“From June 2007 to March 29, 2022 T-Mobile has significantly underperformed the S&P 500 308% versus 161% for TMUS. We think TMUS is about to close the gap and outperform the market.”

COMPANY PROFILE

T-Mobile US, Inc. (NASDAQ: TMUS) is America’s supercharged Un-carrier, delivering an advanced 4G LTE and transformative nationwide 5G network that will offer reliable connectivity for all. T-Mobile’s customers benefit from its unmatched combination of value and quality, unwavering obsession with offering them the best possible service experience and undisputable drive for disruption that creates competition and innovation in wireless and beyond. Based in Bellevue, Wash., T-Mobile provides services through its subsidiaries and operates its flagship brands, T-Mobile, Metro by T-Mobile and Sprint.

Style Factor Benefits

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where T-Mobile scores well as of 3/30/22:

73% high 3 year sales growth

97% high free cash flow growth

77% high absolute free cash flow

91% positive change in momentum vs long term momentum score

76% low price to sales

80% low volatility requity

89% low downside beta profile

84% high absolute sales

99% EPS surprise recent quarter

98% positive ROE profile

84% strong sales surprise recent quarter

Opinion

Our investment in TMUS is a view on our current cautious view of the economy and the interest in a defensive equity. We prefer business models that tend to be defensive in difficult economic times but that have solid growth opportunities and potentially robust positive catalysts ahead. TMUS fits this narrative, witness the style factor rankings above.

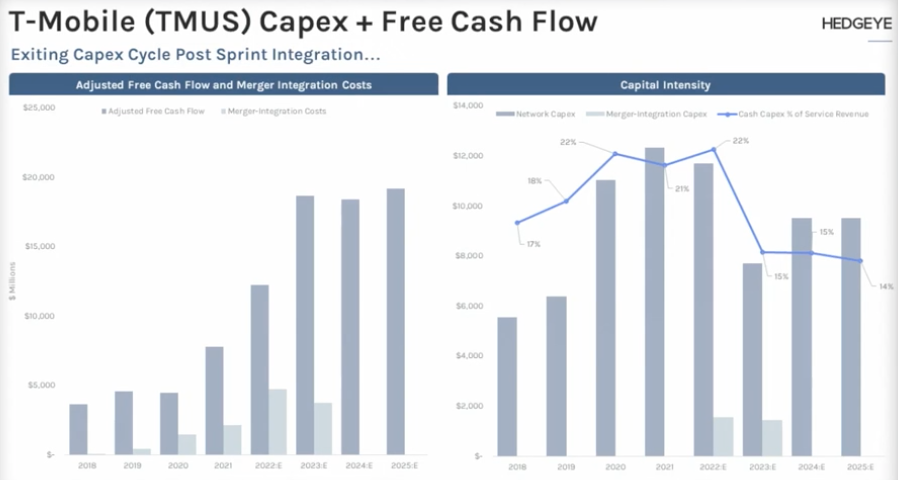

Here’s the thesis: Defensive business model in telecom and internet 5G rollout. The grower in the industry. Winding down their big capital deployment cycle so more profitability is on the way. Fixed wireless & home internet roll-out has been strong and will be rolled out further across the country. Sprint churn likely has peaked and conversion of those customers is well under way. Big potential catalyst: potential for major share repurchases as capital deployment peaks and rolls over. By some analyst expectations, could buyback up to $60B of the float which is 38% of market cap and ~79% of the float. Deutsche Telekom owns ~79% of the float so they would sell stock into this buyback and Softbank owns ~5% of float and would do the same. Adjusted free cash flow is set to accelerate meaningfully from here to drive the buyback catalyst while Sprint merger integration costs fall to zero by next year. That's a potent combination and opportunity imo. Network cap-ex peaks this year and cash capex as a % of service revenues should fall by 30%+ over the next few years freeing up alot of FCF. Robust emerging free cash flow while buying back stock aggressively drives the FCF yield incredibly high over the next 3 years making the stock much cheaper than it looks. At $128/share today, the stock has a projected target between $170-200 while still having very defensive characteristics. And they have pricing power and continue to make a compelling case for switching away from AT&T and Verizon to TMUS plus the home internet opportunity just beginning. Alot to like about this stable business and the growth opportunities they have.