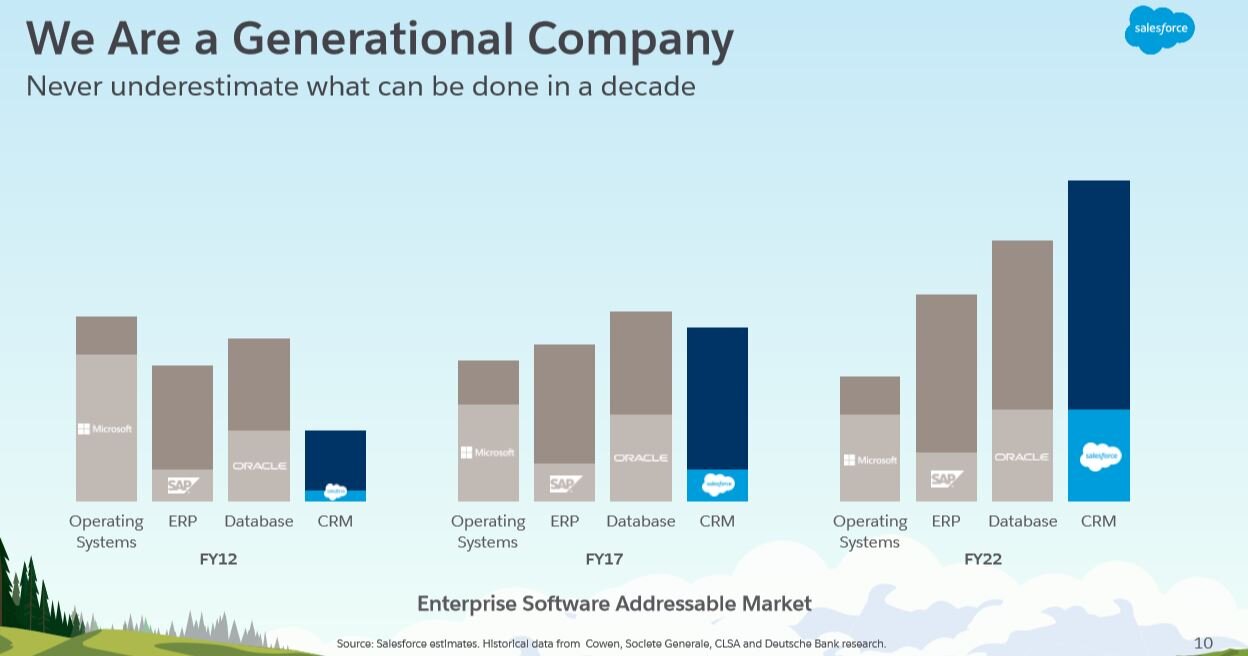

“From July 1, 2004 to November 4, 2019 Salesforce stock returned roughly 1352% versus the S&P 500 return of roughly 170%. That’s a powerful endorsement for CRM”

COMPANY PROFILE

Salesforce is the world's #1 customer relationship management (CRM) platform. Our cloud-based CRM applications for sales, service, marketing, and more don’t require IT experts to set up or manage – simply log in and start connecting to customers in a whole new way.

More than 150,000 companies use Salesforce CRM to grow their businesses by strengthening customer relationships. CRM helps companies understand their customers’ needs and solve problems by better managing customer information and interactions – all on a single platform that’s always accessible from any desktop or device.

Recent Earnings: Second quarter 2020

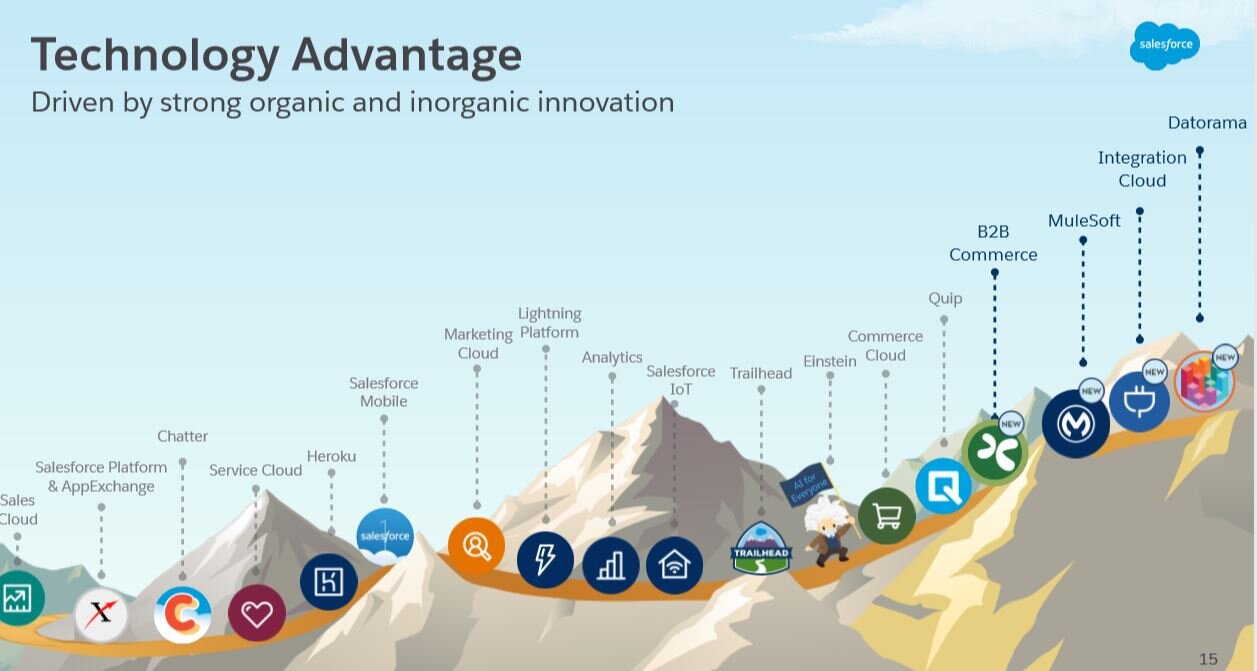

With our Customer 360 vision, Einstein AI and the millions of Trailblazers innovating on our platform, Salesforce has never been better positioned for the future.

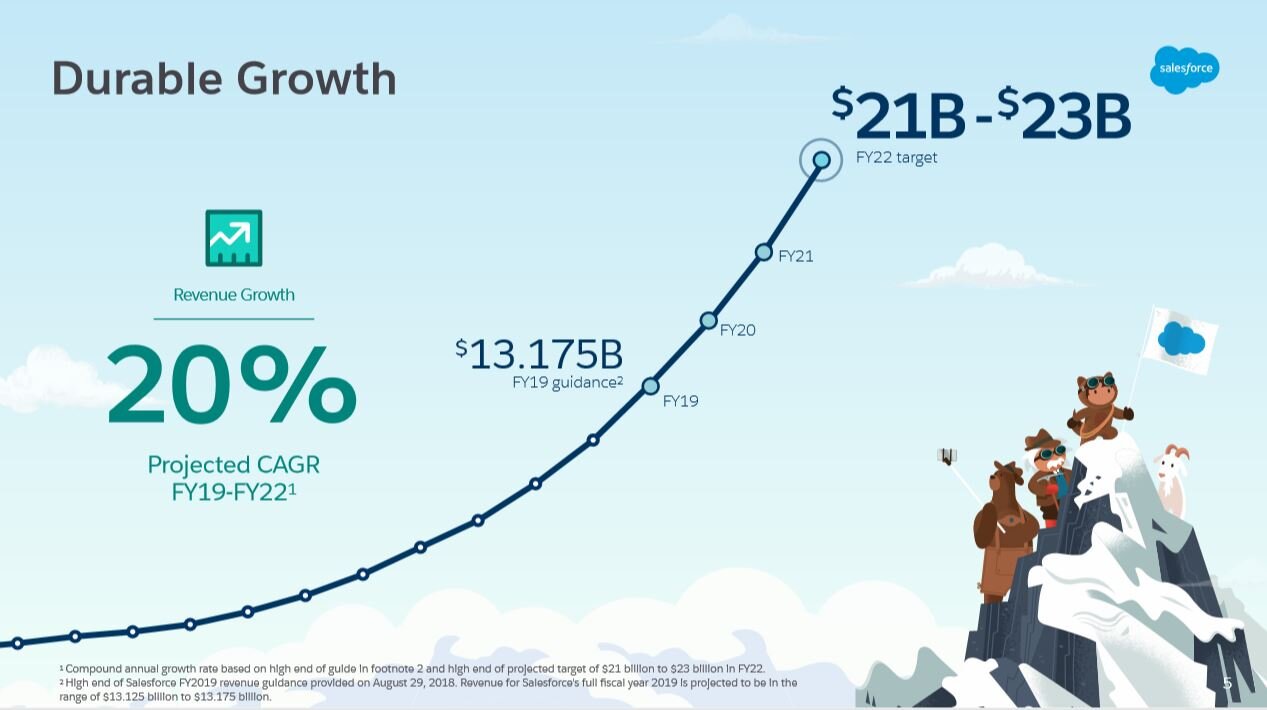

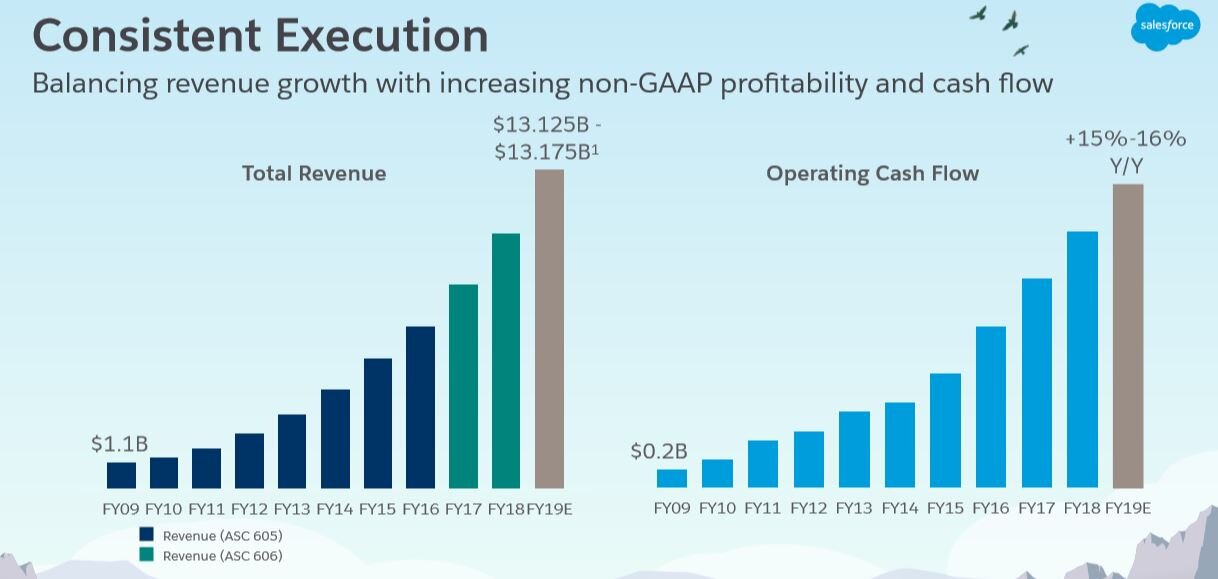

Raises FY20 Revenue Guidance to $16.75 Billion to $16.90 Billion.

Second Quarter Revenue of $4.0 Billion, up 22% Year-Over-Year, 23% in Constant Currency.

International revenue was 29% of total, lots more opportunity to expand here.

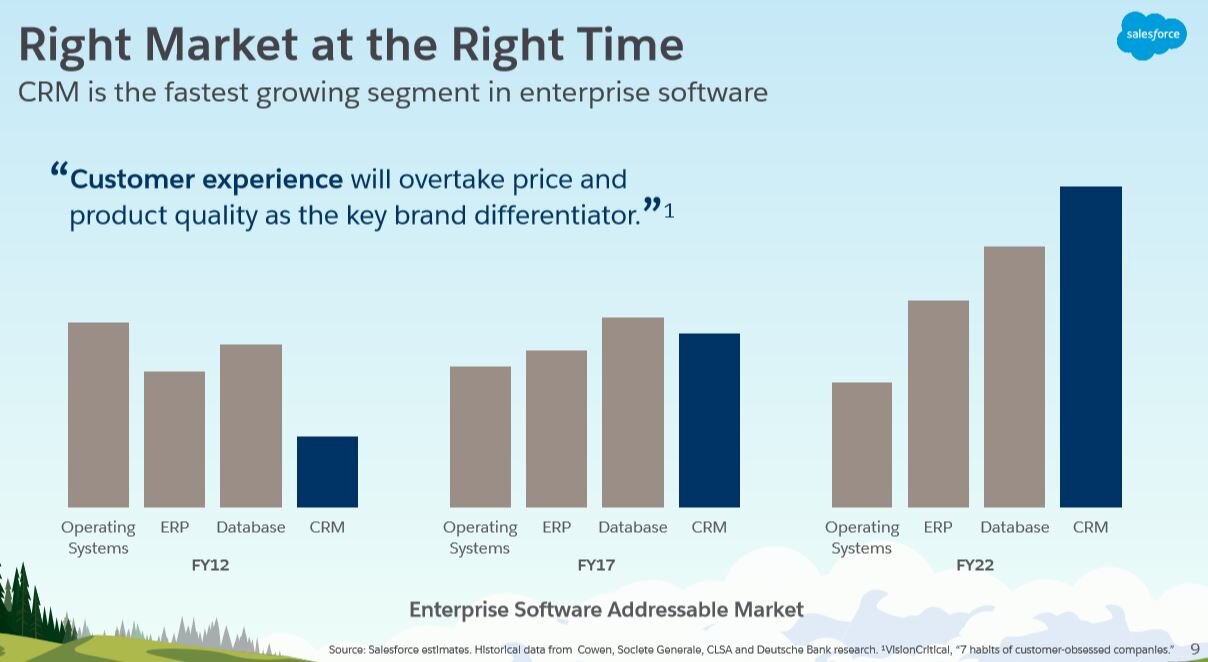

CRM is a recurring revenue machine >$10B currently - that deserves a higher multiple.

Current Remaining Performance Obligation of Approximately $12.1 Billion, up 23% Year-Over-Year.

Remaining Performance Obligation of Approximately $25.3 Billion, up 20% Year-Over-Year.

Initiates Q3 FY20 Revenue Guidance of $4.44 Billion to $4.45 Billion, up 31% Year-Over-Year.

Initiates Q3 FY20 Current Remaining Performance Obligation Guidance of 24% to 25% Year-Over-Year.

Operating cash flow of $458M +38% YOY.

Mulesoft added $122M to revenue and appears to offer significant future opportunities.

Cash generated from operations for the second quarter was $436 million, a decrease of 5% year-over-year. Total cash, cash equivalents and marketable securities ended the second quarter at $6.04 billion.

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where CRM scores well as of 11/4/19:

88% for 3YR sales growth

87% low debt to Enterprise value

90% high 1YR sales growth

92% high 1YR EPS growth

99% high R&D + SG&A versus total sales - A strong innovation factor

Factors that could significantly improve offering future strong profitability:

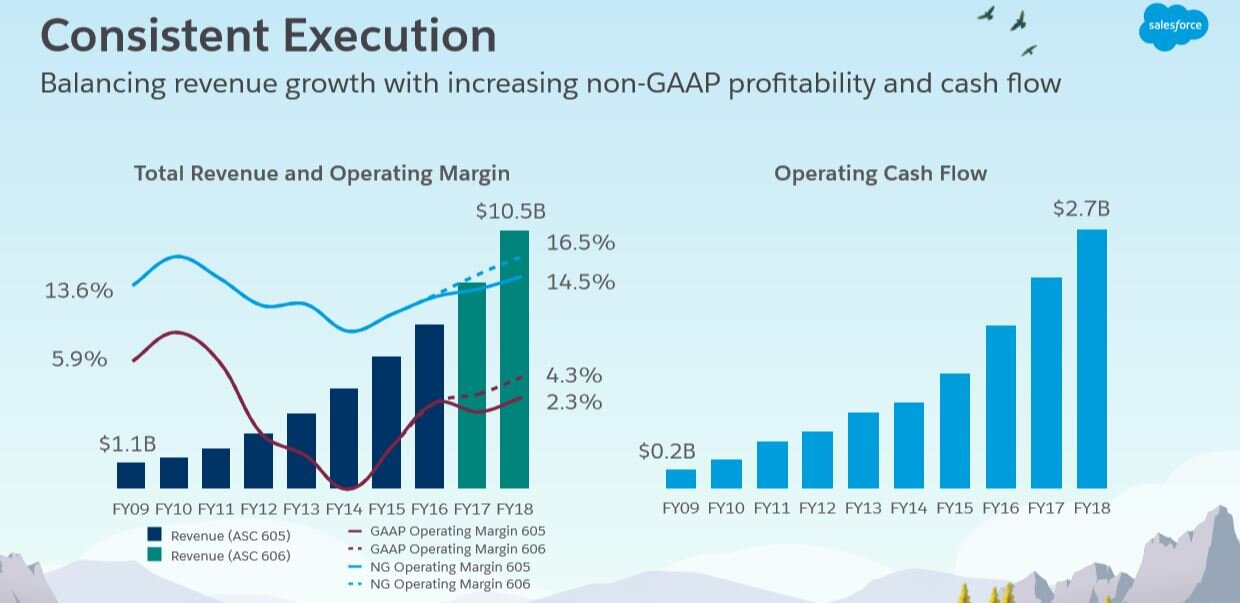

Operating margins

Return on Equity

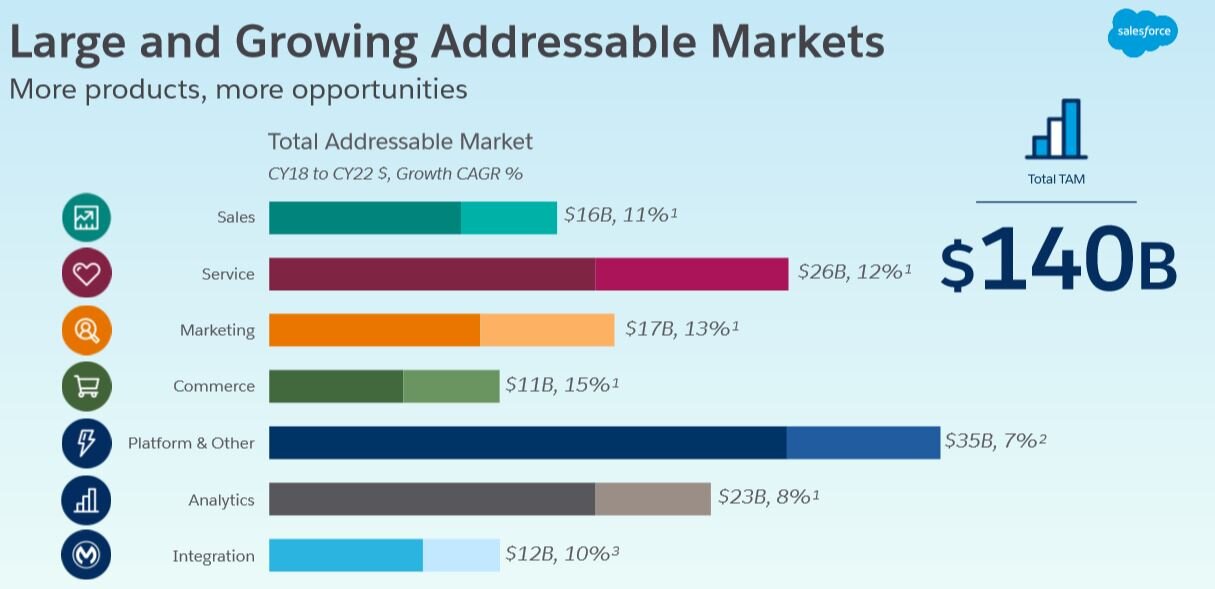

Salesforce has been a monster performer but seems to be consistently under-appreciated. The stock is uber expensive as all software stocks are today but they are delivering on goals and have shown a willingness to self-disrupt for future growth. They are a serial acquirer and their latest acquisition of Tableau Software brings together the world’s #1 CRM with the world’s #1 analytics platform. With a 26% YOY backlog growth, the business appears to be very healthy. Last quarter they raised revenue guidance despite the macro environment and FX headwinds. I suspect those will turn into tailwinds as the Fed goes more dovish and the USD peaks. Margins have room to expand further. If there’s an issue for me it’s the continued ramp in headcount but my bet is on managements ability to know when to dial it up and down according to the opportunities they see.

This company is run by a solid human being and a great leader who values doing good as much or more than doing well. That allows CRM to attract the best employees and it’s consistently been on the top places to work and most admired companies lists. CRM is playing in an addressable market that’s significant and only growing from here. Yes, all of these software and Cloud stocks are expensive and still beholden to the business cycle but with a solid management team, strong vision, culture of innovation and willingness to self-disrupt, enormous end market’s and multiple product revenue streams, many of which are recurring in nature, CRM is very well positioned for future revenue growth and market share gains.

Technically, the stock has still not reached the highs of October 2018 and has been volatile. It recently broke out of a downtrend, now testing that downtrend, and will be a solid, “add-on-dips” stock for the strategy. I like to start small and add on dips to build a bigger, more meaningful position. CRM has significant opportunities outside the U.S. so their growth ceiling is much higher than their arms can reach for now.