Happy new year!

We started the year with some good gains and the bears have come back ready for more downside it seems.

While I understand and appreciate the bearish bias people have for the next few months, my gosh is the boat crowded on one side. Bears are everywhere and even bulls are nervous. While the timing is always uncertain, if you have some duration and the ability to deal with higher VOL, historically speaking these are great times to be tranching into quality stocks, not running out of them. Here’s some charts to highlight the bearish bias.

Chart #1: consumer sentiment. When its under 60, forward returns tend to be above average. We got as low as 50 late in 2022.

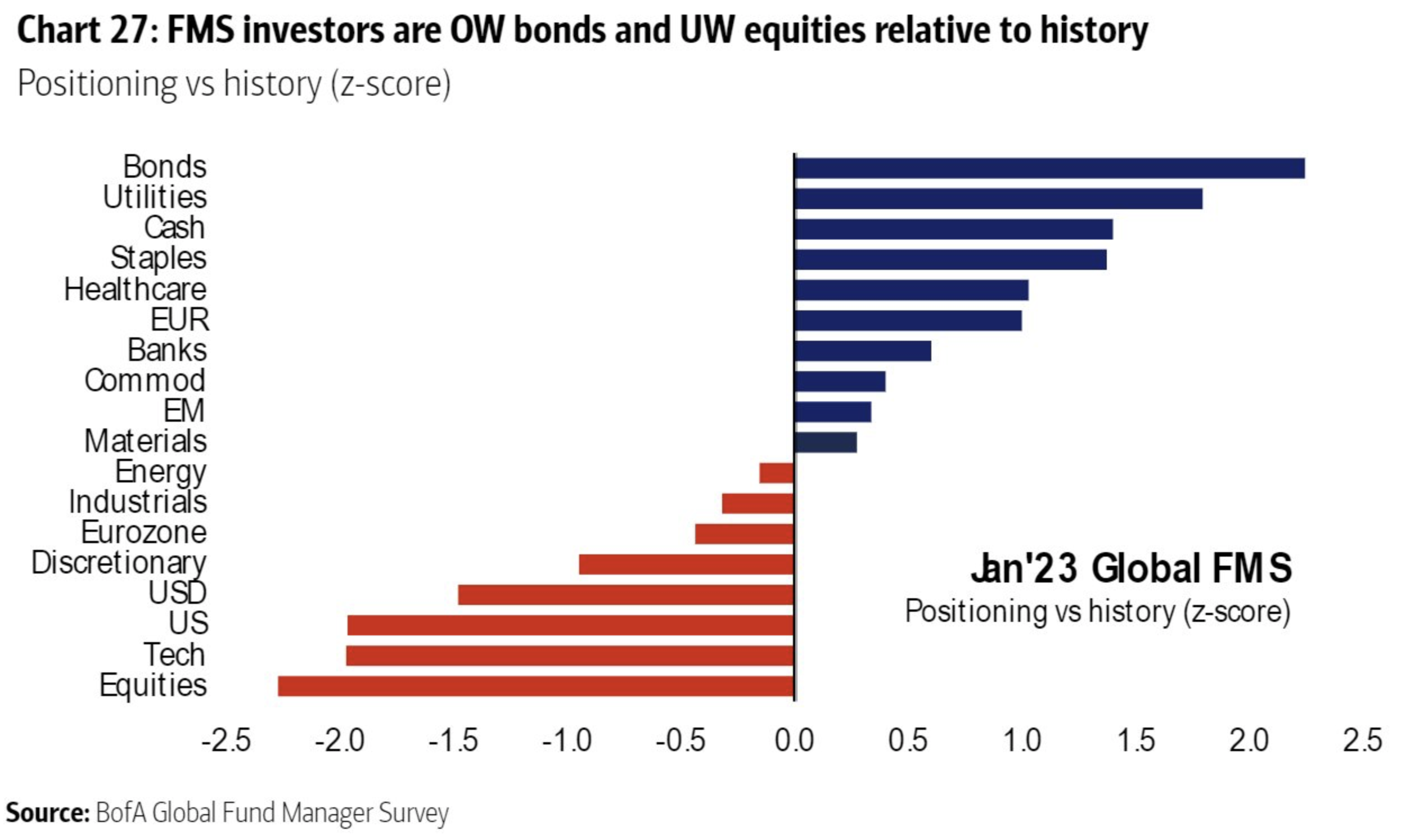

Chart #2: Institutional money manager positioning is rarely this skewed away from equities and “risk assets”. Just think about how much money will run through a narrow door when some uncertainty is removed and consumers/investors feel less bad. It will happen all at once and the flows will be epic so whatever downside we have will quickly be recovered aka a 2009 type of move.

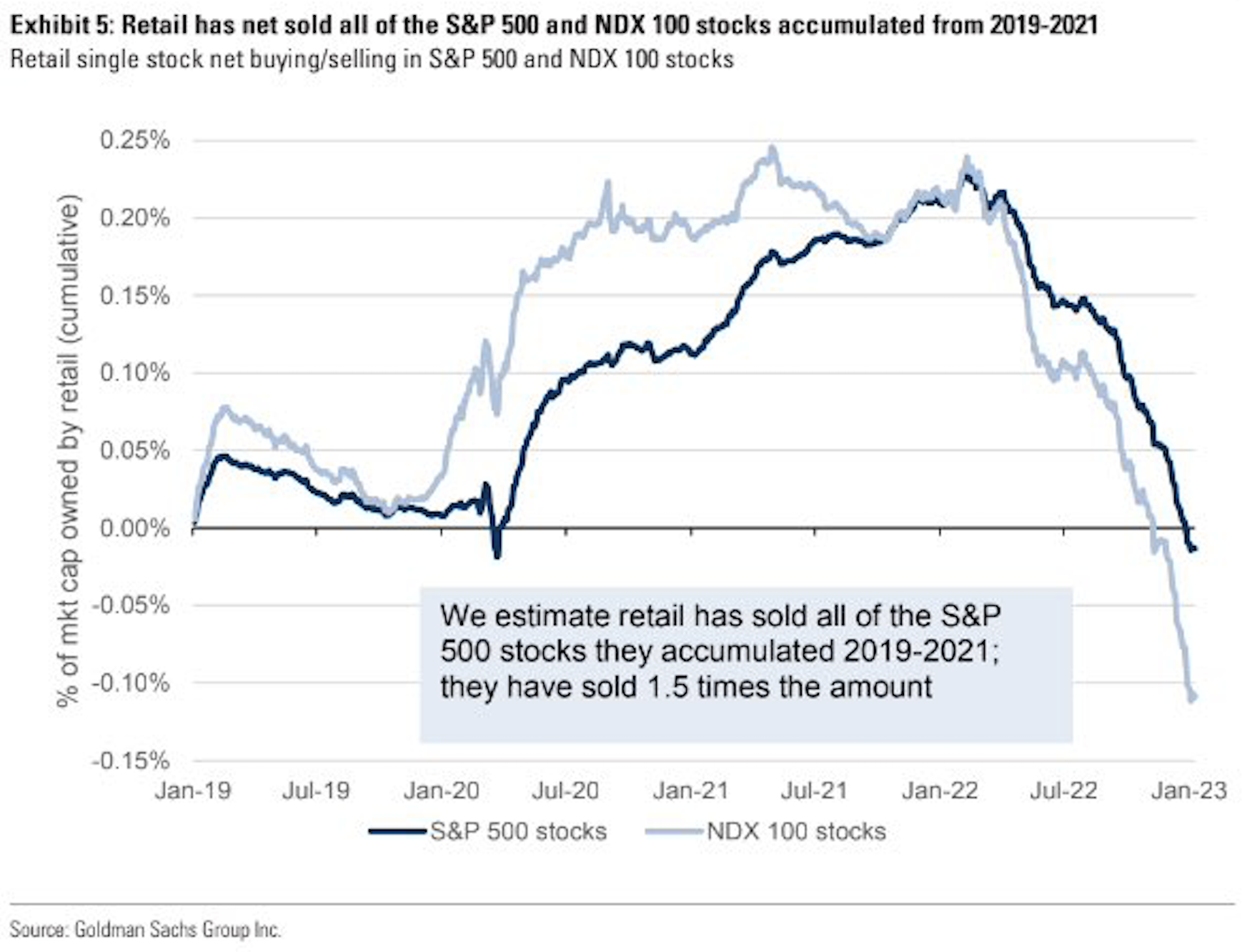

Chart #3: Redemptions have been enormous over the last 90 days. This chart from Goldman shows retail investors have net sold all of the S&P 500 and Nasdaq stocks they bought from 2019-2021, that’s alot of selling and a lot of new buying power at some point folks.