“From January 2009 until September 5, 2019, Tencent stock has returns roughly 3273% versus 229% for the S&P 500. ”

COMPANY PROFILE

Here’s something from TenCent management that speaks volumes about their future long-term goals: “Our decade-long investment in payments and cloud services illustrates how our strategy of allocating capital to a range of pre-revenue and investment-stage activities ultimately broadens our revenue streams and generates sustainable profit growth over the long term, from communications services to games, advertising, digital content services and now FinTech and Business Services. We continue to invest in emerging services and activities as, we believe, technology continues to provide new consumer and enterprise opportunities.”

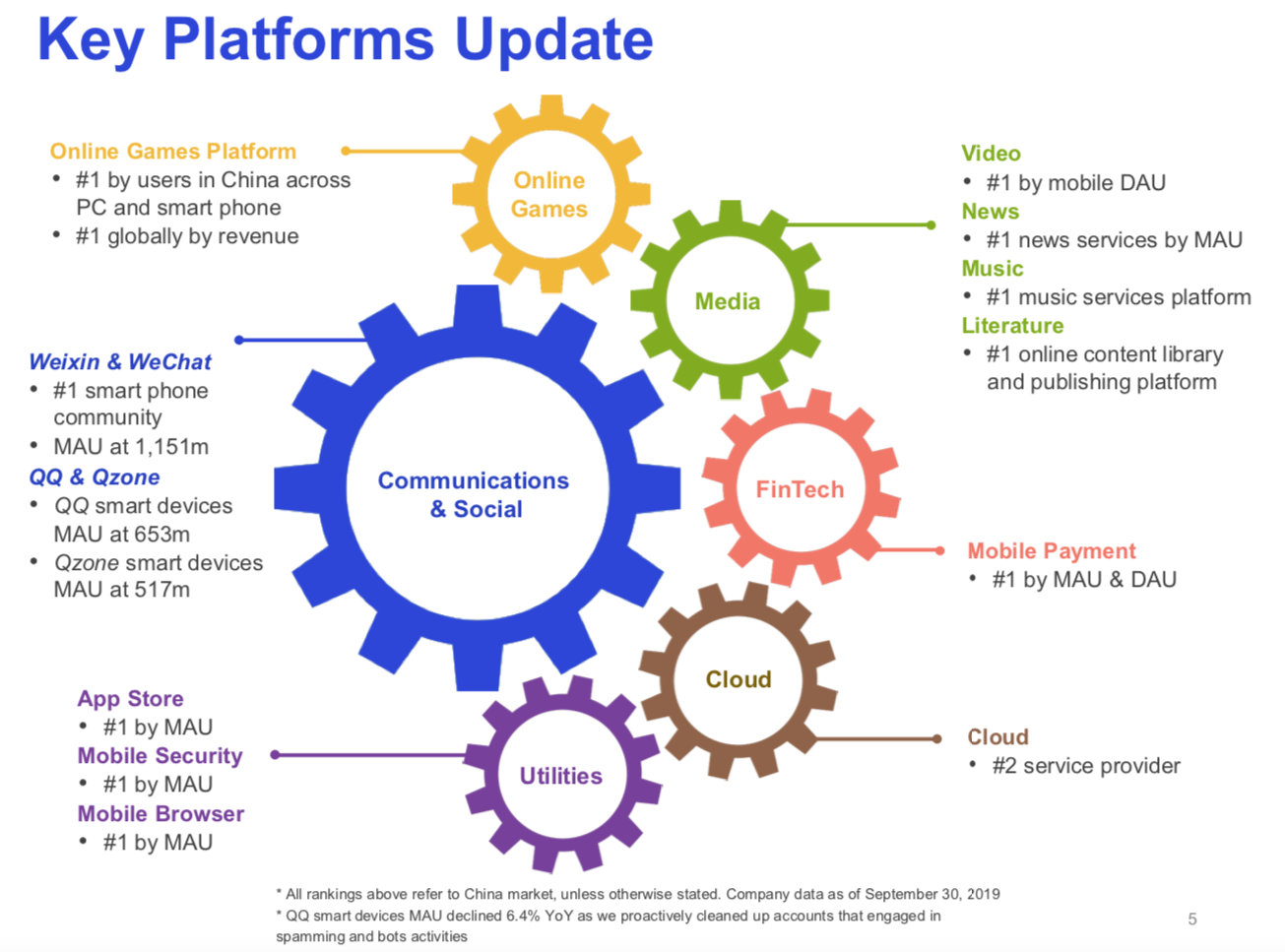

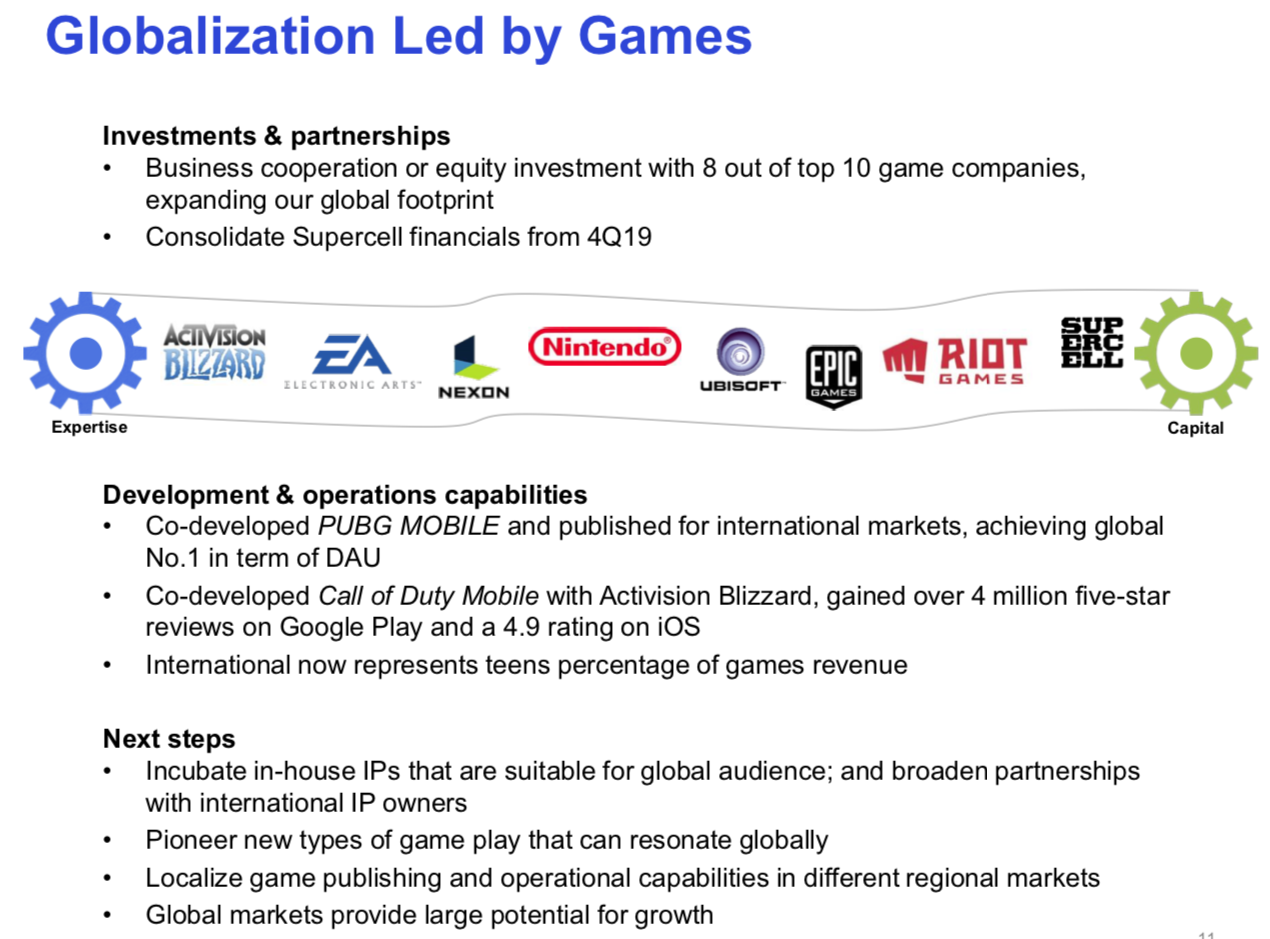

China’s middle class is growing by leaps and bounds. The country now has the third largest household consumption rate valued at an estimated $4.4 trillion in yearly consumption capacity. Moreover, Asia has 4 billion consumers. That’s a huge business opportunity for consumer-focused brands. As millions and millions of consumers reach middle-class status, their consumption will rise and their loyalty to their favorite brands will gather momentum. Tencent, is not a household brand in the U.S. but it certainly is in China and across Asia. Ten-Cent is headquartered in Shenzhen, China. Essentially, an investment in Tencent is like buying stakes in Facebook, WhatsApp, Amazon, AWS, PayPal, Netflix, Google for Ads, Spotify for music, Riot Games(League of Legends), Slack for collaboration and Nintendo, all in a single platform business. They own stakes in American video game maker Activision (5% stake) and EV car manufacturer Tesla (5% stake). They also own 40% of Epic Games which is the owner of Fortnite, an enormous video gaming phenomenon.

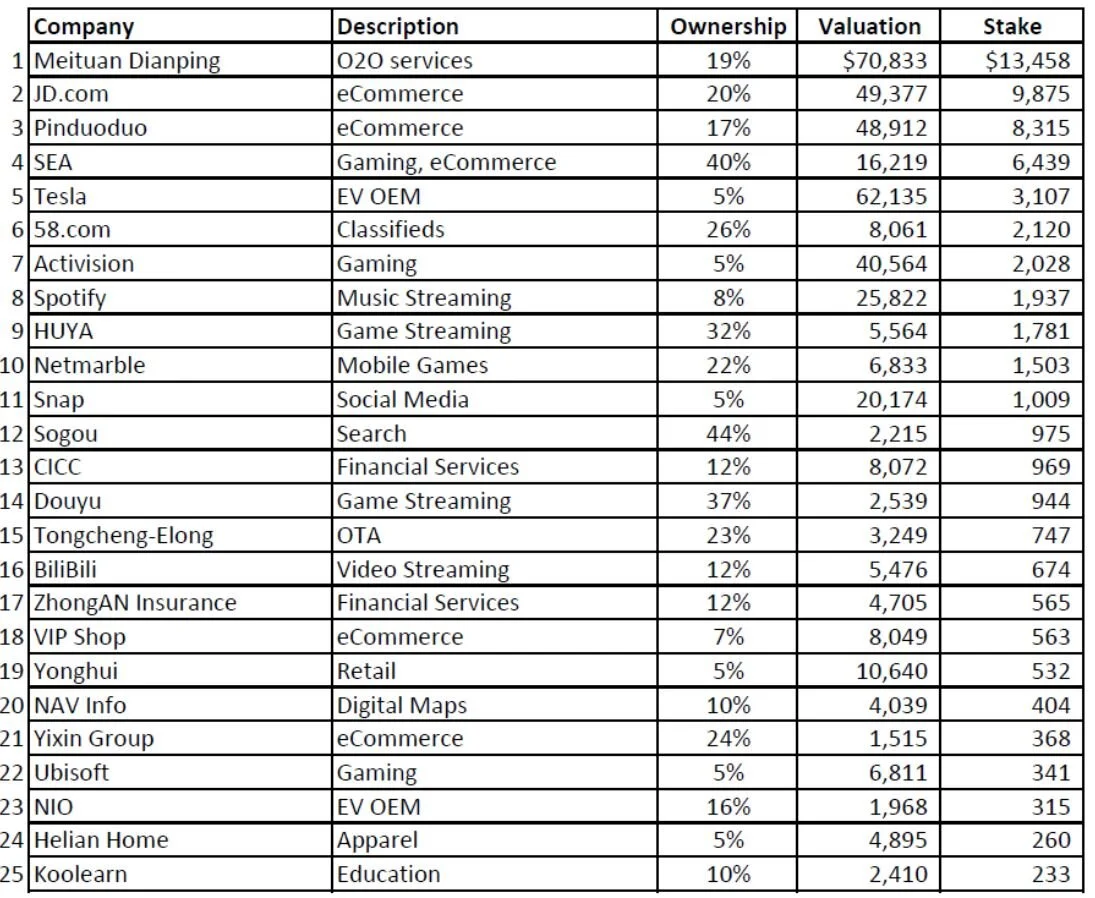

The Berkshire Hathaway of China Tech, here’s the list of the public companies TenCent holds stakes in, impressive and does not include the private companies they have stakes in. Top 25 stakes are about $60 billion in market cap. Data via @therealjunto on Twitter. Here are some private companies:

Riot Games 100%

Epic Games 48.4%

Bluehole 11.5%

Grinding Gear Games 80%

Supercell 84.3%

Frontier Developments 9%

Kakao 13.5%

Paradox Interactive 5%

Fatshark 36%

Funcom 29%

Sharkmob 100%

Source: @stevenmessner

Recent Earnings: A doing well by doing good focus

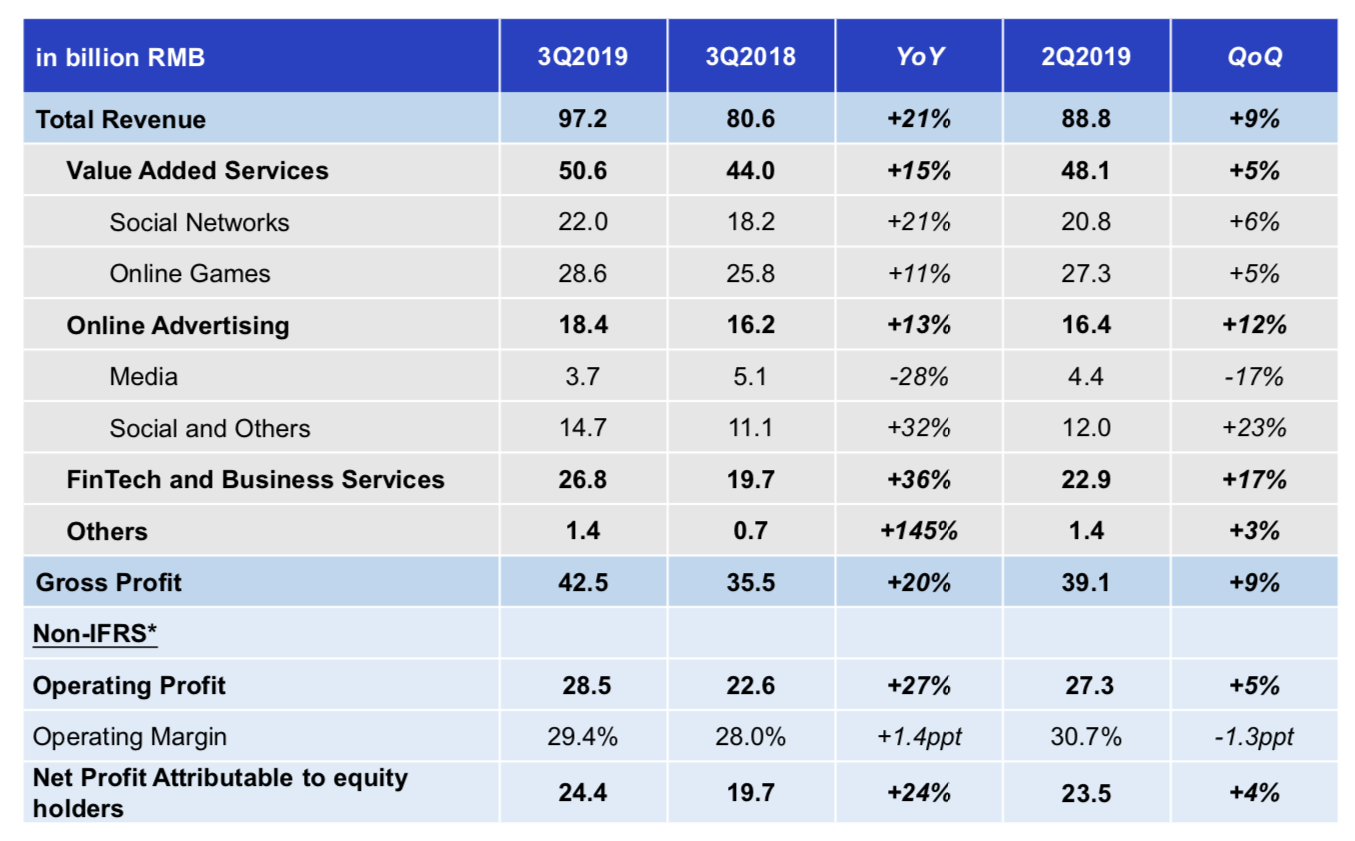

Revenues increased by 21% year-on-year.

Strength primarily from: commercial payment services and other FinTech services, smart phone games, as well as social and others advertising.

Operating profit decreased by 7% year-on-year.

Free cash flow* was RMB37,732 million, up 36% YoY.

Our FinTech and Business Services and Advertising segment revenues each increased at double digit percentage rates from the second quarter thanks to rising user activity and improved advertising technology.

We will continue investing in our products, technology and services as we seek to provide value to our users and do good for society.

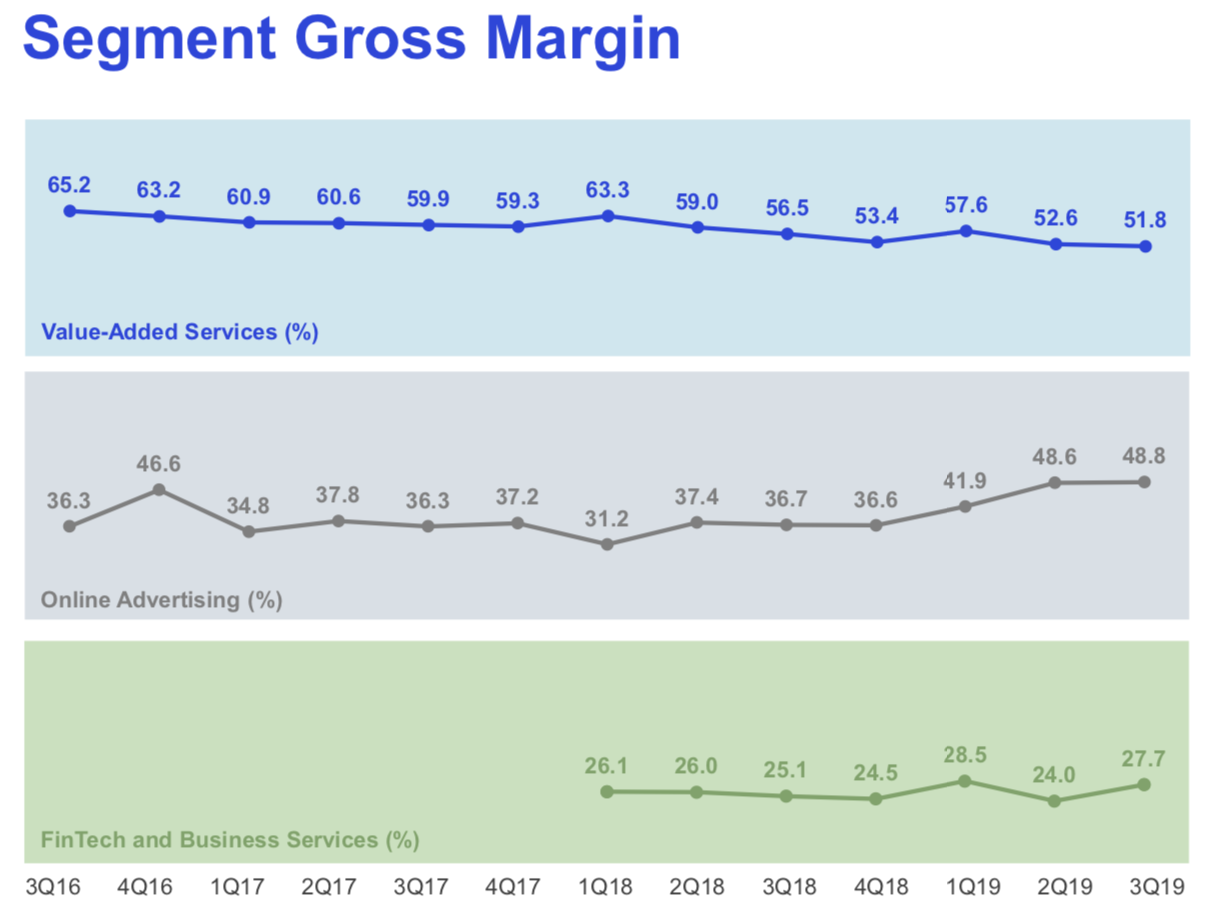

Revenues from VAS increased by 15%.

Online games revenues grew by 11%.

The online gaming increase primarily reflected revenue growth from smart phone games in both domestic and overseas markets.

Partly offset by lower revenue from PC client games - Read: Mobile continues to be where it’s at from a gaming perspective.

Social networks revenues increased by 21%.

Social strength: from digital content services such as live streaming, video streaming subscriptions and music streaming services.

Revenues from FinTech and Business Services increased by 36%.

FinTech strength: due to both increased daily active consumers and number of transactions per user.

Revenues from Online Advertising increased by 13%.

Social and others advertising revenues increased by 32% via Weixin Moments strength.

Media advertising revenues decreased by 28% due to: lower revenues from our media platforms including Tencent Video due to the challenging macro environment.

Capital expenditure was RMB6,632 million, up 11% YoY.

Net debt position totalled RMB7,173 million

Fair value of our stakes in listed investee companies (excluding subsidiaries) totalled RMB352,656 million

By my math, their “investment or VC positions” are currently valued at $50.2 billion which is roughly 12% of the total market cap.

GOALS & FOCUS:

Digitalization: supporting important rapid revenue growth and reached substantial scale for our Cloud Services.

Reinforced our historic leadership in long form content activities such as drama series, variety shows, anime series, music, literature and comics via upstream integration.

Exceeded 300 million DAU for Mini Programs, and now feature vertical Mini Programs via Weixin Pay entry points for healthcare, mobility and smart retail services.

Globalizing our activities, particularly for online games.

We have streamlined our operations for agility, including a reduction in our selling and marketing expenses to revenue ratio in recent quarters.

Opinion

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where TenCent scores well:

98% for 3 year sales growth

79% for high ROE

83% for low debt to enterprise value, a quality measure

92% high 1 year sales growth

86% for high overall operating margins

93% for projected dividend growth

Ten Cent has hot a growth patch the last 12 months but it’s come at a time when China’s economy has cooled. Ten Cent is an enormous investment company in China and Asia and that cuts both ways. In boom times, their investments will add significant leverage to the revenue story and in slowdowns, they will act like an anchor but make no mistake, Ten Cent is at the center of every major trend across China and Asia: Fintech, mobile payments, mobile messaging, E-Commerce, video gaming, advertising, social networking, etc. They are a long-term winner and in my experience, you keep adding to long-term winners when they are having short-term problems. That’s what I will keep doing so when China bottoms and begins to grow better, the big position will add significant value to the portfolio.

Consider this from EMQQ ETF provider: Tencent invested in more than 700 companies. Among the 700 companies, 63 are now listed, and 122 are unicorns with market capitalization or value of more than $1 billion. During 2018, 16 of the invested companies went public, including the much-publicized Tencent Music Entertainment Group (TME). The combined total market capitalization of companies in which Tencent holds more than 5% now exceeds $500 billion. Tencent’s jewel for video gaming is its 40% stake in Epic Games, creator of Fortnite. “Investment” is a core strategy for Tencent. Investment allows Tencent to focus on their platform and business to provide better services for partners and investment companies. The company cited its investments in several companies to create Tencent Video, still a unit within Tencent, as well as investments that helped to create WeChat Pay, a leading Chinese online payment platform.

TenCent’s ultimate goal: First and foremost is creating an open and fair platform in our business so that everyone can achieve the highest value through their excellent ability. In that regard, the company places creating user value as a paramount concern. Second, it aims to build the best team to identify and execute its investment strategy. Third, since many of these are emerging ideas, there is a focus on avoiding pitfalls such as excessive discounting and subsidies. Fourth, choosing its investors wisely. Finally, aims to always put the interests of the user over the company’s.

The last few quarters have been a bit noisy and this quarter in particular was not as clean as Alibaba’s but I love both stocks long-term. My position in BABA is slightly larger than TenCent’s given the bigger opportunity in E-Commerce I see. BABA just offers a more direct way to gain access to that theme. Back to TenCent. The company is a cash cow, is involved in every major theme in China, is dominating social with WeChat and has significant stakes in soo many important consumption-focused businesses. The stock had a nice pullback with the China market and has been recovering of late but still well off the highs. The Chinese economy has clearly cooled off but make no mistake, their economy will be larger than ours in the not too distant future, the population is 4x that of the U.S. and they are just getting started with the conversion from a manufacturing base to a services, domestic consumption base. Owning the brands that are leaders with consumption and particularly, E-Commerce should offer a wonderful long term investment experience. Buy the dips in this great and diverse Chinese brand.

Great quote from BrandFinance:

“At US$50.7 billion, WeChat is a rising star, having lifted its brand value 126% over the previous year. Its influence is reflected in the impressive way in which the brand has successfully created a digital ecosystem for its 1 billion Chinese users who use the platform every day to instant message, read, shop, hire cabs, and more. WeChat is the jewel in the crown of Chinese tech giant Tencent, which ranks 21st, holding a brand value of US$49.7 billion. ”