Intuitively, we knew high stock based comp as a percent of revenue was not a sustainable or ideal thing for the operations of the business and its metrics upon which investors judge the business. But YTD with the massive multiple compression thats happened everywhere, specifically to the most expensive and profitless stocks, high SBC was a heck of a style factor to use as a short thesis. Look at this chart showing how horrible management teams are at capital allocation decisions. Enriching employees at the expense of shareholders by diluting them to smitherines! And this year, its not enriched employees who now have to figure out how to live on salary alone when they counted on an always-appreciating stock for their livelihood.

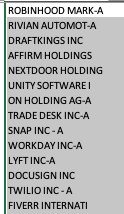

Here’s the 15 brands in my brands Index of 200 with the highest SBC as percent of the company TTM revenue.

FYI, this equal weighted basket is -63% YTD and it was down over 70% before the latest stock rally. Ironically, I still see most management teams distributing more stock, likely because old options are underwater and never will be monetized. Thats a bad situation for a company when you have to keep diluting shareholders to re-price underwater options just to keep your employees.

This is happening all across tech in particular so I suspect theres real incentives to move from one company to the next just to get a cheap set of option grants! Heres the worst offenders in the brands index for high SBC expense.