Third Point Sony Position Update, October 2019

COMPANY PROFILE

Gaming (software & hardware), Music (publisher & labels), Pictures (film & TV), Semiconductors, Consumer Tech (camera’s, TV, computer monitors, home entertainment, smartphones), and Financial Services business. Sony is focused on some very important consumption themes. Sony is a consumer electronics company, which has its roots dating back to 1946, when the company was founded as Tokyo Telecommunications Engineering.

Other operations include an advertising agency business located in Japan; Internet-related businesses; and a location-based entertainment business in Japan and the US.

Recent Earnings

Wow it’s hard to decipher financial information from a Japanese company! They do not make it easy and Sony’s business lines certainly could be streamlined better. As you can see from Dan Loebs note above, change comes slow in Japan, big corporate restructurings have rarely been a popular decision in that country. Perhaps that’s why their markets have been asleep for the better part of 30 years.

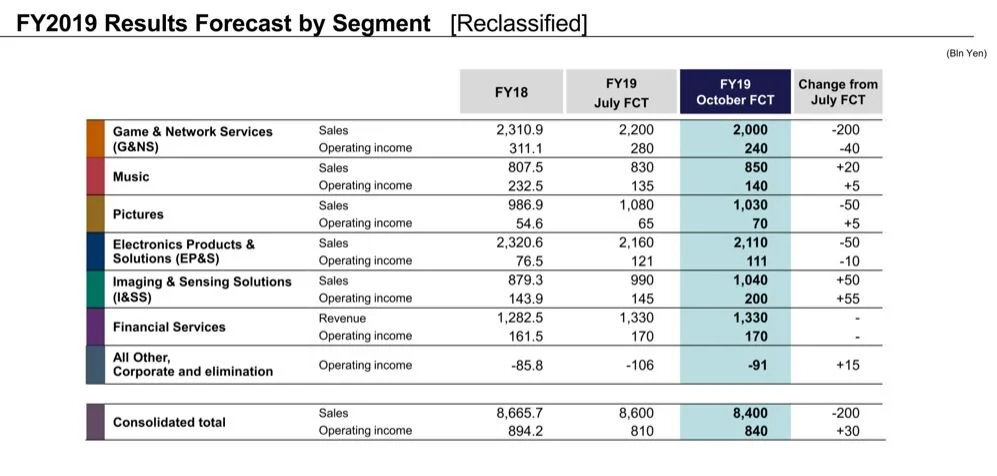

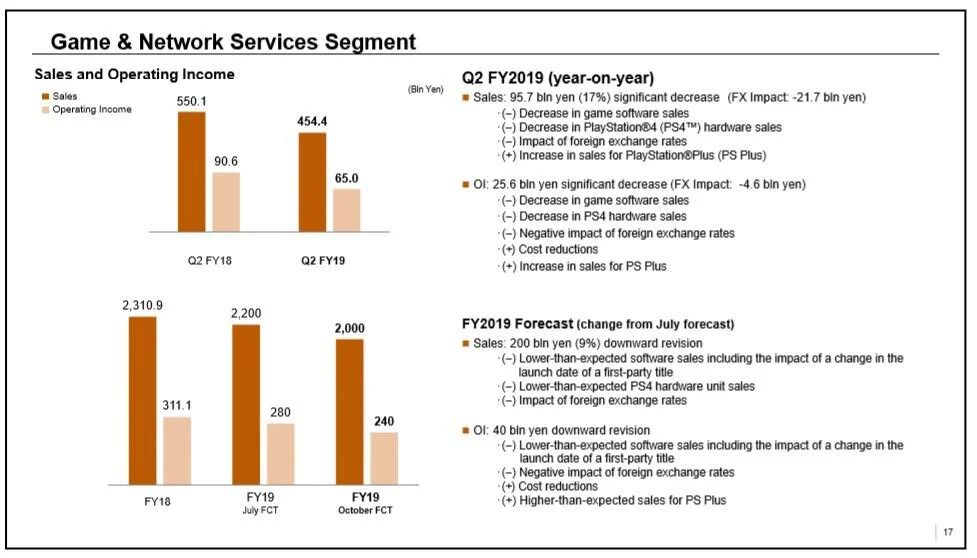

The Gaming division was the disappointment but they are also building for a major platform upgrade with PS5 next year so that’s to be expected. Gaming profits slid 28% to 90.6 billion yen as contributions from big gaming hits last year, such as “Marvel’s Spider-Man”, waned and sales for its mainstay PlayStation 4 console, now six years old, fell.

Sony also faces harsher competition as Google parent Alphabet Inc and Apple Inc have entered the market for game streaming services. To better compete with new rivals, Sony this month slashed its annual subscription fee for its PlayStation Now cloud gaming service by 40% to $59.99.

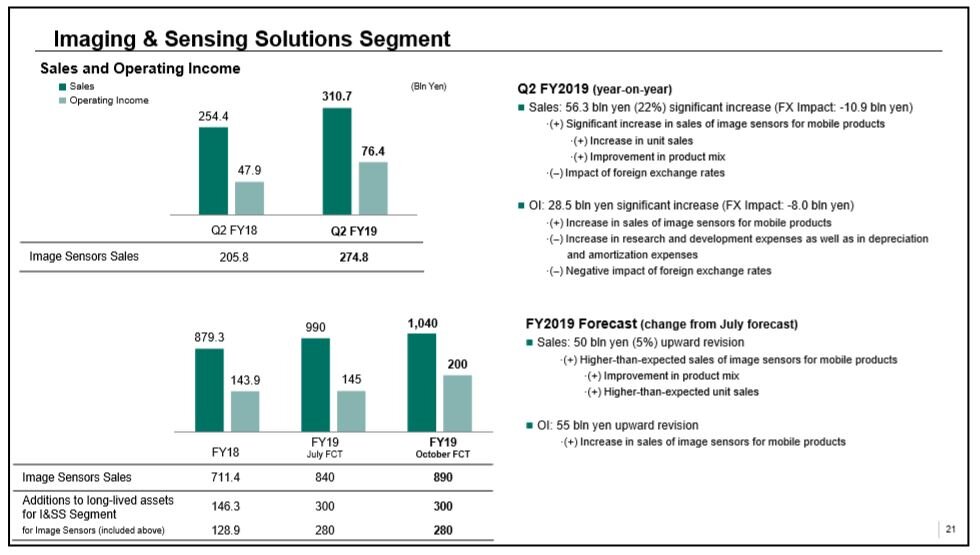

The Image & Sensing division is pulling the load currently. Demand for smartphone image sensors has grown as phone manufacturers introduce multiple-lens camera systems for high-end models - a key differentiator as improvements in other phone functions and features have slowed.

Apple, for instance, added a third lens to the iPhone 11 Pro model, matching the three-camera setup on flagship models for rivals like Samsung Electronics Co Ltd and Huawei.

They will continue to be strategic around share repurchases to enhance ROE and EPS but the priority going forward will be on strategic M&A. further strategic asset divestitures of investments (read through selling more Spotify stock) and heavy investment in organic R&D and cap-ex for future growth.

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Sony scores well as of 9/17/19:

82% 1YR sales growth

94% high FCF Yield - a solid value metric

80% strong price momentum

82% low price/sales

80% high absolute free cash flow

85% high margin expansion

93% high cash balance to total market cap

10/30/19 Update:

The company will be stubborn around major restructuring so this turn-around could take longer than expected. The company is asset-rich and cheap so it should have some support but major upside might take some time. For now I’ll be patient and collect a nice dividend but it will be a source of funds if I see better near-term opportunities given it’s a fairly chunky position for us.

Older comments:

Sony is one of the most recognized brands around the world. For years the stock went nowhere and traded in a range but under the hood there’s been significant innovation and a change in the corporate culture. A change towards innovation and a willingness to make hard decisions for the benefit of the company and its future. Sony is a deeply undervalued stock with roughly $78 billion in sales and a $74 billion market cap. That’s the kind of ratio I really love in a world where there’s some significantly expensive and likely overvalued stocks. IMO the stock should double from current levels over time so there’s a strong margin of safety embedded in the current stock price.

Gaming

PlayStation is the crown jewel. It’s the most recognized and largest gaming console by market share in the world. As the console world slightly shifts to streaming, Sony will also thrive with its PlayStation subscription service. In the meantime, the shift to cloud-focused gaming will see slow adoption rates and the real hockey-stick growth should occur once 5G technology goes mainstream. Gaming online is not like internet search, there are significant latency issues currently and the games are now super complex and speed is important for success in gaming. Eventually, the shift away from hardware manufacturing costs should provide a nice boost over time. The margins are in the software development and gaming developers love the Sony platform given its size and scale. Innovation is key but Sony has a strong track record along with Nintendo. PlayStation 5 will be launched next year in November and historically the stock performs well as interest and buzz begins to form. This will be a significant technology refresh so the company has high hopes for this launch. Shareholders should do well as we get closer to that eventuality.

Music

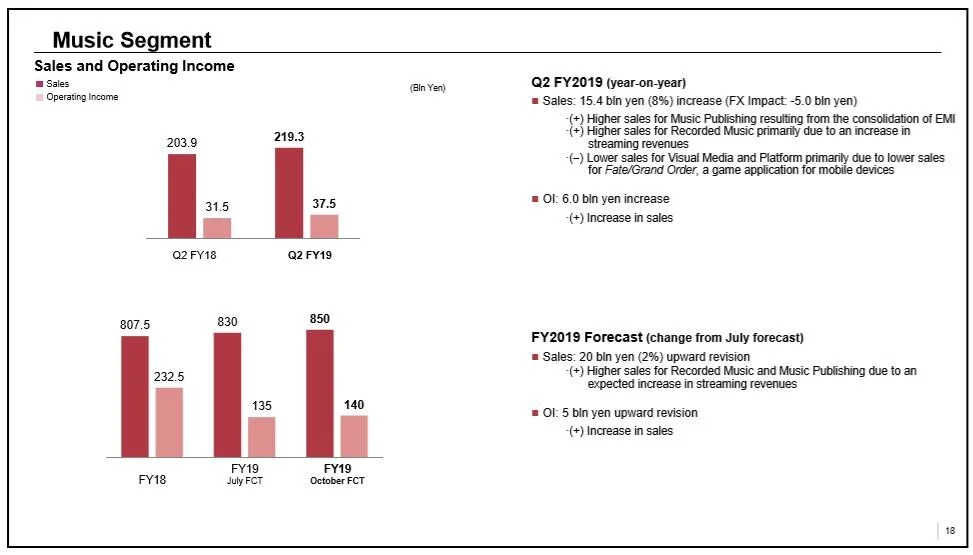

I’m a massive Spotify loyalist and that stock has struggled because of issues working with the music labels. Sony Music sits at #2 from a market share perspective and they have a lot of power over pricing and licensing deals. Sony is also the largest music publisher with a solid, 1-2 punch in music. That is a significant economic moat inside a very important media consumption category. Sony is a large shareholder of Spotify so I suspect they will at some point be divesting that stake which is one of the catalysts for SNE stock. For now, it’s a hidden call option on the future of the music business which appears quite bright.

semiconductors

This is a very important, capital intensive business. They produce everything from smartphones to displays and this business has a strong economic moat in the industry. This business likely deserves to be a stand-alone company which is part of the divest-and-conquer strategy for the stock. Spinning out this business will allow Sony to focus on more profitable business lines with a more asset-light approach.

investments

Spotify - For my comments on Spotify, here’s the link: Spotify

Sony currently owns roughly 3% of SPOT stock. I do not have access to their cost basis but it’s likely to be a spectacular gain sitting on their balance sheet. I suspect the ultimate plan is to divest this stake and reinvest the cash into core operations but they have not stated publicly what their plan is. For now, the SPOT investment is an asset that has value in a variety of ways.

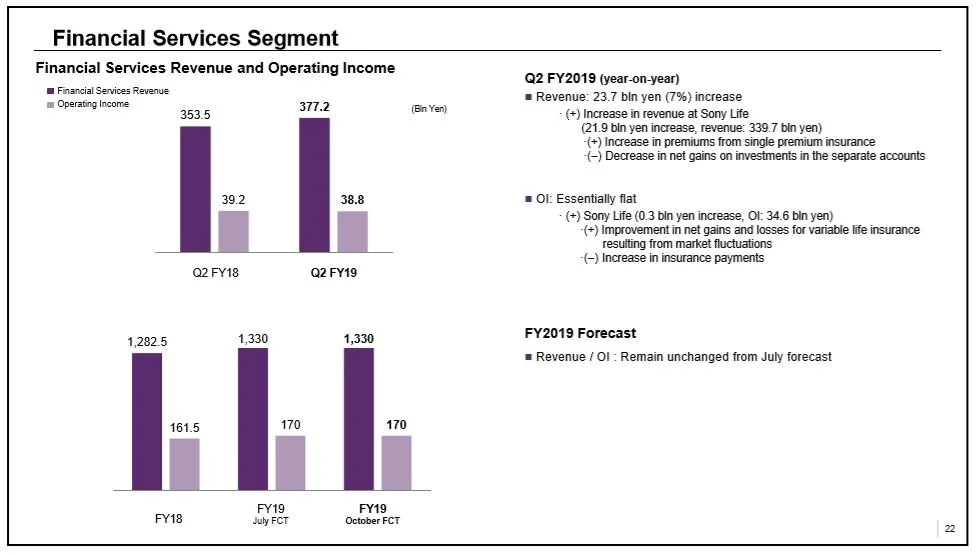

2. Sony Financial

This is another non-core asset for Sony that has divestiture value. The business is primarily life insurance focused but has a small piece of traditional finance businesses.

Bottom line

Sony’s brand is significantly more relevant than the stock price over the last 20 years would indicate. That’s either a value trap or a significant opportunity. The answer to this question lies with the management team and their interest in changing the culture. There appears to be lots of evidence that the culture is changing and innovation is increasing. Sony stock has been trading at a discount because years of mis-management and having a “bolt-on” mentality. This company could and should be a well oiled machine dedicated to some significant business lines. In order to finance the innovation, significant divestitures need to happen. That’s the bet I’m making with this stock ownership. If I see diminishing evidence that management does not intend to stay laser focused and divest non-core businesses, the thesis will no longer be valid and the stock will be sold.

There are clear catalysts going forward:

PlayStation 5 next year is a major catalyst with a significant technology re-fresh.

Tech upgrades in smartphones, particularly surrounding 5G - given Sony’s high market share in the category, they should benefit greatly from continued re-fresh cycles.

Divesting non-core assets and using the cash for cap-ex innovation and immediate share buybacks.

Technical evidence of imminent break-out from long term stagnation.