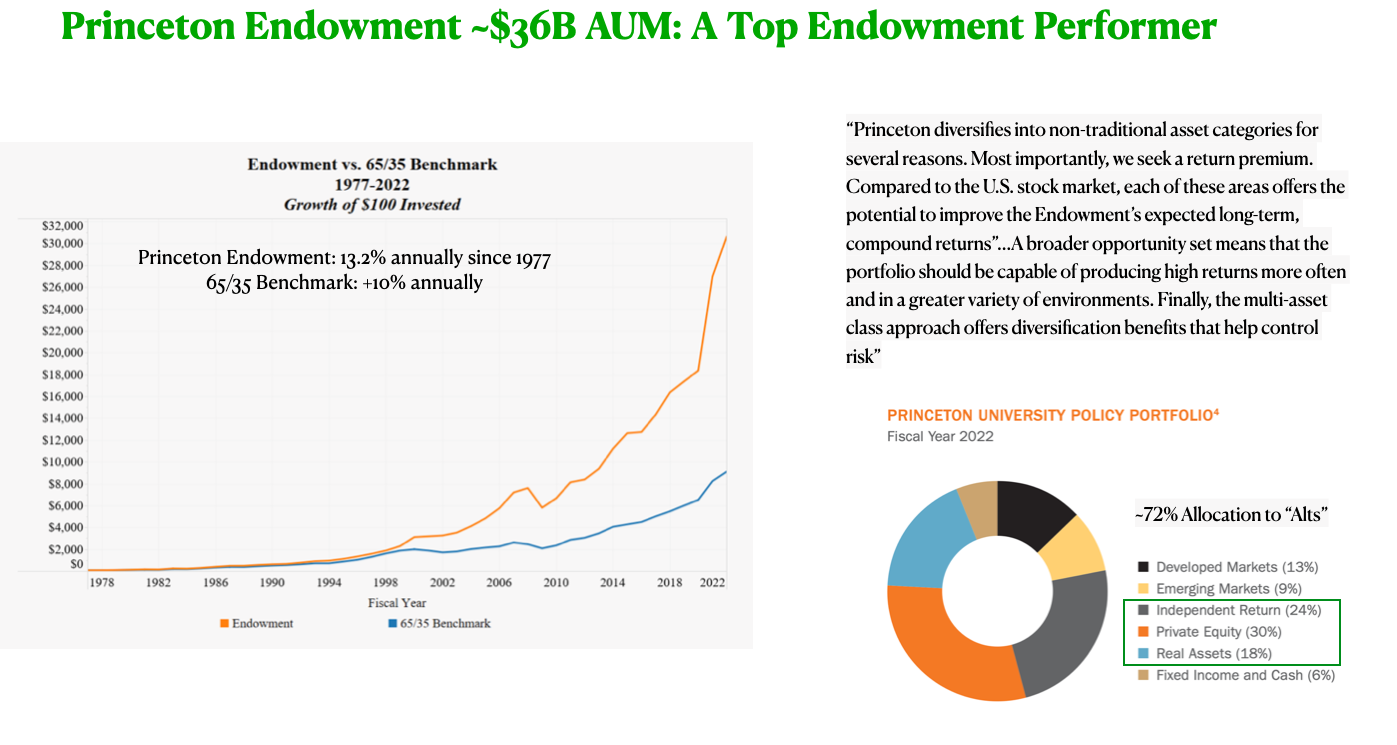

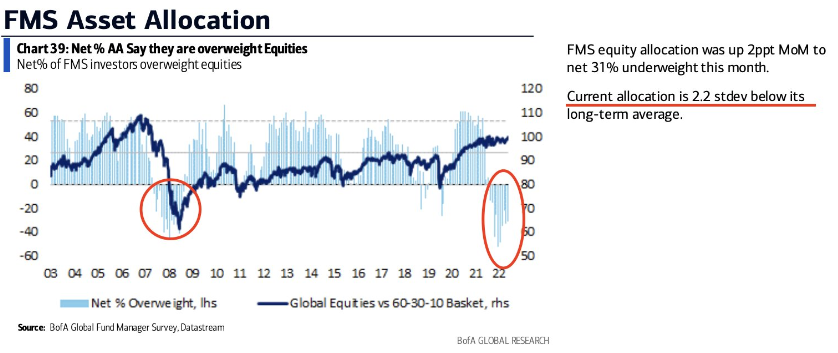

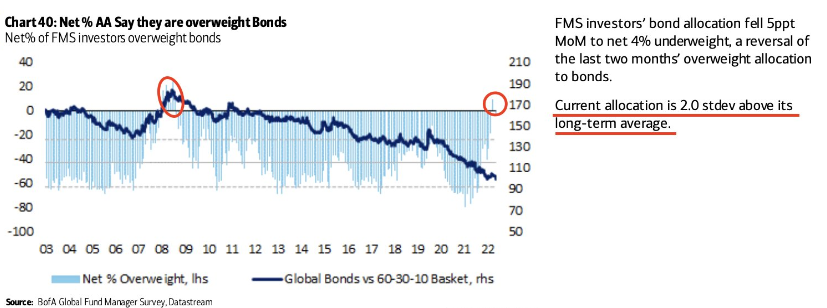

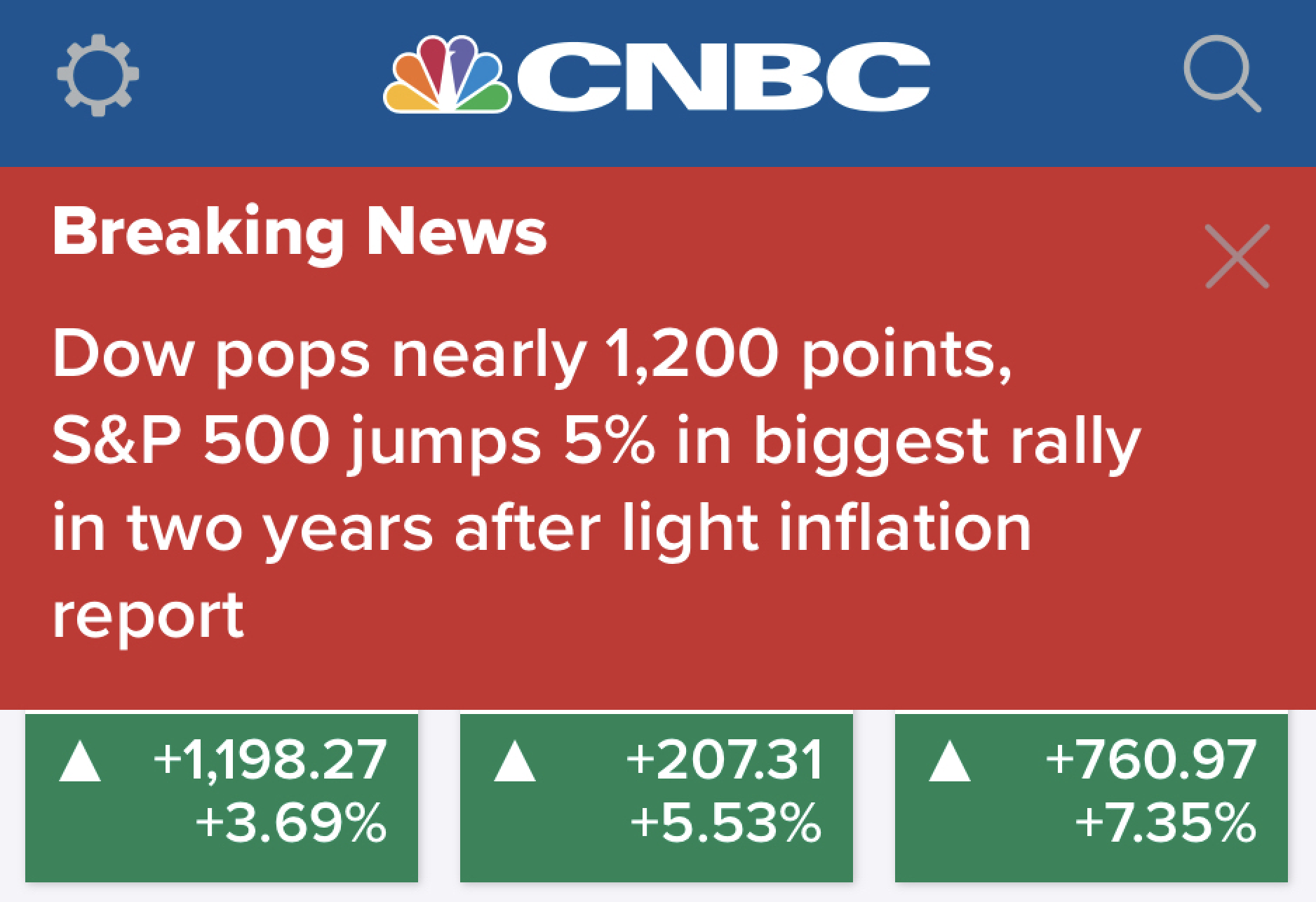

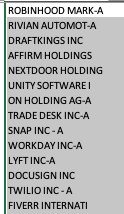

In today’s volatile times, I think it’s important to remember, the storm happens during the “normalization” process which for rates and inflation, is well under way. At a new Fed Funds range of 4.25%-4.5%, we are well past 2/3 of the way to our longer term destination. Because rates and the cost of capital were artificially held too low for too long, there will continue to be zombie companies floating to the top over the next few years. Please make sure you move up in quality, focus on positive and growing free cash flow businesses and avoid companies that need access to capital to fund operations, that capital is alot more expensive today. I am a huge fan of the Private Equity brands currently because they will feast on the carcasses of the companies that ran their businesses like free capital would never end.

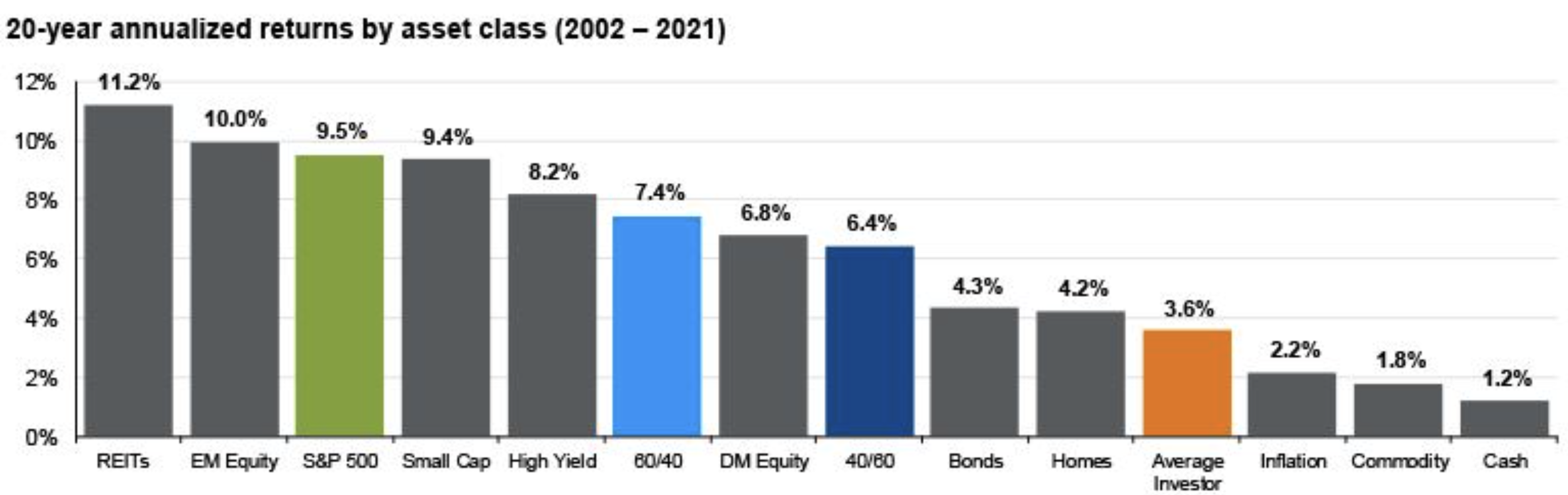

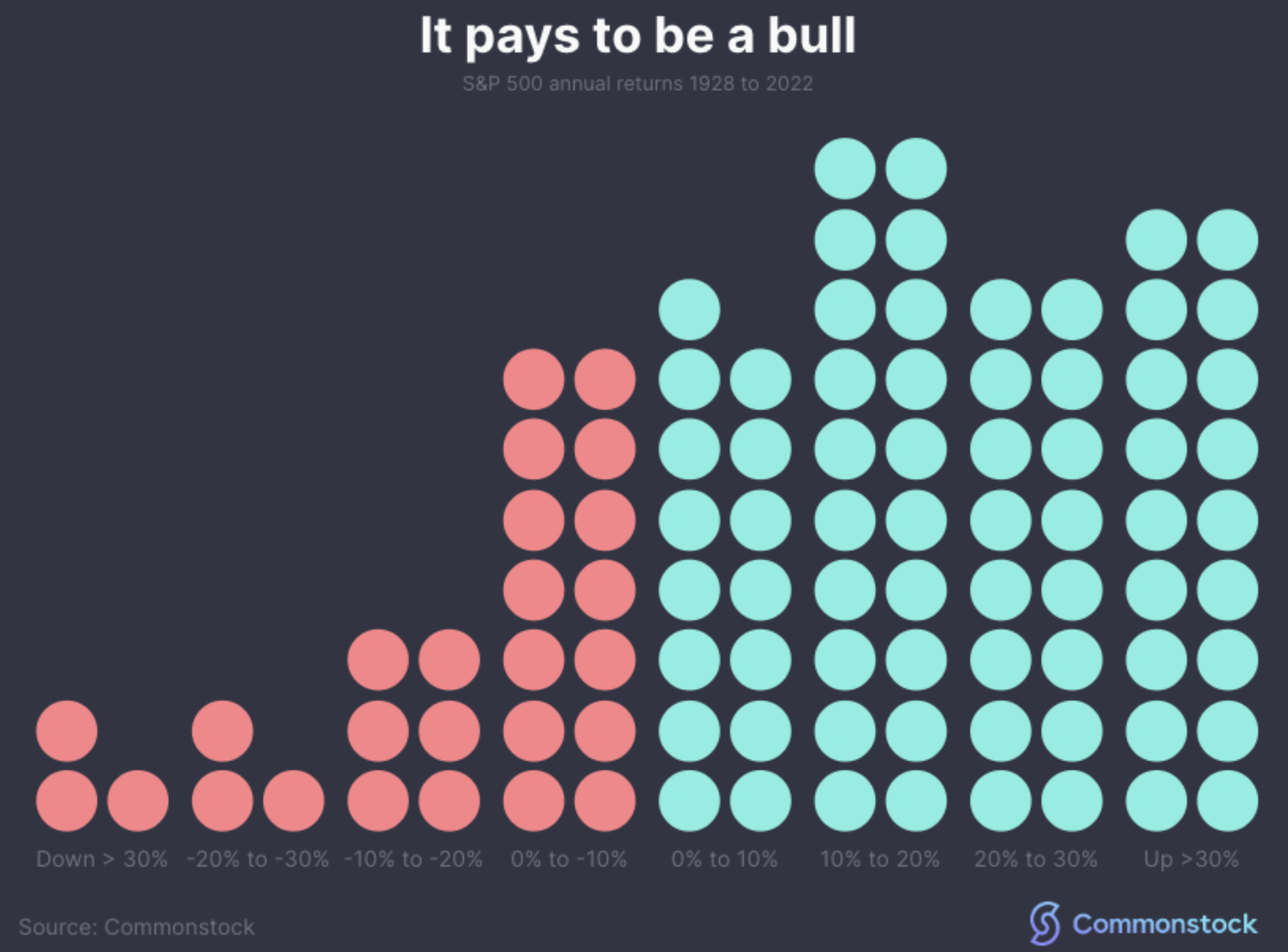

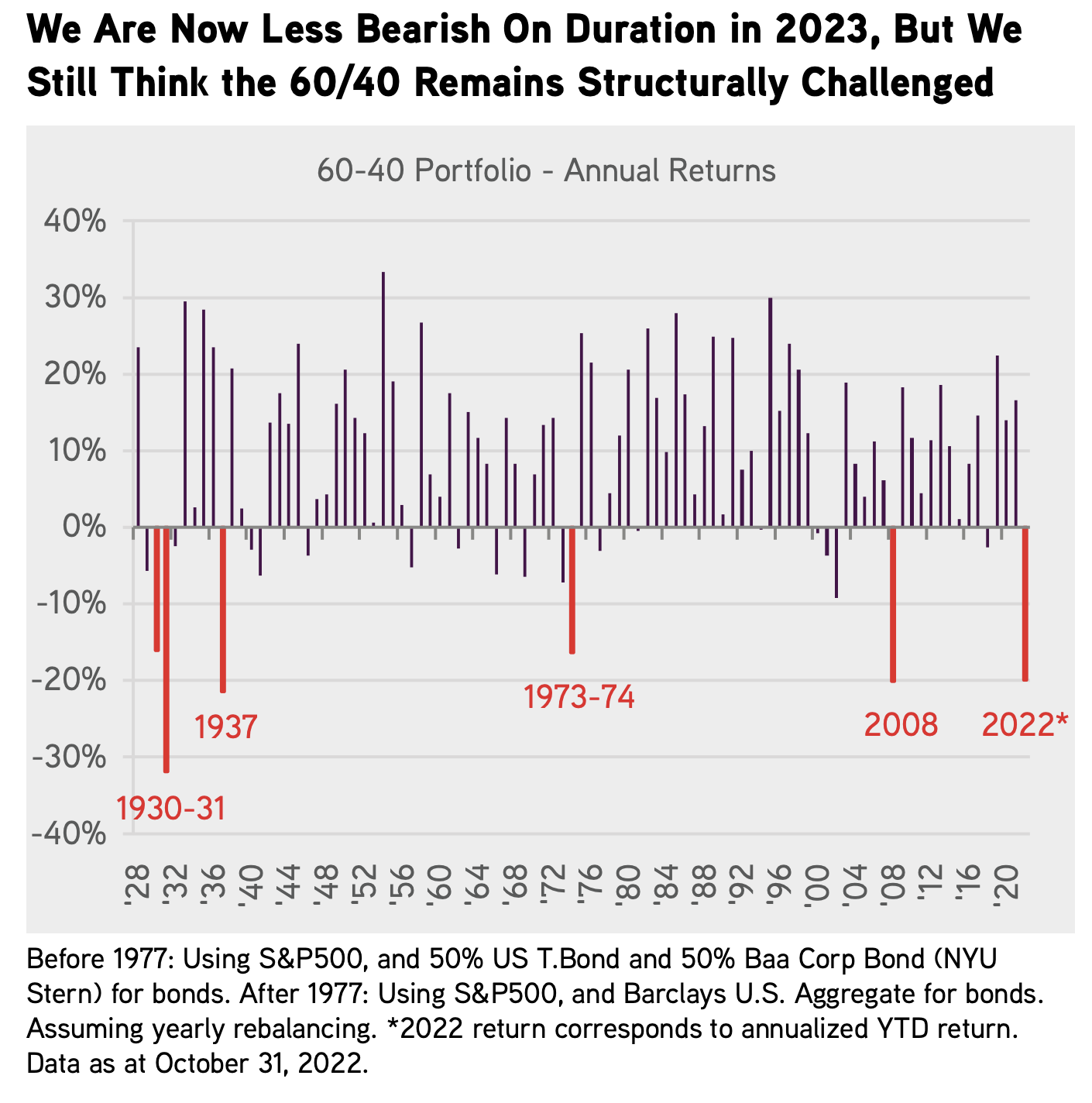

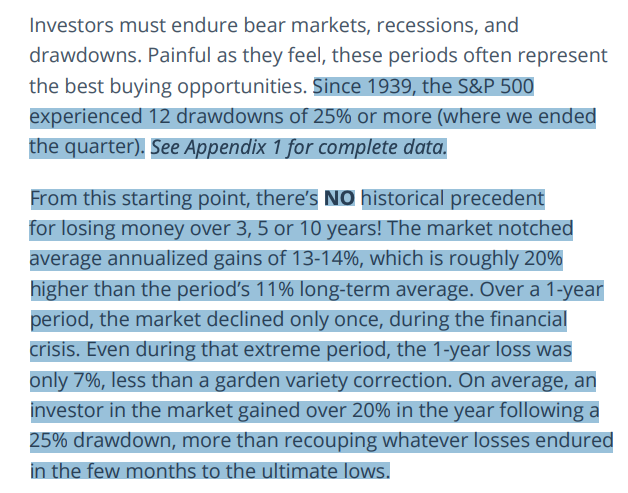

Below, I have highlighted a handful of periods that show what more normal periods look like in monetary policy, inflation and GDP, particularly to compare them to the most recent period starting with Ben Bernanke in 2006, then Yellen, and now Powell. As you can see from the image directly below, from 1955 to Bernanke’s arrival at the Fed, normal fed funds was around 5.5%, normal CPI was about 4% and stocks provided an attractive return. In the next chart, we look at the abnormal period we have all become accustomed to where fed funds is ultra low, CPI is ultra low but equity returns are elevated. On the surface, this looks like a better solution, but the rampant speculation and funding of terrible business models and mis-allocations of capital ultimately end up being more destructive than a more logical range of monetary policy with an appropriate cost of capital. What’s the moral of the story? Investors should expect more normal equity returns than what we think we deserve. We still have a bit of normalization to go, so we should expect volatility to linger for a bit longer, but once we are at a normal place and the rules of the road are more well known, asset markets should settle down and macro won’t be as front & center. Ultimately, its company fundamentals that drive stock prices. History shows, stocks do just fine in periods with higher cost of capital, higher interest rates, and higher inflation than we think is “normal”. Why? because shitty businesses find it hard to get funding, and markets purge the bad and feed the good. Here’s the data: