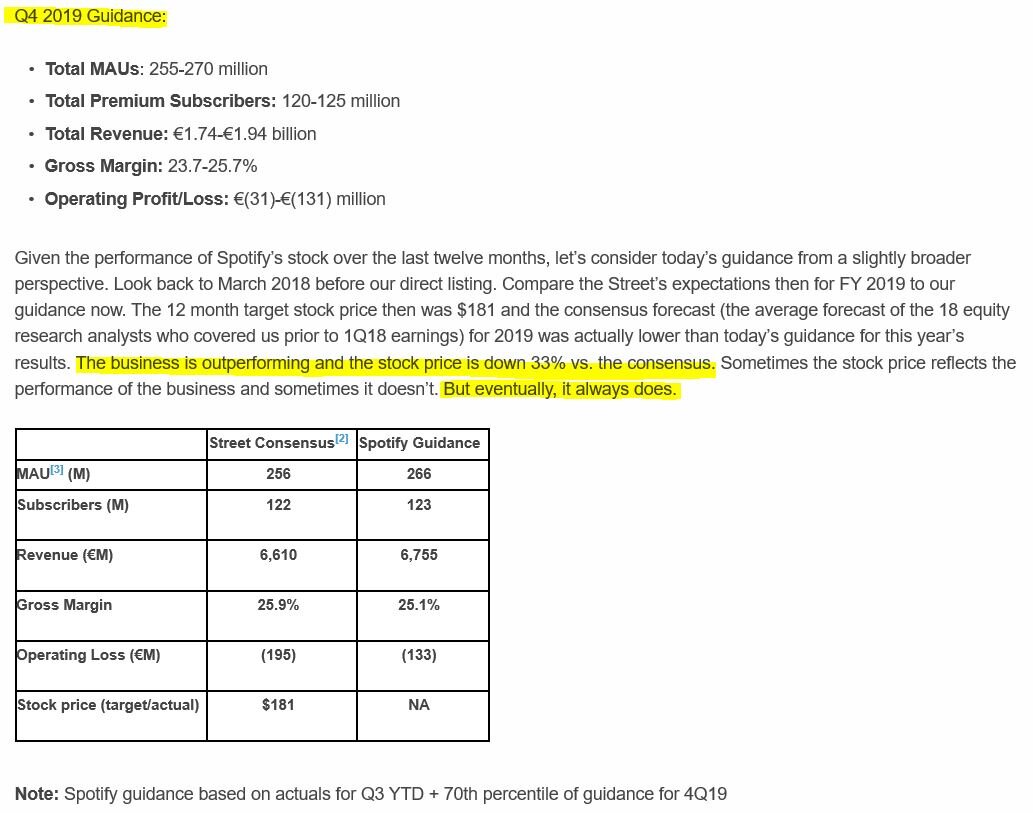

“Since April 1, 2018 when Spotify offered stock direct to the public, the stock has been volatile but has been a serial under-performer while they built their user base. The stock has returned roughly 1% versus the S&P 500 return of roughly 12%. First you build a platform and drive subscribers, then you get to monetize those subscribers in a recurring revenue machine. I’ll be patient on this one.”

COMPANY PROFILE

Spotify transformed music listening forever when we launched in 2008. Our mission is to unlock the potential of human creativity by giving a million creative artists the opportunity to live off their art and billions of fans the opportunity to enjoy and be inspired by these creators. Everything we do is driven by our love for music.

Discover, manage, and share over 50 million tracks for free, or upgrade to Spotify Premium to access exclusive features including offline mode, improved sound quality, Spotify Connect and ad-free listening.

Today, we are the world’s most popular audio streaming subscription service with a community of more than 232 million users, including 108 million Spotify Premium subscribers, across 79 markets.

For more information, images, or to contact the press team, please head over to our press page at https://newsroom.spotify.com/.

Recent Earnings - Great interview with cfo on 10/28/19 earnings beat

Total revenue of €1,731 million grew 28% Y/Y in Q3

Premium revenue was €1,561 million, up 29% Y/Y, while Ad-Supported revenue was €170 million, up 20% Y/Y.

Approximately 75% of the impact to ARPU is attributable to product mix changes, and the remainder a function of changes in geographic mix and other factors.

Ad-Supported business, revenue growth of 20% Y/Y underperformed our expectations in Q3. Roughly 80% of the miss was related to self-inflicted implementation and integration issues we experienced with the rollout of a new order management software to replace Google’s Doubleclick Sales Manager which was sunset in July.

Podcasting revenue outperformed expectations with strong Y/Y growth but is still a relatively small slice of the total Ad-Supported business at less than 10% of total ad revenues.

Gross Margin was 25.5% in Q3, 30 bps above the high end of our guidance of 23.2-25.2%

Operating expenses increased significantly less than the pace of revenue growth.

We generated €71 million in net cash flows from operating activities and €48 million in Free Cash Flow in Q3

November 5, 2018, Spotify announced a program to repurchase up to $1.0 billion of its publicly traded shares. During Q3, the Company repurchased 1,130,675 shares at a total cost of $142.1 million and an average cost of $125.68 per share. Through September 30, the Company has repurchased 4,210,251 shares at a total cost of $554.5 million and an average cost of $131.71

Accelerating MAU growth, and better than expected (1) Subscriber growth, (2) Gross Margins, and (3) Operating Profit

8th consecutive quarter, free cash flow was positive

Continue to see exponential growth in podcast hours streamed (up approximately 39% Q/Q)

Podcast engagement is driving a virtuous cycle of increased overall engagement and significantly increased conversion of free to paid users

Total MAUs grew 30% Y/Y to 248 million, outperforming the high end of our guidance.

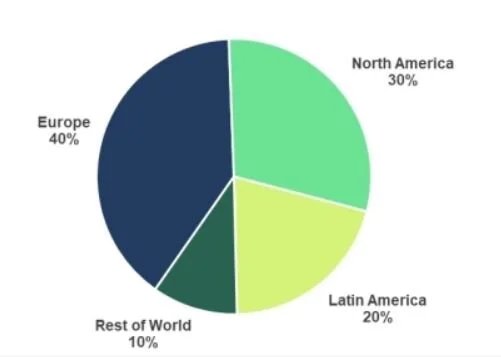

Developing regions continue to be a significant driver of this outperformance

Southeast Asia remains our fastest growing region (excluding India), and Y/Y growth in Q3 accelerated 1400 bps vs. 3Q18.

India outperformed our forecast by 30% this quarter. This momentum was driven by a number of factors including the launch of our first broad-based marketing campaign, “Sunte Ja” (“Listen On”)

Better onboarding experience leads to increased engagement, which leads to better retention, conversion, satisfaction, and ultimately, lifetime value

113 million Premium Subscribers globally, up 31% Y/Y - strong performance in both Family Plan and Student Plan

Churn improved 19 bps Y/Y and 7 bps sequentially.

Public data shows Spotify is adding twice as many subscribers per month as Apple music

We believe that our monthly engagement is roughly 2x as high and our churn is at half the rate

Our estimates imply that we continue to add more users on an absolute basis than Amazon

Amazon’s user base skews significantly more to ‘Ad-Supported’ than ‘Premium

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where Spotify scores well as of 9/17/19:

95% 3YR sales growth

97% margin expansion

81% high free cash flow growth

92% low debt to enterprise value

91% high 1YR sales growth

84% high 1YR EPS growth

10/28/19 Update post-earnings:

There’ so much leverage in this business at scale. Clearly, there’s some short-term thinkers short the stock today as it rips +17% as I type on a great earnings report. Investors and traders get too narrow in their scope sometimes, widen the lens and connect the dots and you will see a stock that’s super cheap relative to its long-term opportunity set. Spotify is the undisputed, most popular music streaming service for global consumers who love music. It’s now becoming THE most important hub for compelling and diverse podcast content. They have made some significant acquisitions in this area that will allow a significant amount of content to be consumed and this content comes at a higher margin given they own most of it or have better terms than in music. They have not mentioned their intent but you better believe they understand the next big growth driver could be from adding a streaming on-demand video option for their original content made to video’s to compete with all other content providers. That makes them a wonderful acquisition at some point and it also makes the stock cheap relative to future potential. They will not do this alone, if they do it at all, they will likely take a partner and strike a meaningful LT JV. That announcement alone is worth another 15%+ to the stock price. Time will tell, it’s just me connecting the dots.

Bottom line:

They are executing very well, certainly much better than the 1YR stock price would indicate and that realization is making the stock re-rate in 1 day. Operating margins are super low so we should expect them to climb over time, there’s wicked leverage in that metric in my opinion. This flywheel is getting more robust every day and these add-on’s offer new and significant revenue opportunities. What happens when/if they decide to create a deeper relationship with new and emerging artists and become a record label themselves? The labels can make threats all they want but eventually the tail gets bigger than the dog and the dog is left begging for the tail to stay connected. That’s where I believe we are headed from the labels/Spotify/artists perspective.

Original comments February 2018:

Spotify is the best music streaming platform on the planet. Period. The brand has wicked strong brand love and lots of pricing power over time as it beefs up its non-music business lines. The stock has been an under-performer of late but I do not expect that to continue much longer, the fundamentals and industry trends always matter most. The short-term problem is the music industries rules and regulations keeping margins lower than where they should be as well as Apples powerful network effect that smells a lot like a monopoly. So much so, Spotify has already sued Apple for making it really difficult for iOS users to gain access to the SPOT app. But make no mistake, look on your cell phone home screen, which apps occupy the most valuable real estate on the home page? Spotify is one of the most frequented apps for me. I love my music and love the simple interface built by Spotify. Not to mention they have the smartest, AI engine in the industry and keep the music I love in front of me so my playlists keep growing. I love subscription-based models as well, especially those with pricing power. Spotify absolutely has pricing power and is a key leader in the music and now podcasting categories with their pending acquisitions of podcast leaders: Gimlet Media and Anchor. In my opinion, SPOT has plenty of room to grow into the valuation it currently has. They did a smart equity swap with Ten-Cent Music, the #1 streaming music provider in China as well so they benefit from China and ex-china music streaming growth. SPOT also is now available in India and that market offers significant room for growth. Spotify is running fast to become the leading streaming company focused on podcast audio. They are committed to making original programming with higher margins and will figure out the monetization. If the government ever sacks-up and deals with Apples monopoly there’s a massive re-rating UP for Spotify. I have no idea what Spotifys plans are but they could easily take their original content providers and do JV’s with other content providers and use their platform for original content SVOD (streaming video on demand) distribution. For now, the stock has been a disappointment but when a business builds an important and superior platform in a highly important category for consumers, the profits will come. If they stop executing I’ll be out, eventually the superior business model and brand will assert itself. I’ll add to this stock on further dips.