This is what the media, the Fed, our politicians have created. Massive VOL and uncertainty.

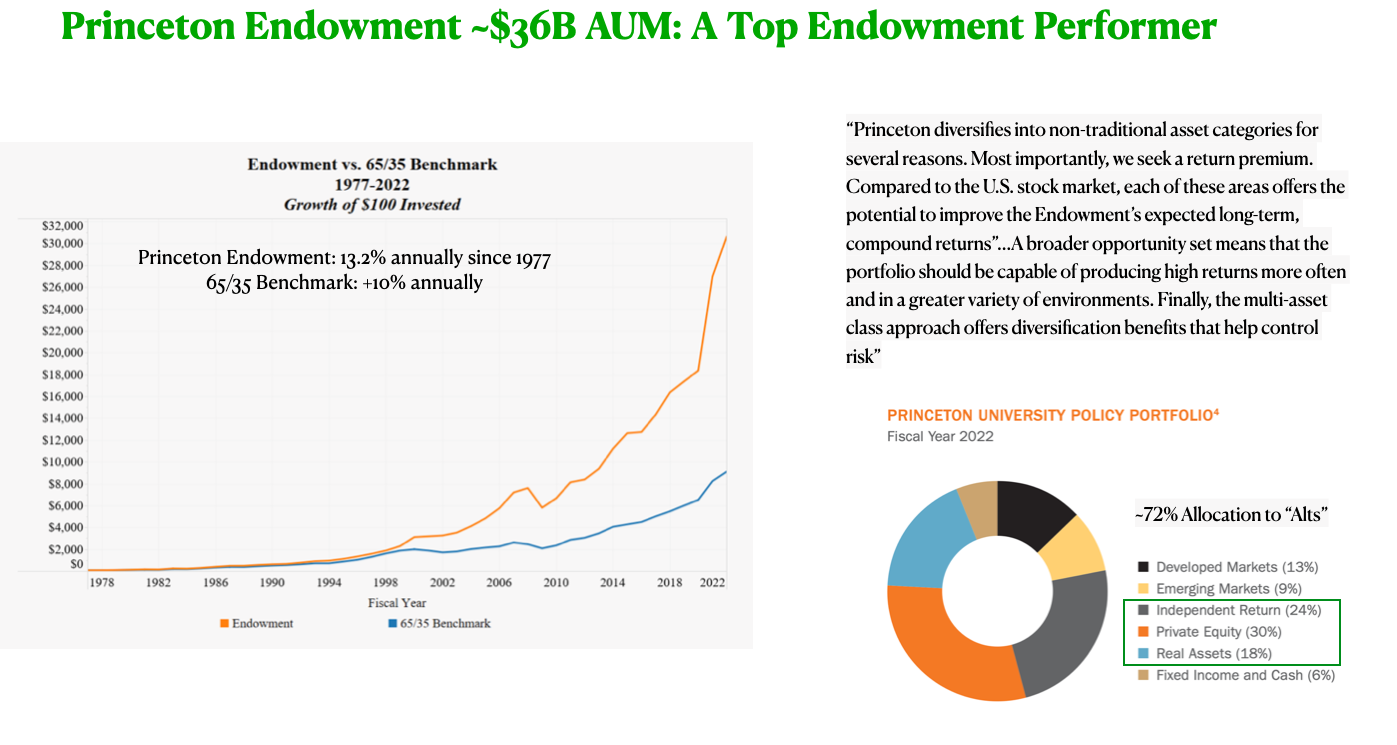

To see what’s trending today, look no further than Twitter. And they wonder why I want as much private markets exposure as possible. People will one day wake up to the reality: public markets are a complete and utter casino, the top private market asset managers will benefit most, thats why we own their stocks and assume the vol they have as public vehicles. Their business is only getting more robust and their stocks are on sale.

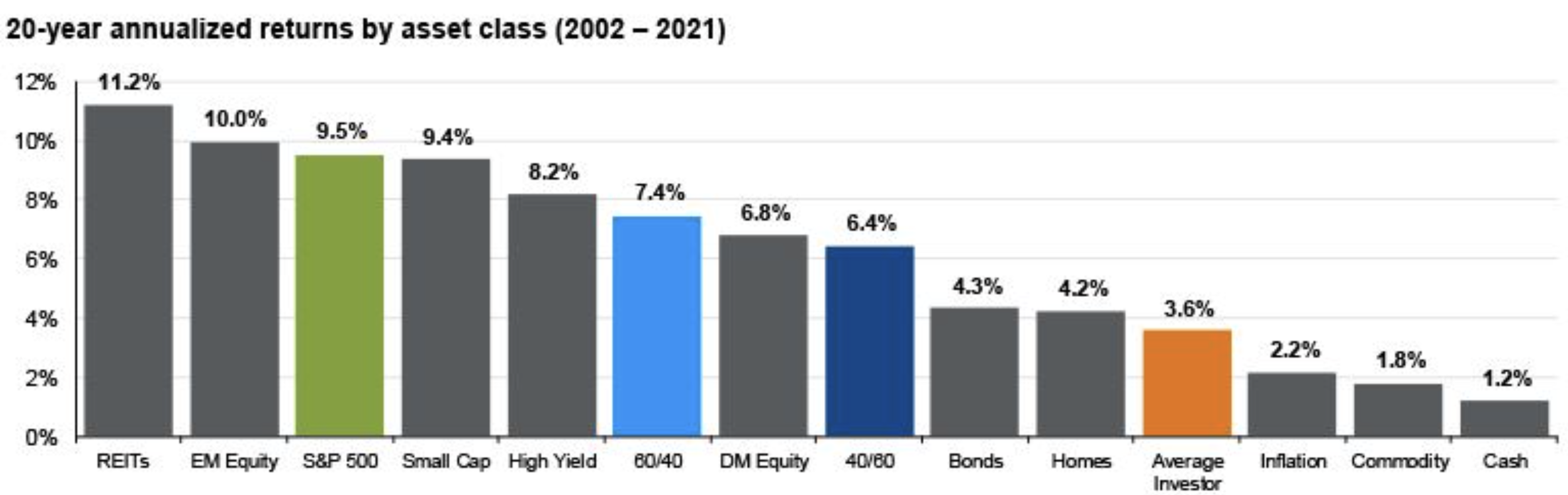

This one graphic illustrates why the average investor performs much worse than markets and institutions: they focus on what they can’t control and ignore what they can. If you know you’re too emotional about investing and markets, use more privates. Over time they perform better and the ride is much smoother.

Here’s a JP Morgan graph showing the avg returns over 20 years. You can be the dumb money or the smart money, your choice.