“From July 31, 2015 to December 28, 2021 PayPal stock returned roughly 505% versus the S&P 500 return of roughly 100% or 5x the return of “the market”.”

COMPANY PROFILE

PayPal is a leading technology platform company that enables digital and mobile payments on behalf of consumers and merchants worldwide. We put our customers at the center of everything we do. We strive to increase our relevance for consumers, merchants, friends and family to access and move their money anywhere in the world, anytime, on any platform and through any device.

We provide safer and simpler ways for businesses of all sizes to accept payments from merchant websites, mobile devices and applications, and at offline retail locations through a wide range of payment solutions across our Payments Platform, including PayPal, PayPal Credit, Venmo and Braintree products.

Paypal has grand plans to build a superApp that allows consumers globally to go through 1 door to gain access to a multitude of products and services surrounding investing, shopping, deals, and social commerce. Anything they can offer to generate more payments volume drives their business model further.

Style Factor Benefits

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Paypal scores well as of 12/28/21:

High mean reversion opportunity for 2022 with very poor momentum and wide distance from already reduced consensus estimated target price

83% high EPS growth 1 year

77% high % sales surprise last quarter

73% high FCF

74% low debt/EV

70% high FCF growth

2/2/2022 Update

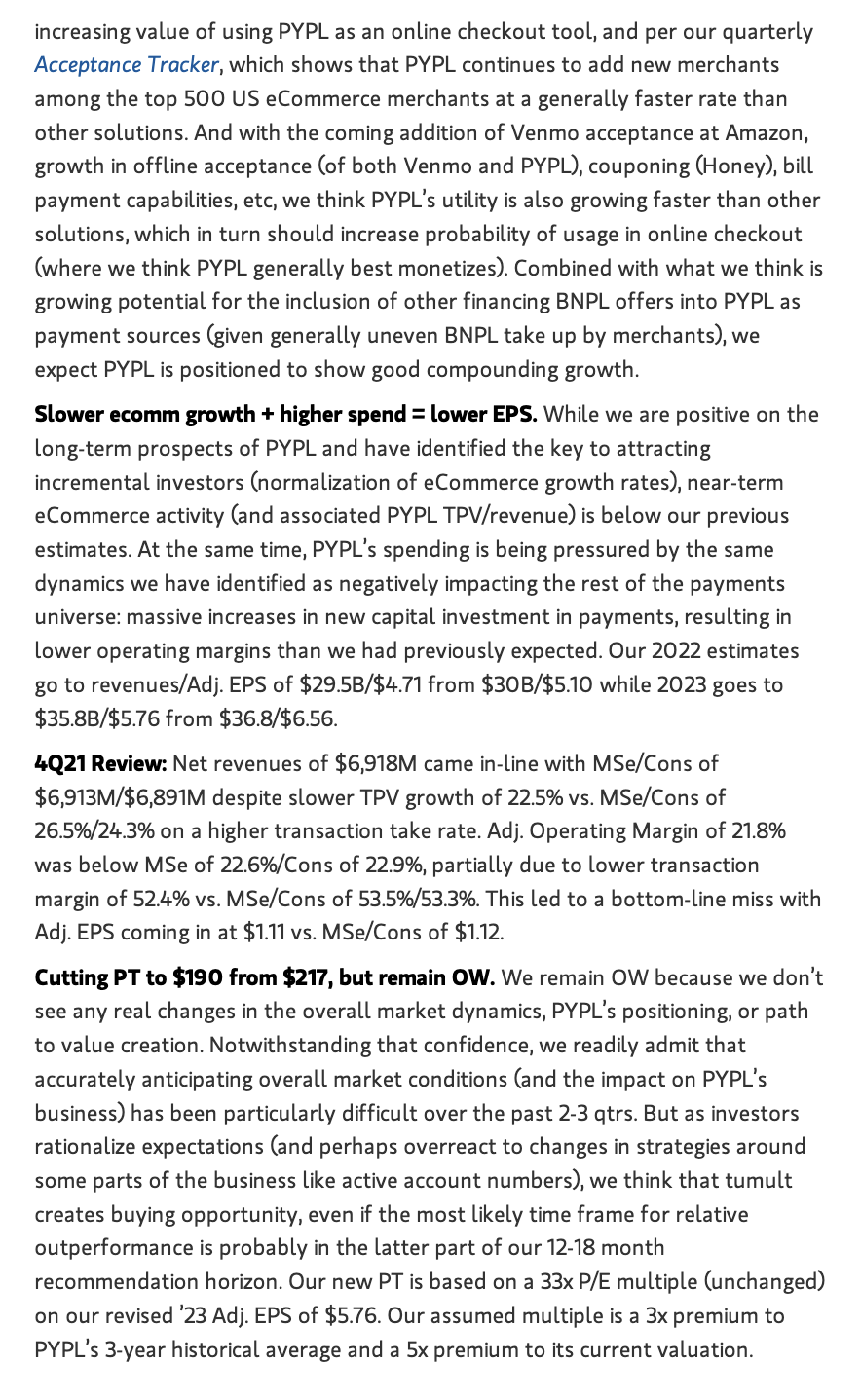

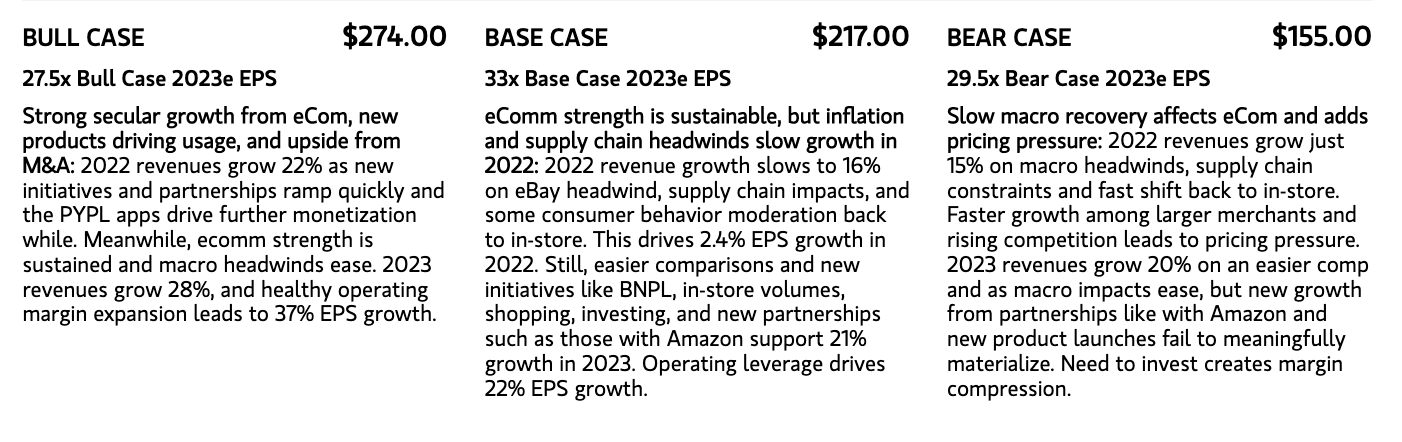

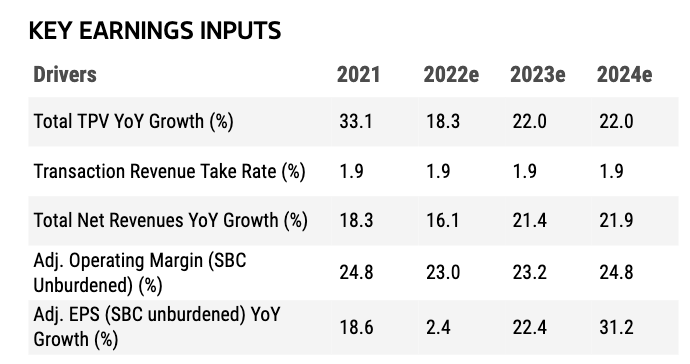

Earnings were reported last night and PYPL laid quite the stink bomb of a rotten egg. Growth for any business can be rocky at times but my issue currently is with PYPL management. I think they got very complacent with growth and really didn’t understand who their clients were and what makes them act on a regular basis. It’s clear right now that management does not have a ton of visibility in their business and their customer cohort is feeling the pinch of inflation pressure and has either chose different payment providers or is spending less. That’s what higher prices across every spending category does, it forces people to think about their spending choices. Unless your income is rising as fast or faster than inflation, you are spending more each month on a net basis. For a large part of the population who has very little in savings and lives paycheck to paycheck, some belt tightening is now starting. As a stock picker, my job is to invest in the brands that people love and that want/need to keep spending on their products/services. Right now, it’s not completely apparent that Paypal has a real and sustainable moat other than consumer laziness to change different vendors for their checkout wallets. Paypal needs to have a very competitive solution for the upper income consumer versus being tethered to the lower income and younger consumer who is sometimes more price sensitive. Management has been a horrendous capital allocator over the last 12 months and has spent almost $3.5B buying back stock at an average price of $220 with a stock quote today at $130. They are either horrendous investors and market timers or the have zero visibility on their business which scares me a bit if I’m being honest. The decision I am in the process of making is this: Is PayPal about as good a business as it will get and showing signs of secular decline OR is this a slowdown in their business that will ultimately recover as their customers feel less stressed about inflation pressures? If it’s the latter, the stock needs to go lower still. If it’s the former, the stock is a raging buy down here because when the stock was at $130 in early 2020 and late 2019, the quarterly revenues were roughly $5B vs $6.9B now, TPV then was $200B and its now $339B and the company had about $12B in cash then and has $16B now. Clearly they have benefitted from the last 2 years and the question is, will they keep those customers and have them transact more regularly and have more engagement with the brand. For now, that question is unclear. Its a smaller position currently and before I want to add to the position I need to have the answer to the question above. For now, I want to hold the stock and see if it stabilizes. The stock has traded a massive amount of volume today relative to “normal average daily volume” so anyone who is not committed is leaving all at once. This could take a few more days of selling but then we get to see whether there is any buying interest out there. TBC. Here’s a report from Morgan Stanley FWIW, they seem to believe this slowdown is temporary.

12/28/2021 Update

I love the company and its products and services and see the enormous global opportunity. The competition is fierce but the pie is big enough for many players to succeed. The stock, like Visa, and Mastercard has lagged badly and experienced a significant drawdown. The good news is, the stock is building a base while the management team aggressively buys back stock which reduces the share count at a time when their Ebay drag will diminish greatly. The business trends are solid, BNPL division is now bigger than industry peer Affirm and they are well positioned for a re-acceleration of growth into 2022. I think PYPL will be a top performer in the portfolio after a rest year in 2021. Analysts have reduced estimates and target prices significantly and because of tax-loss selling and a general loathing of most expensive growth stocks, the stock looks very attractive at current levels. Because Paypal re-set growth expectations in 2021, the shareholder base virtually turned over from high growth investors to GARP and CORE investors, a much larger group of money managers and much more stable shareholders. I expect the stock to rise at least 30% during sometime in 2022 and we have been adding under 200. Like MA/V, the stock is setting up for an EPS beat as share counts fall and business trends re-accelerate. I can’t wait to compare V/MA/PYPL next quarter to see who was most aggressive about buying back stock while the stock was weak. Paypal in particular has a good track record of being aggressive at buybacks during periods of weakness. I expect to see at least $240+ sometime in 2022. Venmo is just beginning to add value to the P&L and with the new Amazon check-out option using Venmo, I think this unit will be the source for upside surprise in 2022. As we end the year, the stock looks bombed out and building a nice base from which to build a better chart in 2022.