale, its operating profit margins have increased from 4% in 2016 to 21% in 2021. Over

the last five years, Netflix has held content spend per subscriber constant despite growing overall content spend by 23% per annum. At the same time, the company has increased price by 7% annually, resulting in dramatically improved subscriber unit economics. From the customer’s perspective, Netflix’s value proposition has become better each year as the growth in the volume of new high quality content has comfortably exceeded price increases. We believe that the combination of continued subscriber growth and pricing power will allow the company to leverage its growing content spend over an even larger future subscriber base, which will drive substantial future margin expansion and provide a better value proposition to its subscribers each year. The opportunity to acquire Netflix at an attractive valuation emerged as investor concerns over management’s short-term guidance, exacerbated by recent market volatility, led to a substantial decline in the company’s share price. Despite a 47% increase in revenue, approximately 800 basis points of margin expansion and a vastly improved free cash flow profile over the last two years, as of March 22, 2022, Netflix’s share price is down approximately 45% from recent highs and is trading below its February 2020, pre-pandemic share price.

Although we expect some near-term variability in the company’s quarterly growth and profitability, we are confident in Netflix’s long-term outlook. Over the next decade, we estimate the company can achieve double-digit annual revenue growth, significantly expand its operating profit margins, and grow its earnings per share by more than 20% per year. Moreover, the company is now cash flow positive which over time will enable capital return through share buybacks in the coming years.

We believe Netflix’s current valuation represents a meaningful discount to intrinsic value for a business of its quality and exceptional growth potential.

Earnings 1/19/22:

Ok first, this market hates anything in the growth basket. Growth stocks have gone from market darlings and leaders in performance and revenue growth to laggards and bubble stocks. Yes, there’s absolutely a bubble component to some growth stocks (SPAC’s, meme stocks, reddit board stocks, Ark ETF stocks, etc.) but we don’t traffic a ton in the high growth, profitless company market. Right now, the sellers are being indiscriminate in their selling by just selling everything, but the truth always lives somewhere in the middle so in due time, investors will start sifting through the growth rubble to buy the best and most enduring growth business models and brands that are currently offered on mega sale and not generally too expensive when compared to their growth, balance sheets and recurring revenue. Netflix certainly fits that bill.

What a day to report your earnings! Markets have been selling off lately and growth stocks have been under distribution largely since November of last year. The market was up today until the last few hours when a seemingly endless supply of sell orders was released. Now remember, it’s options expiration tomorrow and there’s a massive amount of open interest that needs to be reconciled, which causes a lot of short-term volatility. NFLX told investors last quarter that this quarter would be a heavy spend quarter and they did not disappoint. There were positives and negatives in the report, which is always the case, but largely the company is executing well on their long-term growth plans. Foreign exchange losses because of a strong dollar cost them $1billion and they grew subscribers a bit less than the street expected. On an absolute basis, they are executing well, creating lots of compelling content, keeping consumers engaged for longer, adding new subscribers, and raising prices because costs are rising, but the value proposition is still heavily skewed in their favor.

I want to be clear: the game of comparing a company’s quarterly earnings to an aggregate analyst consensus number is completely idiotic. Analysts have proven over and over they have a horrible track record at “predicting” the trajectory of a business’s financial metrics and extrapolating these metric trajectories to future stock prices. The assumptions are often linear, and the market rarely works in a linear fashion. Every day is a game of bulls and bears and algo’s drive short-term market moves, often in contrast to the long-term trajectory of the business. NFLX’s business is growing well but content creation all around the world is costly, time consuming and riddled with potential short-term issues. But once the content is distributed, it can be enjoyed and monetized over, and over which keeps consumers engaged and captive. Back in the day, consumers turned on their TV and pushed buttons on their cable remote and spent all/most of their time inside the cable platform watching shows, sports, and movies. Nowadays, streaming is the norm and Netflix has become the first-place tens or hundreds of millions of people begin and end their content search. That creates a powerful moat and intangible asset for a brand.

After-hours on this slight guide down from consensus, the stock is down 19%, a wildly inappropriate response in our eyes. I added more NFLX on Friday 1/20 around $385 and will trade around the current long-term core position. Analysts, mostly across the board, have reduced the target price and gone from buy to hold AFTER this massive 40% drawdown. The average target now is $500 which is still 25% higher from where it sits at $400 today. I believe that’s conservative but it’s also a nice gain from here. Thanks analyst community, you add zero value and now we get to benefit from your panic downgrades on a noisy quarter. I continue to believe they can double their subscriber base, at least, and the revenue ramp they can achieve, over the long term, will be multiples of the current total revenue. They will be FCF positive for 2022, are reducing debt and will return any excess capital to shareholders via buybacks, particularly on days where the stock has a wild over-reaction like I see after-hours tonight. BTFD

Thoughts:

I have said this time and again, Netflix has wicked good pricing power and the value they deliver versus the price they charge offers a significant benefit to consumers. They could go to $20/month without any churn imo. On January 14, Netflix announced it has increased the price of its monthly subscription plans in the U.S. and Canada, effective immediately for new subscribers beginning on Friday.

In the U.S., subscribers to Netflix’s basic plan, which allows for one stream on one screen at a time and does not have HD streaming, will now be charged $9.99 a month, up from $8.99. Standard plans — which allow for users to stream on two screens at the same time — now cost $15.49 per month, an increase from $13.99, while premium plans have inched up to $19.99 a month.

Existing subscribers will begin to see the price changes “over the coming weeks,” depending on their billing cycle, a Netflix spokesperson told The Hollywood Reporter. Subscribers will receive an email and in-app notification 30 days in advance of when the new subscription prices will take effect in their accounts.

To me, Netflix has become a consumer staple, similar to Apple in many ways. Netflix still has exceptional pricing power and has become the first place global consumers go for streaming video. That makes the brand is key staple of my portfolio. It is not a cheap stock but we have already stepped over the cross-over point where FCF generated from current subscriptions pays for new content and offers a wonderful compounding effect for this business. They have plenty of growth left in the tank outside North America. Yes, its lower margin because the prices start very low but they gradually creep up making Netflix quite a stealthy inflation beneficiary. Aside from a love of sports content, I cant for the life of me understand why people still pay for the garbage cable they have. Its 3-4x more expensive, filled with ads, and the content is largely terrible. If I was Reed, I’d buy Fox Sports and build a “top sports events” subscription as well as building the online video gaming subscription. Subscription growth would re-accelerate and the stock would absolutely rip to all time highs. Comps get much better in 2022 after such wicked good Covid subscription benefits. All at a time when they have stellar new content and ramp international content opportunities. I’d pay 3x more for my Netflix subscription and I suspect most would too. This makes the stability and pricing power of the business well worth the high valuation.