“Over the last 20 years ending January 13, 2022, managed healthcare leader United Healthcare has returned roughly 3,030% versus the S&P 500 return of roughly 504%. None of us like our healthcare premiums going up every year but a way to hedge this is to own the best managed care providers in portfolios.”

COMPANY PROFILE

UnitedHealth Group (NYSE: UNH) is a diversified health care company dedicated to helping people live healthier lives and helping make the health system work better for everyone. UnitedHealth Group offers a broad spectrum of products and services through two distinct platforms: Optum, which provides information and technology-enabled health services; and UnitedHealthcare, which provides health care coverage and benefits services.

Style Factor Benefits

From a factor scoring perspective versus the other 199 brands in the brands index, here’s where UNH scores well as of 1/13/2022:

81% high dividend payer

78% high FCF Yield stock

80% strong price momentum

95% high absolute free cash flow

87% strong dividend grower

88% low vol equity which offers stability

85% low valuation using price to sales metric

1/13/22 Update:

Rather than opine what we see in UNH, I’ll just post what one of my favorite hedge fund managers, Dan Loeb said about their UNH position in his Q3 2021 letter. UNH is a key leader in a very important spending category of managed healthcare. Its highly profitable, cheap and a great dividend grower and payer. And it offers vital stability in a tumultuous world right now.

Dan Loeb, Third Point

UnitedHealth is one of the largest healthcare companies in the world and a market leader in both its insurance and healthcare services (Optum) businesses. We initiated our position during the 2020 Presidential election at a time of heightened political and regulatory uncertainty.

We believe under its new CEO, Andrew Witty, UnitedHealth can not only preserve its market dominance and sustain industry-leading growth rates across most of its key segments but also enter new healthcare services markets. Witty is known as a mission-driven CEO who clearly articulates his view that providing high-quality, affordable health care services is a socialgood. Hereceivesconsistentlyhighmarksfromformercolleagues,andwebelievethat his leadership approach will ballast and even strengthen UNH’s already impressive management and employee ranks. The insurance and services businesses are synergistic and complementary, which entrenches United’s critical role in care financing, access, and management. This dynamic gives us confidence in the durability of United’s market leadership.

United’s core capabilities across insurance underwriting, cost and clinical datasets, provider care management, and PBM assets – undergirded by an advanced IT infrastructure – bolster their competitive advantage in providing the most robust insurance benefits at the lowest cost. United is also an early adopter of the technology across a variety of care settings such as telemedicine, digital therapeutics, and continuous glucose monitoring technology for their diabetic type 2 population. This provides better tools and care to patients and gives United better visibility on patient health, which leads to better cost control via early intervention.

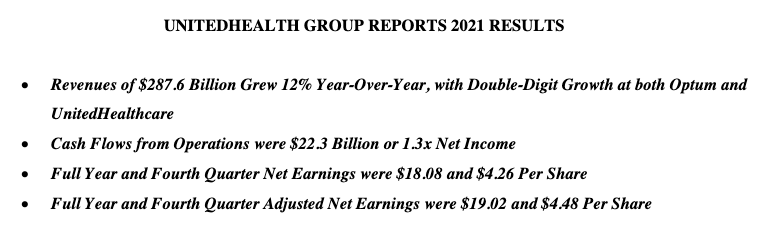

Driven by UNH’s higher-growth businesses like Medicare Advantage (MA) and value-based care MA clinics, as well as strong visibility on growth acceleration post-Covid, we expect the company’s multiple to rise significantly as investors see a path to sustained mid-teens earnings growth. We believe the stock can double in the next three to four years as we see durability of EPS in the mid-teens supported by a high single digit FCF yield while trading in- line with the market.