“From February 1, 2015 to September 9, 2019 Shake Shack stock returned roughly 124% versus the S&P 500 return of roughly 50%. When you resonate and keep innovating, customers keep coming.”

COMPANY PROFILE

Shake Shack is a modern day “roadside” burger stand known for its 100% all-natural Angus beef burgers, chicken sandwiches and flat-top Vienna beef dogs (no hormones or antibiotics - ever), spun-fresh frozen custard, crinkle cut fries, craft beer and wine and more. With its fresh, simple, high-quality food at a great value, Shake Shack is a fun and lively community gathering place with widespread appeal. Shake Shack’s mission is to Stand for Something Good®, from its premium ingredients and caring hiring practices to its inspiring designs and deep community investment. Since the original Shack opened in 2004 in NYC’s Madison Square Park, the company has expanded to more than 240 locations in 29 U.S. States and the District of Columbia, including more than 80 international locations including London, Hong Kong, Shanghai, Singapore, Philippines, Mexico, Istanbul, Dubai, Tokyo, Moscow, Seoul and more.

Recent Earnings

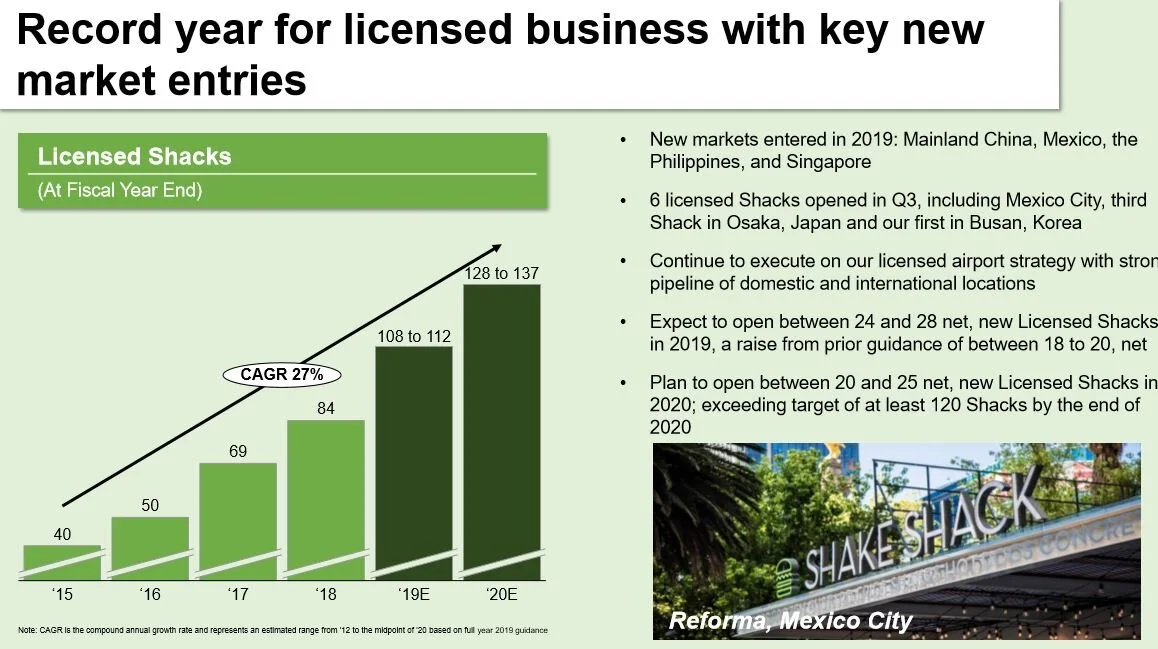

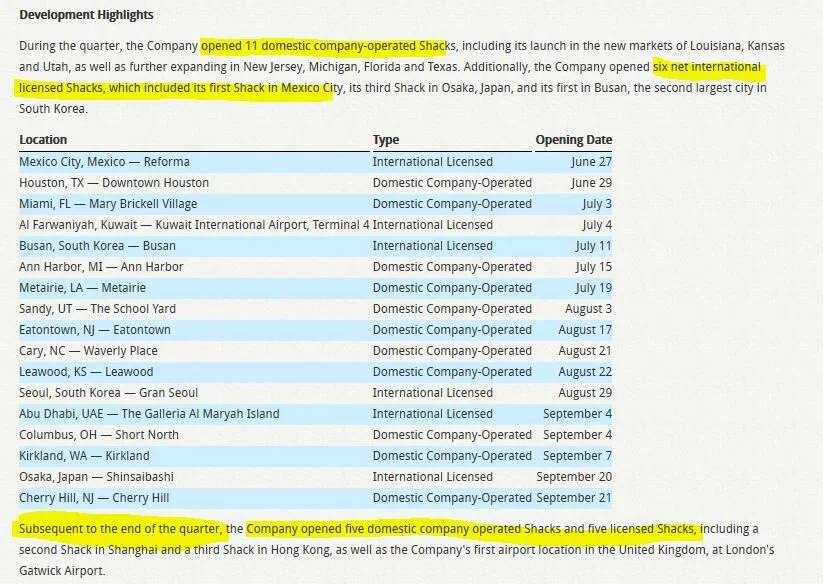

Based on our second quarter results, we are raising our overall revenue guidance including our licensing revenue guidance. It has been a tremendous year so far for our international business, having entered Mainland China for the first time in January, the Philippines and Singapore in the second quarter, and most recently Mexico, earlier in the third quarter. To further our international growth in Asia, we are also pleased to announce our expansion into Beijing through our newly executed development agreement with Maxim's Caterers. We’ve had an incredible start in Hong Kong over the past year, and combined with our first six months in Shanghai, we're bullish on the tremendous growth opportunity we believe exists for the Shake Shack brand in Mainland China. Overall, we have strong and positive momentum across the business heading into the second half of the year and continue to execute well against a robust domestic and international development pipeline, while also testing new Shack formats, and increasing accessibility and convenience through ongoing digital innovation.”

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where LULU scores well as of 9/17/19:

92% for 3YR sales growth

93% strong price momentum

79% low debt to enterprise value

90% 1YR sales growth

78% earnings surprise last quarter

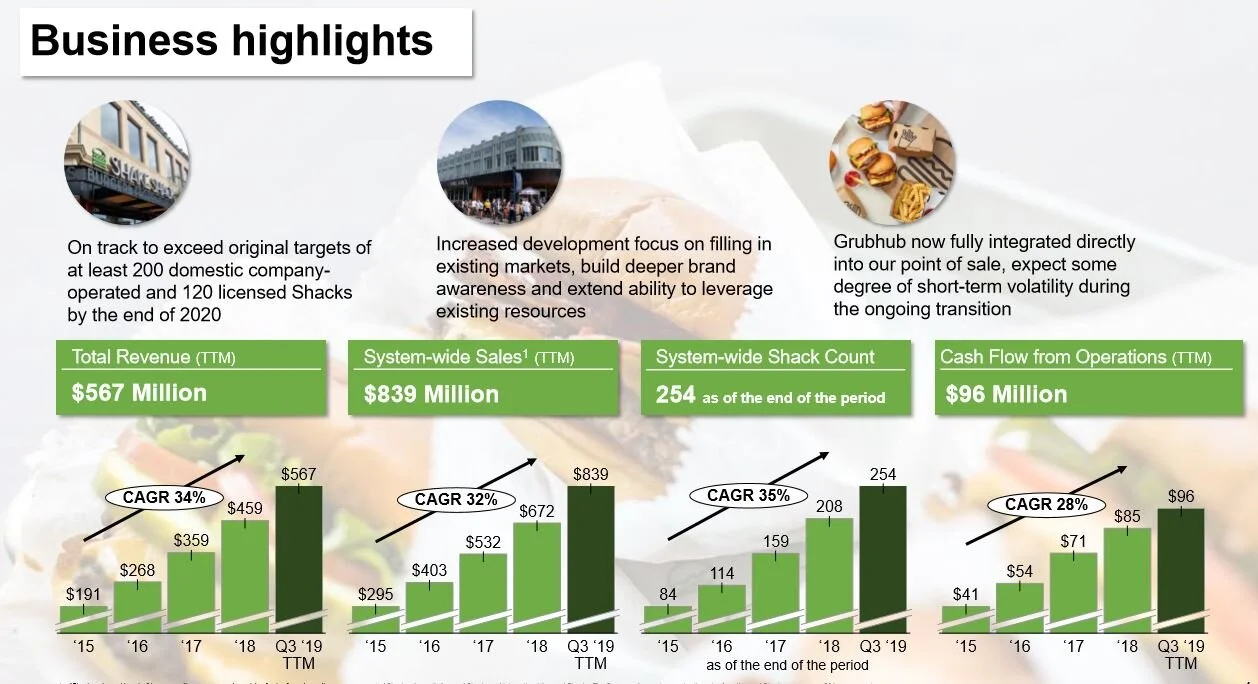

11/4/19 Earnings:

There is absolutely nothing wrong with demand for Shake Shack products. Quarterly sales will be lumpy as they roll out significantly new stores. The issue for the stock after-hours is margin erosion from higher input costs: labor, beef, chicken, paper costs plus an adjustment for new lease accounting. This will give the shorts some ammunition given how pricey the stock is but it in no way disturbs the future growth trajectory of revenues. Short interest is 19% so the stock can be subject to short term moves in both directions. Their standardizing on one delivery partner in GRUBHUB also likely will show some short-term volatility as they transition to one partner. Their decision to standardize on GRUB is based on consistency and offering the best possible guest experience and their research suggests its with GRUB. They get better data from GRUB for marketing. Long-term, they believe GRUB offers the best revenue potential versus other partners.

This company will get a handle on its food costs and will continue to use technology via app ordering and kiosks to get a hold on the labor costs that seem to have momentum around the country. The sales and new store growth metrics are strong and should stay strong. The brand still has very high brand relevancy scores from our research and the potential enhancement to the brand from new stores will only increase the brand appeal. The price points are very close to Chipotle’s and SHAK’s store growth potential is much higher than the company has reported thus far. I expect them to continue to raise store count potential keeping the street engaged in the bigger opportunity around the world. Based on the store growth, profitability of each store, high brand love and relevancy and utilizing innovation too enhance the customer experience and operating margin profile, I still believe SHAK is a $5B market cap brand in 3 years and if they see the big picture long-term picture, is a $10B fast casual brand. They are supremely focused on the customer experience, the high quality ingredients, and global brand recognition process. I’ll buy these dips when I see them and trade around the core holding.

Older comments:

The brand of Shake Shack has huge relevancy scores, which means it’s under-valued relative to its current market cap. In my opinion, SHAK is ultimately a $10B market cap restaurant brand masquerading as a $3.3B company today. Lets talk about cult followings. In-n-Out has one at the low end and Shake Shack has one at the high end. By high end I don’t mean the $25 burger at Ruth Chris, I mean a reasonable burger ($8) and fries in the fast casual space. Let’s call it inline with a burrito from Chipotle and personally, it’s not even close from a taste perspective. The fried chicken sandwich is even more delicious than the burger. Make no mistake, SHAK is early in its growth curve, they are just getting started where full-scale brand recognition is concerned. This stock is NOT cheap and it likely will not get cheap until its growth finally peaks and growth investors leave with a thud. An investment in SHAK is about the growth curve and we are only half way through that opportunity. Like every company, there will be speed-bumps along the way but until they stop innovating or resonating with consumers or allowing food quality to fall, this stock is on my “buy big dips” list.

I’m not sure most investors understand the strong economics of new stores so I’ll outline some details here.

The average mature store generates about $4.3m/year in revenues with 20%+ operating margins.

Most restaurant chains have unit economics of $1.5-2m/year, only Chick-fil-A has better store economics.

They serve beer and wine as a key differentiator to most fast food peers

From SHAK earnings deck Q3, stores earn 30% cash on cash returns are generated from year 2 and beyond, that’s incredibly strong for this industry.

SHAK intends to build ~35 new stores per year and will increase that pace over time.

SHAK is expected to double the store count to 400 stores over the next 6 years.

There’s always the potential M&A option given how niche and cult-like the customers are. There’s plenty of big restaurant chains that would love to add SHAK to their house of brands.