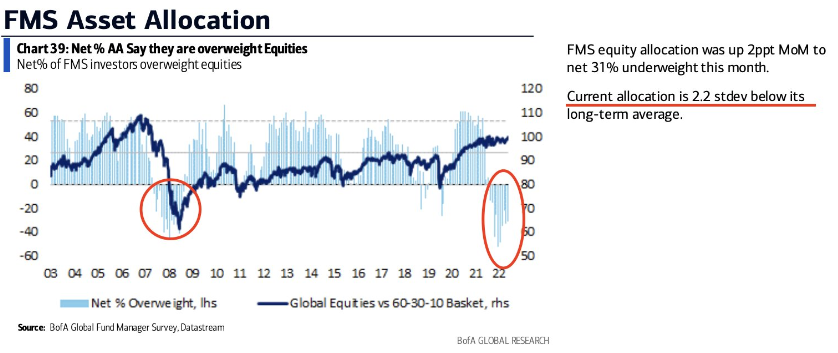

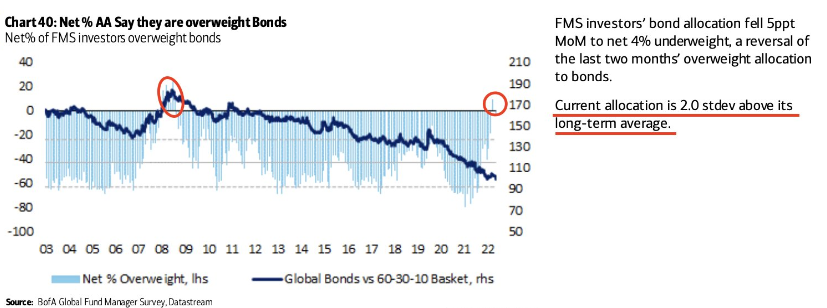

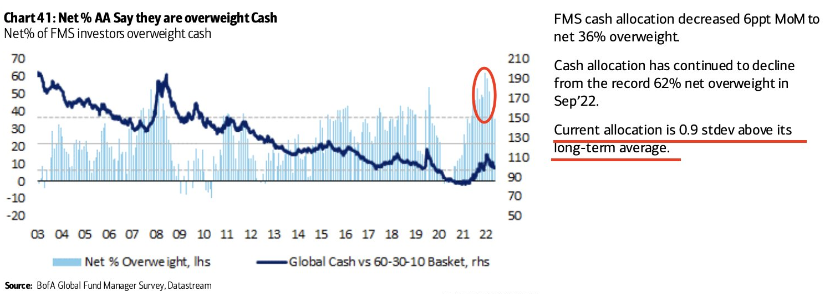

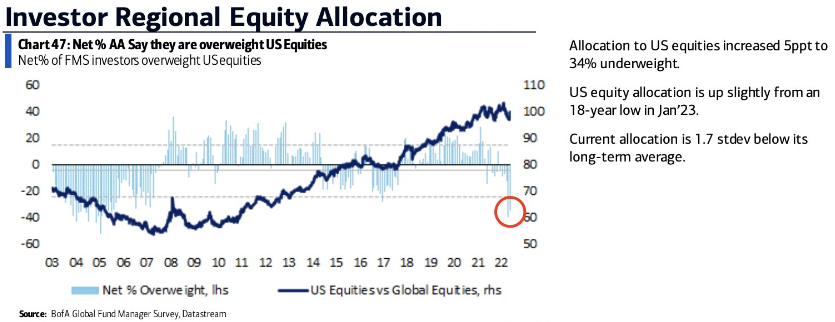

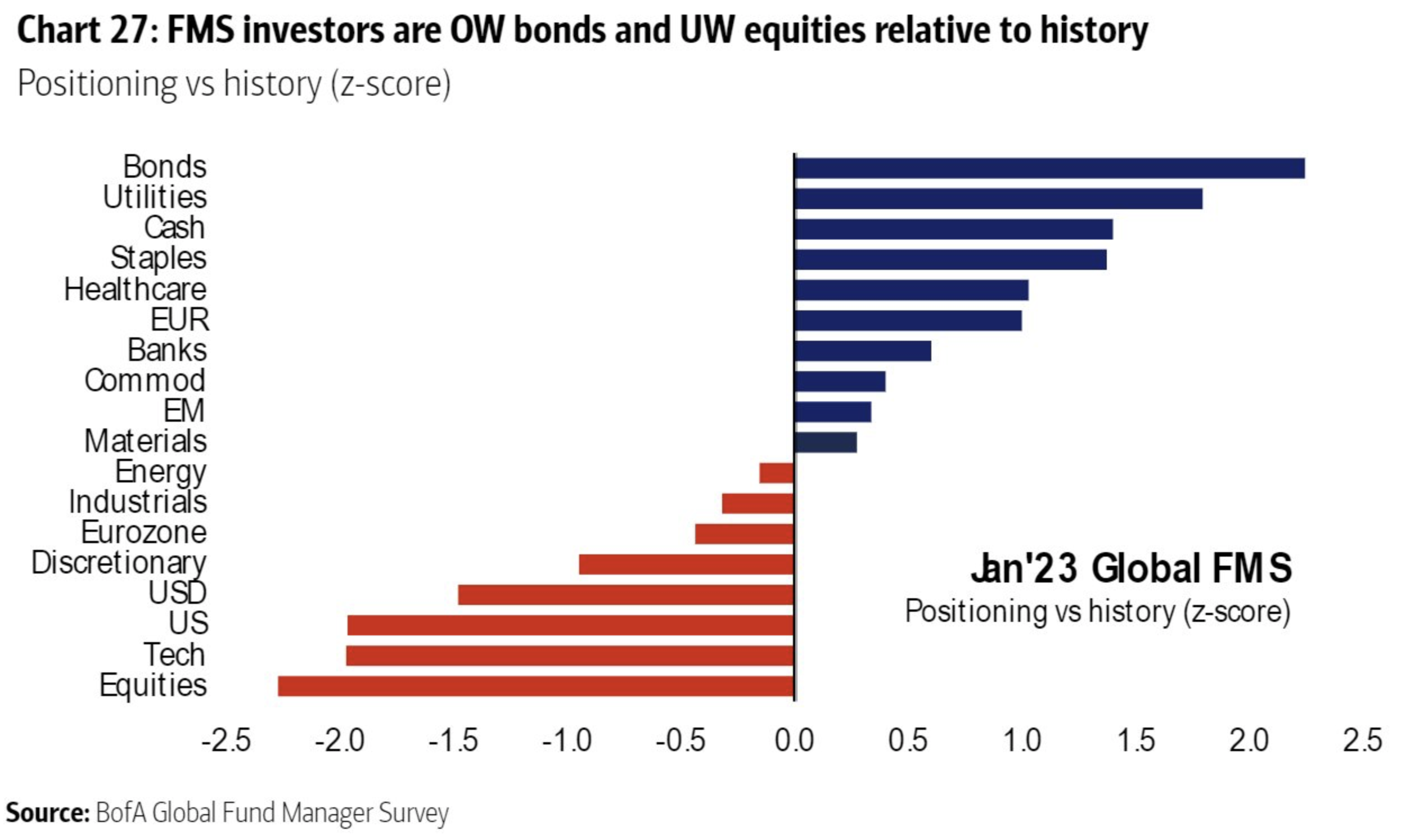

There are a ton of data points to assess each month to give us some idea of where risk-taking appetite is. Extreme positioning is the only thing I look for though. For the last few months, there was some extreme bearishness and positioning which led me to take more risk and add some tactical high beta brands to the portfolio. I’ve since sold those for some great short-term gains. Looking at the January data, positioning is still a bit off-sides and tilted toward being defensive, holding more cash, owning more bonds, and owning less US stocks. Bullishness towards European and especially Emerging Market equities is high, I’ve faded that move a bit by selling the Hermes and Ferrari for now, while trimming the LVMH big position. I’ve added some defensive exposure via healthcare brands UNH, REGN, and LLY with the funds from sales in higher beta and luxury brands. I like the balance I have right now.

Here’s the BofA investment manager positioning data. I love seeing these monthly, once in a while the positioning extremes jump off the page and offer some real tactical trading opportunities. For now, I like adding to US stocks with the high quality balance sheet & GARP style factors present.