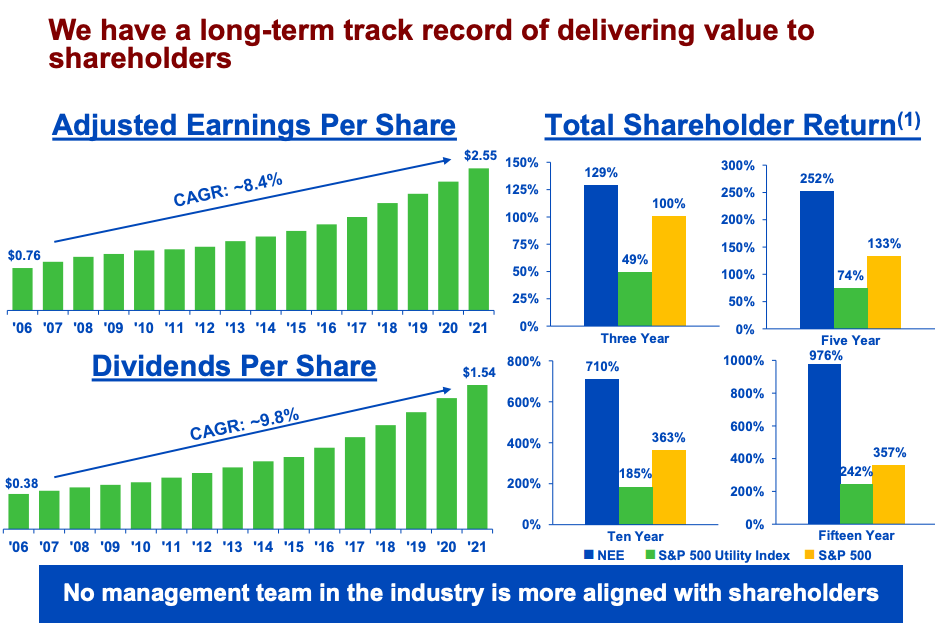

“Over the last 30 year period ending January 12, 2022, Nextera Energy stock has offered a total return of roughly 5,810% versus the S&P 500 return of about 1980%. Not bad for the worlds largest sustainable energy brand.”

COMPANY PROFILE

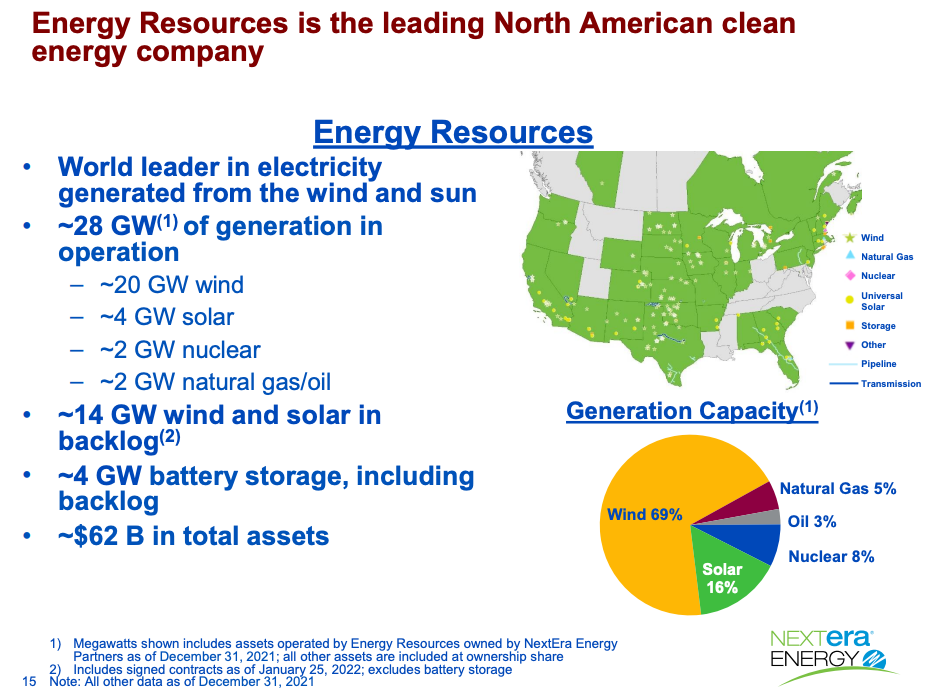

The world's largest utility company. The world’s largest producer of wind & solar energy. They are a regulated public utility (the old Florida Power & Light) and also a a fast growing renewable energy business (Nextera Energy Resources). The public utility serves about 10m people in SE Florida and acquired more in SW Florida. Their business is well protected as a public utility. Their management team is the best in the business. The utility is the cash cow part of the business which funds their faster growing renewables business initiatives.

Here’s a wonderful discussion on NEXTera’s business via a great podcast series called Business Breakdowns. Business Breakdowns - NEE episode

Style Factor Benefits

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where NEE scores well as of 12/31/21:

92% positive rate of change in short term momentum

80% high dividend growth

85% Low volatility equity

90% strong last quarter sales surprise

Update 1/12/2022

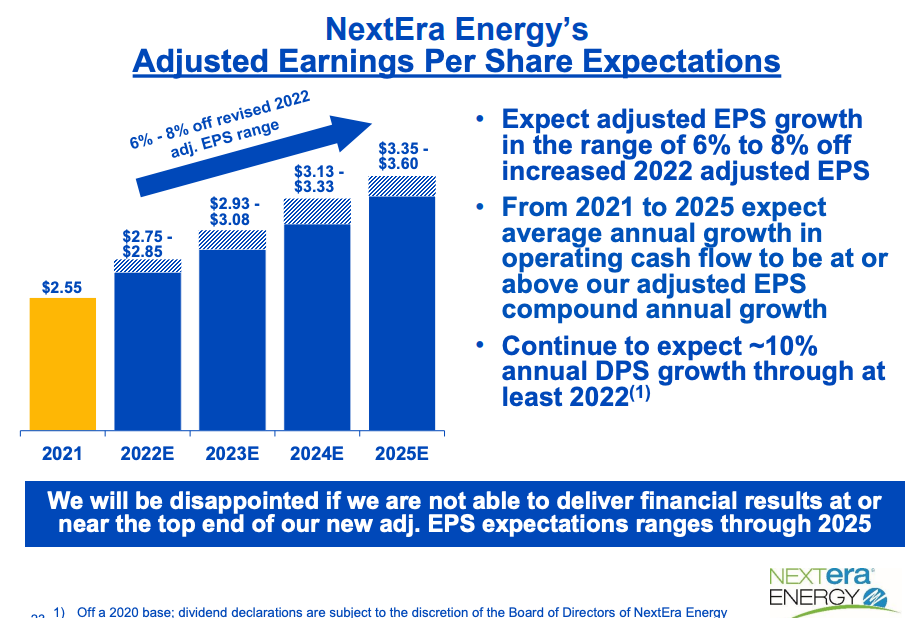

NEE’s vision: To be largest, most profitable clean energy provider in the world. Period. That’s all I need to know. These things take time though. First, utilities are very interest rate sensitive. IMO that’s kind of lazy given they have the ultimate pricing power as an inflation hedge but as rates come up, NEE can be weak but do not lose sight of the big picture opportunity. NEE is an incredibly well-run company with plenty of levers to pull for growth and stability. The world’s leaders have finally gotten the message, climate change is real and sustainable energy is the future but it will take time to evolve across the globe. NEE’s public utility is a major cash cow with solid inflation protection. The utility revenues finance their sustainable energy opportunities in a wonder 1-2 punch for proper energy exposure. This stock has a history of outperforming the market and offers strong defensive qualities in times of turbulence. Now is a wonderful time to have some utilities and sustainable energy exposure with low beta characteristics. We will keep collecting a dividend, get dividend hikes over time and sleep well at night that we are investing in a better future for our climate.