2/27/23

February is almost over, not nearly as intriguing as January from a returns perspective!

The 10 month moving average for the S&P 500 is about 3947 so I’d like to see us close again over that level for two months in a row, that tends to be a pretty positive outcome but the inflation and Fed data seems to be pushing markets around at will.

Positioning was quite extreme and bearish at the end of 2022 and we saw a wicked ramp in January. Since that time, AAII sentiment has ripped back with stock prices going up but with the correction, sentiment has fallen back down to lows. Perhaps everyone is correct but after 30 years of investing, I’m a bit wired to be more positive when the masses are very negative and extreme. Timing is everything though.

Here’s an interesting chart showing buying of VIX calls has gone vertical and back to levels not seen since March 2020, close to the Covid lows. People are clearly bearish and/or positioning with VIX calls to hedge their longs. Honestly, I don’t think that’s a bad trade given VIX is back under 20, I think VIX and markets could be rangebound for a bit longer as the data and Fed chop around.

Here’s the February look for institutional money managers, again VERY bearish stocks, Tech in particular as rates have risen back to highs and markets have gotten soft again.

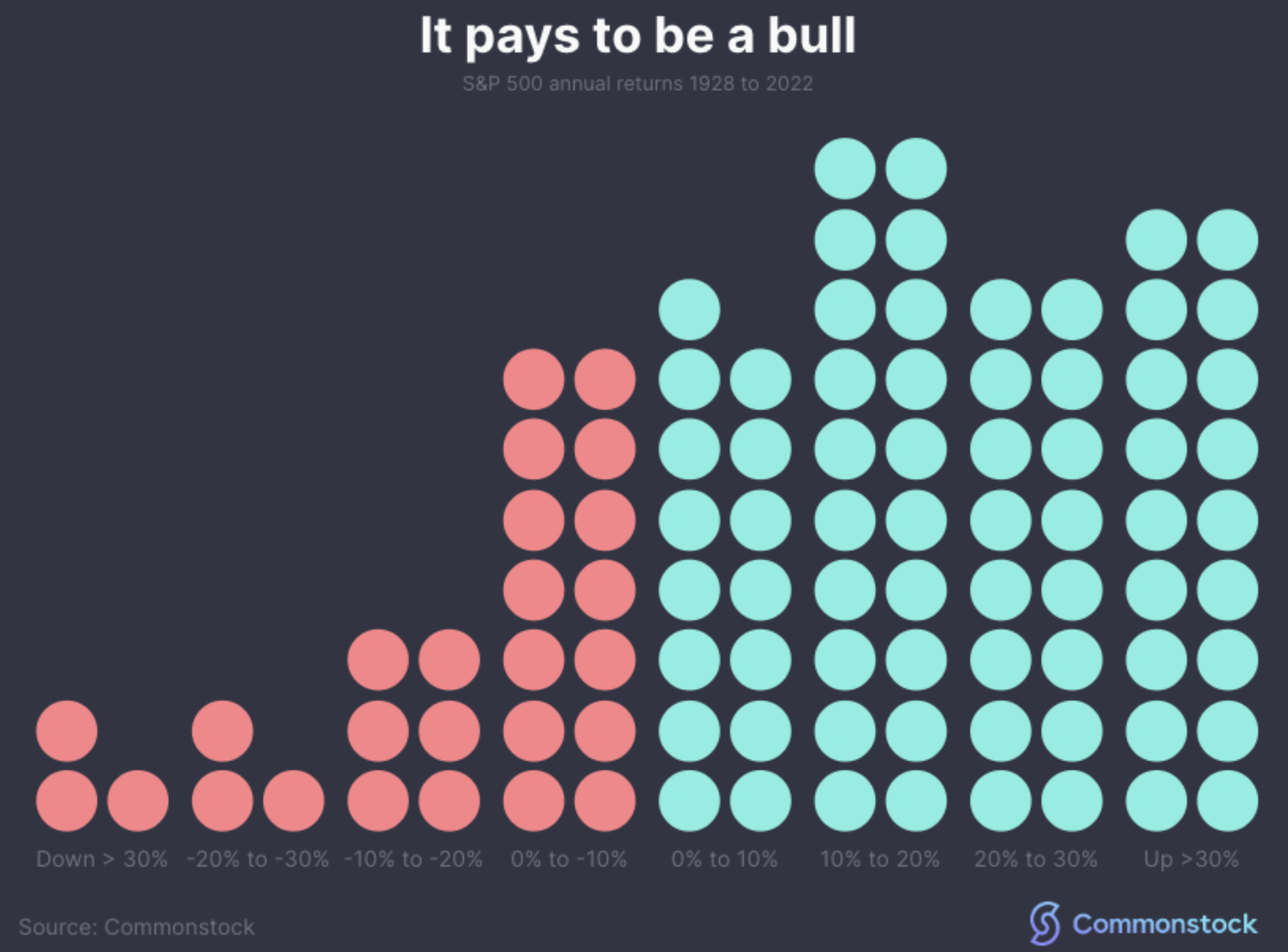

I understand people do not want to lose money, or age, or get shorter as they age, or get slower as they age, but the reality is: it happens. Stocks don’t always go up, they can be volatile some times, the markets act unbelievably irrational at times because human emotions drive decisions along with computers that just trade on very short-term momentum signals and key words. The most successful investors understand VOL is part of the package and they use VOL, when it appears, to their advantage and they add to their favorite long-term holdings at better prices. That’s what you are supposed to do, so while the market is digesting this epic “normalization phase” directed by the Fed, just keep accumulating more shares of your favorite companies. This betters your cost basis, and gets you bigger in names you love. That helps you sleep at night. Remember, if VOL and big swings keep you up at night, you don’t have confidence in what you own, you may be too exposed to the asset class in question, and/or you may just be thinking too short-term. Here’s a little reminder, the odds for being long and invested are overwhelmingly in your favor if you have time on your side. Stocks are positive the bulk of the time and they rarely cluster around “average”, which is about 10% a year pre the ZIRP madness of 2009-2022. If you have some funds or ETF’s that have 1 & 3 year returns well under the long term average, that’s likely telling you it’s time to build bigger positions unless you’ve picked some crazy strategies. We focus on household consumption and business investment through the most relevant and leading brands. That’s a $44+ trillion a year thematic so I feel quite confident we are fishing in the right pond.